The Philippines’ real money gaming market is one of Southeast Asia’s most compelling opportunities, set to add $6 billion in value by 2030. But here’s the strategic question: Can challengers actually break through in a market where one player controls nearly half the pie?”

1. Philippines eGaming market will grow to $6Bn by 2030, but can challengers break DigiPlus’s dominance?

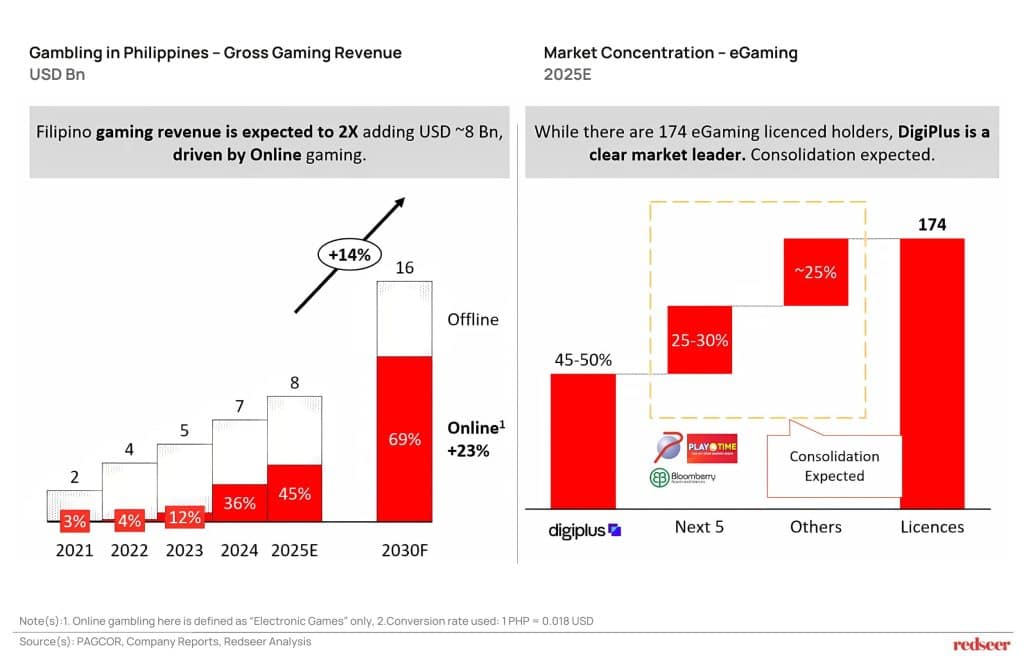

Let’s start with the market fundamentals. The Philippines gaming market is experiencing explosive growth – we’re looking at a doubling of revenue to $16 billion by 2030, with online gaming driving 69% of that total. That’s a $6 billion opportunity in the online segment alone, growing at 23% annually.

But here’s where it gets interesting. Despite 174 licensed operators in the market, DigiPlus maintains a commanding 45-50% market share. The next five players combined only hold 25-30%.

Market consolidation is inevitable, but the question is whether it happens through DigiPlus absorbing more shares or through smart challengers carving out defensible niches before scaling up.

2. Recent regulatory changes create a window for challengers to act now and consolidate market share

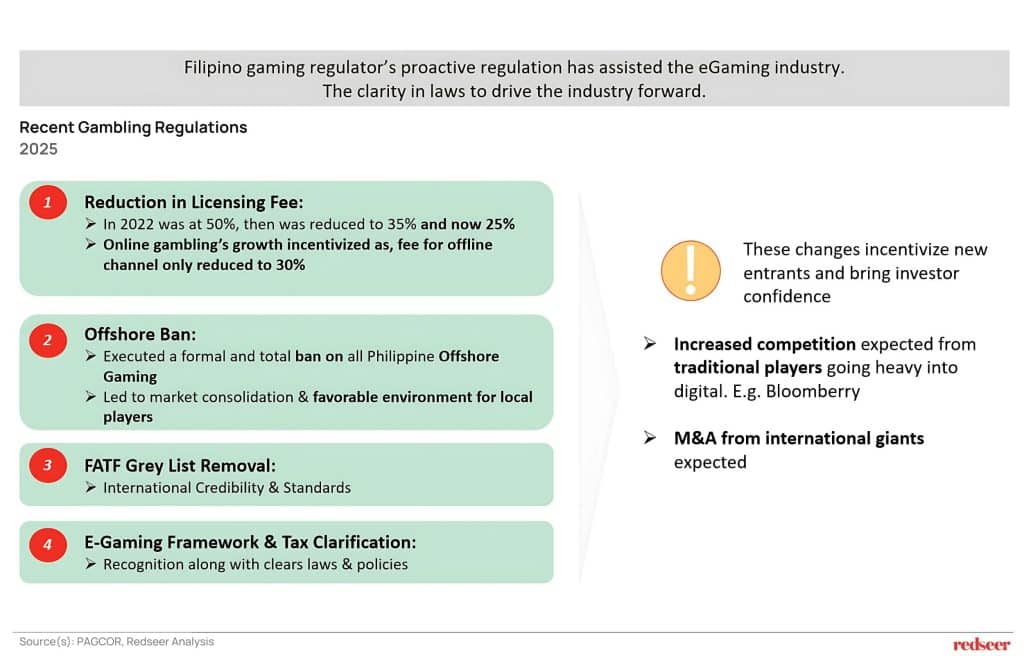

What makes this moment unique is the regulatory environment. The Philippines gaming regulator has made four critical changes in 2025 that fundamentally alter the competitive landscape.

First, licensing fees dropped, that’s a massive cost reduction has opened higher margins. Second, the offshore gaming ban eliminated international competition and created local market consolidation opportunities. Third, FATF grey list removal brings international credibility and opens up foreign investment. Fourth, clear e-gaming frameworks reduce regulatory uncertainty.

These changes are already attracting serious competition. Traditional offline players like Bloomberry are going heavy into digital. International giants are eyeing M&A opportunities. The easy entry phase won’t last long.

3. Winning Strategies (1/2):

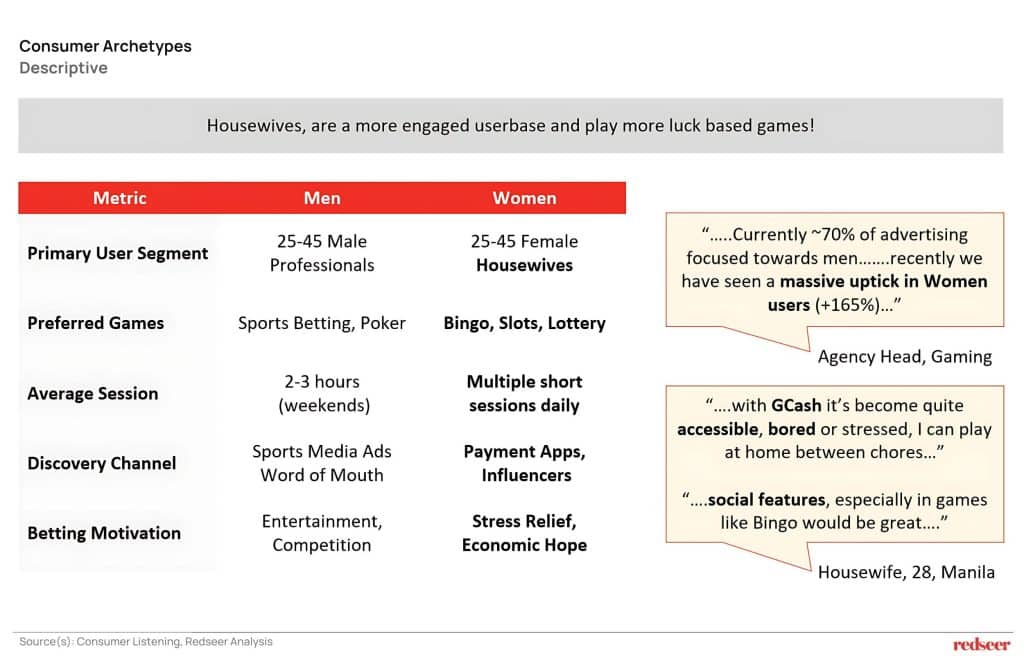

Women are more engaged and profitable; social features & quick luck-based games recipe to win!

The Underserved Opportunity: “Our consumer research has uncovered a massive strategic blind spot in the market. Despite women showing higher engagement and profitability metrics, 70% of advertising spend still targets men. Meanwhile, female participation has surged 165% – that’s explosive growth in an underserved segment.

Why Women Are the Better Bet: Look at the behavioral differences. Men play 2-3 hour weekend sessions focused on sports betting and poker. Women play multiple short daily sessions, prefer luck-based games like bingo and slots, and are motivated by stress relief rather than just competition. This creates higher lifetime value through more consistent engagement.

4. Winning Strategies (2/2):

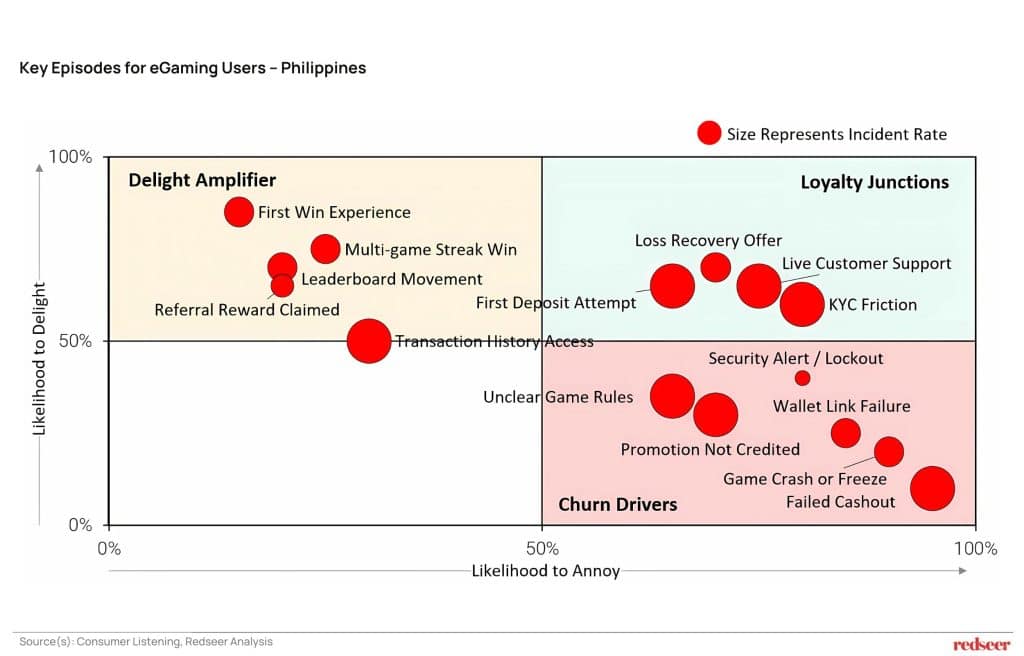

Additionally, we have identified 15 Moments of Truth – where customer loyalty is won or lost

While DigiPlus has scale advantages, our consumer listening research reveals systematic experience gaps across 15 critical user touchpoints. These aren’t minor inconveniences – they’re loyalty-defining moments where customers decide whether to stay or switch.

The Philippines gaming market offers a rare combination of massive growth, regulatory tailwinds, and incumbent blind spots.

Want to understand how you can make the most of it? Reach out to our experts to know more.