Hypergrowth in eGrocery – The new-age digital playing field

The E-tail industry has been the lifeline for residents in the past few months. The COVID-19 pandemic has left no individual, institution, or industry untouched. We have adapted our schedules and habits to this “new normal” of quarantines and curfews. This has consequently affected the e-tail sector – categories have been segregated into beneficiaries and strugglers. At least in the short term.

One of the beneficiaries is of course – Online Grocery or “eGrocery”.

1. 5X growth in eGrocery

During the COVID period, lockdown measures coupled with hygiene concerns pushed consumers towards online channels to meet their grocery needs. The industry went up 300% by volume and 500% by value in this short period. As a result, it grew to over 25% of the e-tail industry in UAE & KSA, up from 6% pre-COVID.

2. Online buying behavior to be sustained

This increase in eGrocery purchases was propelled in part by a significant number of first-time users of online grocery platforms. What is interesting is that consumers depict intent to continue this behavior even after the situation normalizes. Over 35% of consumers in UAE will “stick” to online channels. This is comparatively lower for KSA at ~15%.

3. However, customers have new expectations

Even though the client base has increased, players need to be wary of new expectations to succeed. A year ago, consumer decisions on eGrocery platform preference were heavily weighted towards value proposition metrics such as deals & discounts, product variety. The new-age customer prioritizes customer experience metrics delivery speed, packaging quality and of course contactless delivery. This shift signals the maturity of consumers.

4. Omnichannel players seem to have garnered a lead in mind share

When asked to choose amongst eGrocers, over 50% of consumers rank omnichannel players in their Top 3 preferences. Omnichannel players have stepped up the game through initiatives that have resulted in an agile supply chain leading to efficient fulfillment. An example is Carrefours move to transform 2,000 metres in one of their stores into a fulfillment centre that can cater to 2,000 additional orders.

5. Which gives players ample opportunity to up the ante

The increased demand and revised consumer expectations has disrupted the industry and given players more “ways to play”. New business models such as hyperlocal delivery are entering the segment to fill this new vacuum. The possibility for a sustained superior position in the industry is more achievable than ever. Digital readiness and robust supply chain management are critical playbooks that industry players would need to tap in to in order to succeed.

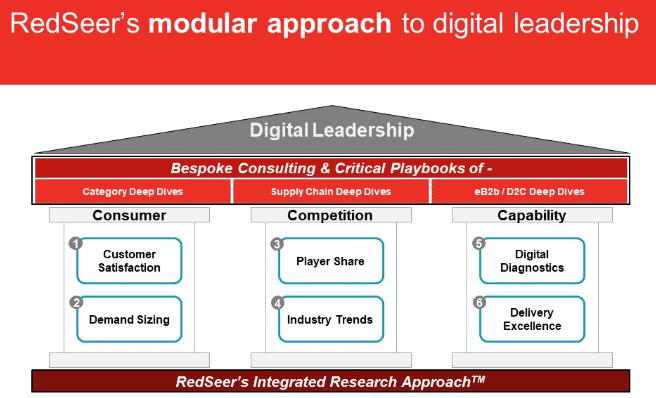

6. Modular approach

We have created a modular approach to digital leadership – a combination of bespoke consulting, critical playbooks and deep dives into the 3 pillars of consumer, competition and capability.

Read More:

1. eGrocery in UAE – Q3 Update

Written by

Rohan Agarwal

Partner

Rohan Agarwal has been a part of the Redseer Strategy Consultants journey for over six years. He is an expert in digital strategy for traditional corporates and start-ups.

Talk to me