Online higher education has come a long way in a relatively short time. Just a few decades ago, the concept of being able to learn at any time, from anywhere was unheard of. Today, however, the industry is experiencing unprecedented levels of growth, and is expected to soar even higher in the years to come. In this week’s newsletter, we’ll take a closer look at the latest picture of online higher education growth, and explore some of the growth drivers that are helping to fuel this remarkable expansion.

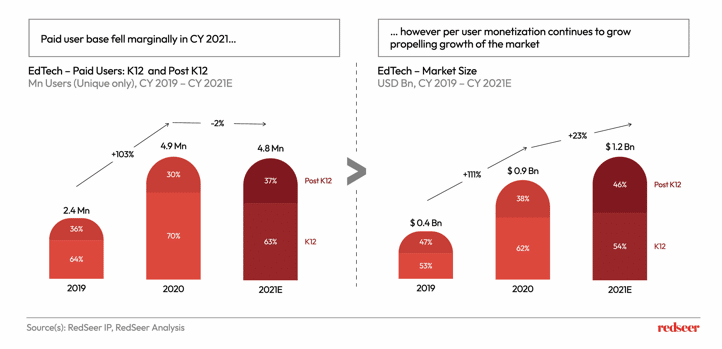

1. EdTech is finding a new normal after COVID-19- induced surge

The Edtech sector in India has been through a wild ride over the last few years. Before the COVID-induced pandemic hit us, EdTech stayed in the shadows. However, during the pandemic, the sector saw an unprecedented rise. The new normal, it seems, is a healthy dose of COVID-induced euphoria, followed by a period of more measured growth and evolution. EdTech is seeing a new crop of entrepreneurs and investors and is evolving to meet the needs of a rapidly evolving landscape. Further, the sector has received a boost from the government’s efforts to improve the quality and reach of school education, and from the continued digitization of India’s economy.

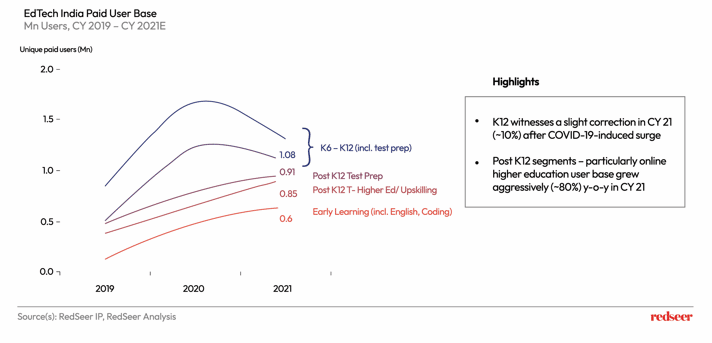

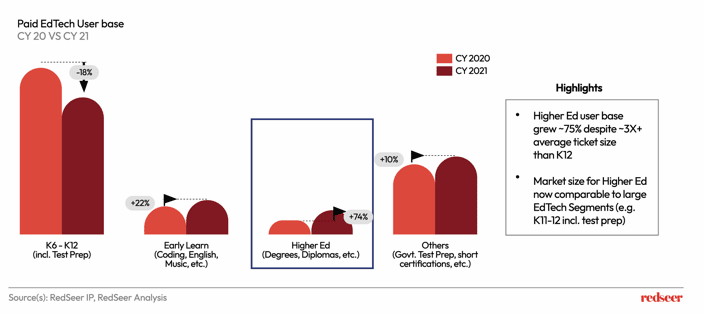

2. But we witnessed something more — Higher ed emerges as the fastest growing sub-segment, while the K12 and Test Prep segment slowed

Soon after the COVID-19-induced pandemic, K12 and test prep in particular witnessed a dip in their growth. However, the same cannot be said for higher education category, as higher ed turned the tables around by emerging as the fastest growing sub-segment.

3. The user base for higher education grew ~75% in the last year — superseding other edtech segments

The report further stated that the user base for online higher education grew by ~75% in 2021, despite a 3X growth in the average ticket size compared to the K12 segment. In fact, the market size for online higher education is now comparable to the largest EdTech Segments (I.e., K6-12 including test prep).

4. The four main drivers responsible for the sector’s growth are…

Relaxation in regulations governing degrees is one of the causal factors that is driving this growth forward. Thanks to this, EdTech companies can now partner with universities to offer online degrees. The unbundling of courses and democratization of access unquestionably boosts the demand for online higher education and also increases the completion rate. Another growth driver is the supply-side capacity gaps. India has supply-side constraints in education infrastructure (especially for specialized courses). Transition to the credit system as well as the realization of the need for higher education by students and working professionals who are new to the workforce, is further contributing to the boom in this sector.

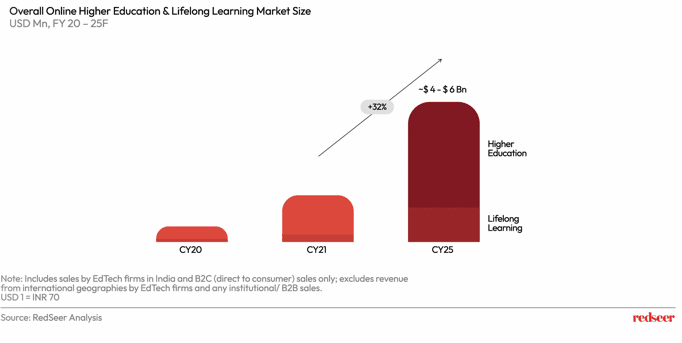

5 With the Online Higher Education & Lifelong learning market poised to reach ~$ 5 Bn by CY 2025, EdTech Is Destined To Flourish!

India’s booming edtech market, which saw multiple startups and increased funding during the pandemic, is expecting further boost on the back of growth in higher education and lifelong learning segments. The market for online lifelong learning also will expand further with “further push after COVID as the economic uncertainty further establishes the need for continuous learning”.

With millions of young people in India looking to gain access to world-class education and training, online higher education has become a key sector in the Indian education landscape. The future is surely bright for this sub-segment, making it an exciting space to watch.