2024 has been a transformative year for global markets, and we’ve seen a number of critical shifts since our last update. From rising interest rates to fluctuating oil prices, the investment landscape has been anything but stable. In this article, we’ll explore how these economic headwinds are reshaping capital markets, with a special focus on the MENA`s resilience in the IPO space.

What to expect in this article:

- FED interest rates reached their highest levels since the Dot-Com era

- The impact of declining oil prices on MENA liquidity

- MENA’s standout performance in the global IPO market

- Upcoming IPOs this year

We solve the strategy behind scale!

Read on for a detailed overview of key market movements and how MENA is bucking global trends.

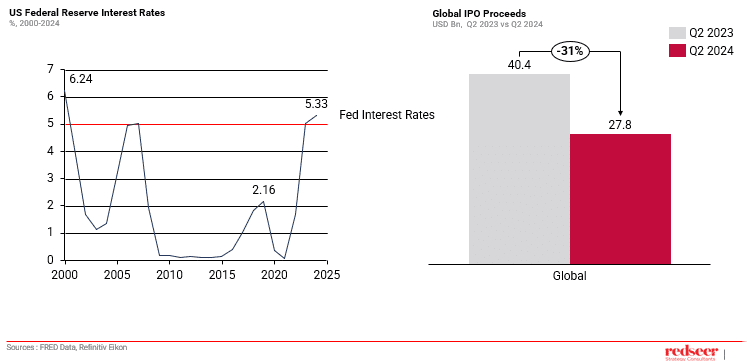

1. FED Interest Rates Are at Their Peak Since the Dot-Com Era, Leaving Global IPO Proceeds to Shrink

The global financial landscape has seen a significant shift, with the U.S. Federal Reserve raising interest rates to levels not seen since the early 2000s. In 2020, rates were at a modest 2.16%, but by 2024, they’ve surged to over 5.33%, altering the global investment climate. With higher interest rates, companies find it harder to access capital through loans as debt financing becomes costly. As a result, many turn to equity markets, but raising funds through IPOs is now also more expensive, as investors expect higher returns to compensate for the increased risk and cost of capital. This has led to a 31% drop in global IPO proceeds, as companies either delay going public or seek alternative funding methods, further tightening capital markets.

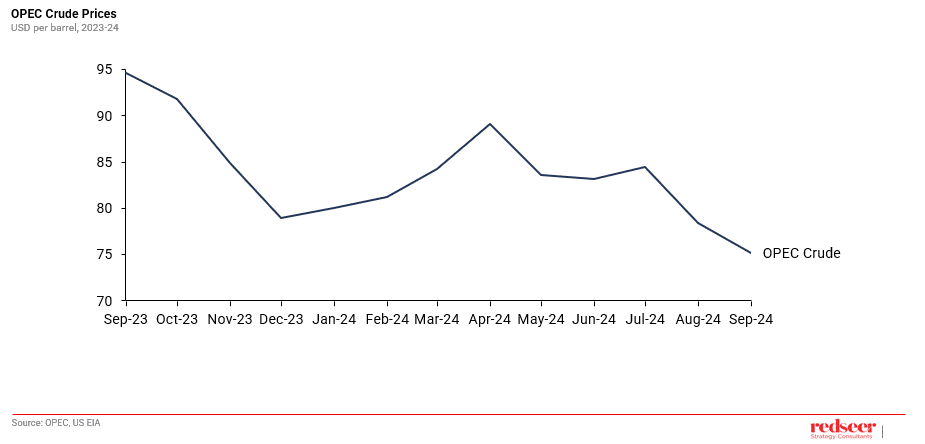

2. MENA is Also Facing Liquidity Headwinds with Declining Oil Prices

A sharp decline in oil prices has contributed to liquidity constraints, creating hurdles for traditional revenue streams. OPEC crude prices, which stood at $94.6 per barrel in September 2023, have plummeted to $75.17 by September 2024, largely due to a combination of slowing global demand, geopolitical shifts, and OPEC’s own production adjustments aimed at balancing supply.

Lower oil revenues have directly impacted government spending, as many regional economies rely heavily on oil exports. This slowdown also extends to government-backed family offices and oil-linked industries, where reduced liquidity is constraining investment.

3. While the IPO Market Has Declined Globally, MENA Has Emerged as a Leading Region, with Investor Confidence Remaining High

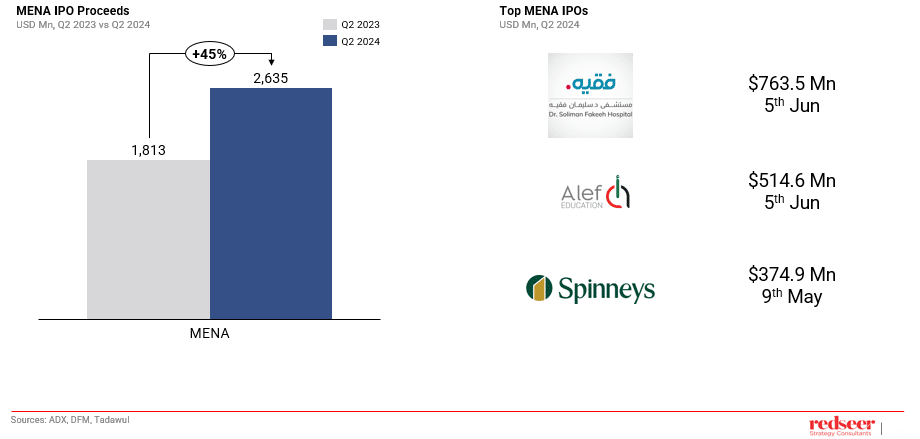

Despite these challenges, MENA has emerged as a standout player in the global IPO market. As rising interest rates make debt financing more expensive, companies in the region are increasingly turning to equity markets as a more viable option for raising capital. While global IPO activity has slowed, MENA’s IPO market is defying the trend, with a 45% increase in listings. This surge is fueled by strong investor confidence and a diverse range of industries stepping into the public market.

Notable IPOs this year include Dr. Soliman Fakeeh Hospital’s offering, raising $763.5 million on June 5th, Alef Education’s $514.6 million IPO, and Spinneys’ impressive public listing with $374.9 million raised in proceeds. MENA’s resilience and access to equity capital are positioning it as a key player in the global investment landscape.

4 . The upcoming IPOs signal strong market confidence, and continuing momentum in the MENA equity markets

Several major IPOs are on the horizon in the MENA region, signaling continued momentum in the equity markets. Among the highly anticipated offerings is Tabby, a leader in the buy-now-pay-later (BNPL) space, alongside retail giants Lulu Group and Avenues World, both of which are expected to attract significant investor interest. In the aviation sector, Etihad Airways is also preparing for its public debut, signaling confidence in the region’s travel and tourism recovery. Additionally, Talabat, a key player in food delivery, and fintech company HyperPay are gearing up for their IPOs, underscoring the diversity and strength of MENA’s upcoming public offerings. These upcoming listings signal strong market confidence, reinforcing MENA’s resilience amidst global economic headwinds.

In a world where access to capital is becoming more challenging, MENA’s ability to maintain a strong IPO pipeline showcases its strength and adaptability. As global markets face uncertainty, the region stands out as an oasis of opportunity, proving that even in the toughest economic climates, there’s always room for growth and innovation.

Stay tuned for more updates as MENA’s IPO journey continues to chart new territory in 2024 and beyond.