India’s trucking sector is witnessing an ongoing evolution, characterized by the adoption of digital transformation alongside significant infrastructure development. This shift reflects the industry’s responsiveness to changing demands and technological advancements. As a vital component of the country’s logistics ecosystem, trucking not only fuels economic growth but also serves as the backbone of trade, agriculture, and manufacturing. Despite its significance, the industry faces numerous challenges rooted in inefficiencies, fragmentation, and underdeveloped digital infrastructure. However, the trucking landscape offers substantial opportunities for businesses and investors who can capitalize on the sector’s evolution. In today’s article, we’ll explore the key factors that define the Indian trucking industry, the challenges it faces, the emerging opportunities, and the role of digital trucking platforms in addressing these inefficiencies.

Trucking Sector: A Critical Piece of the Logistics Puzzle

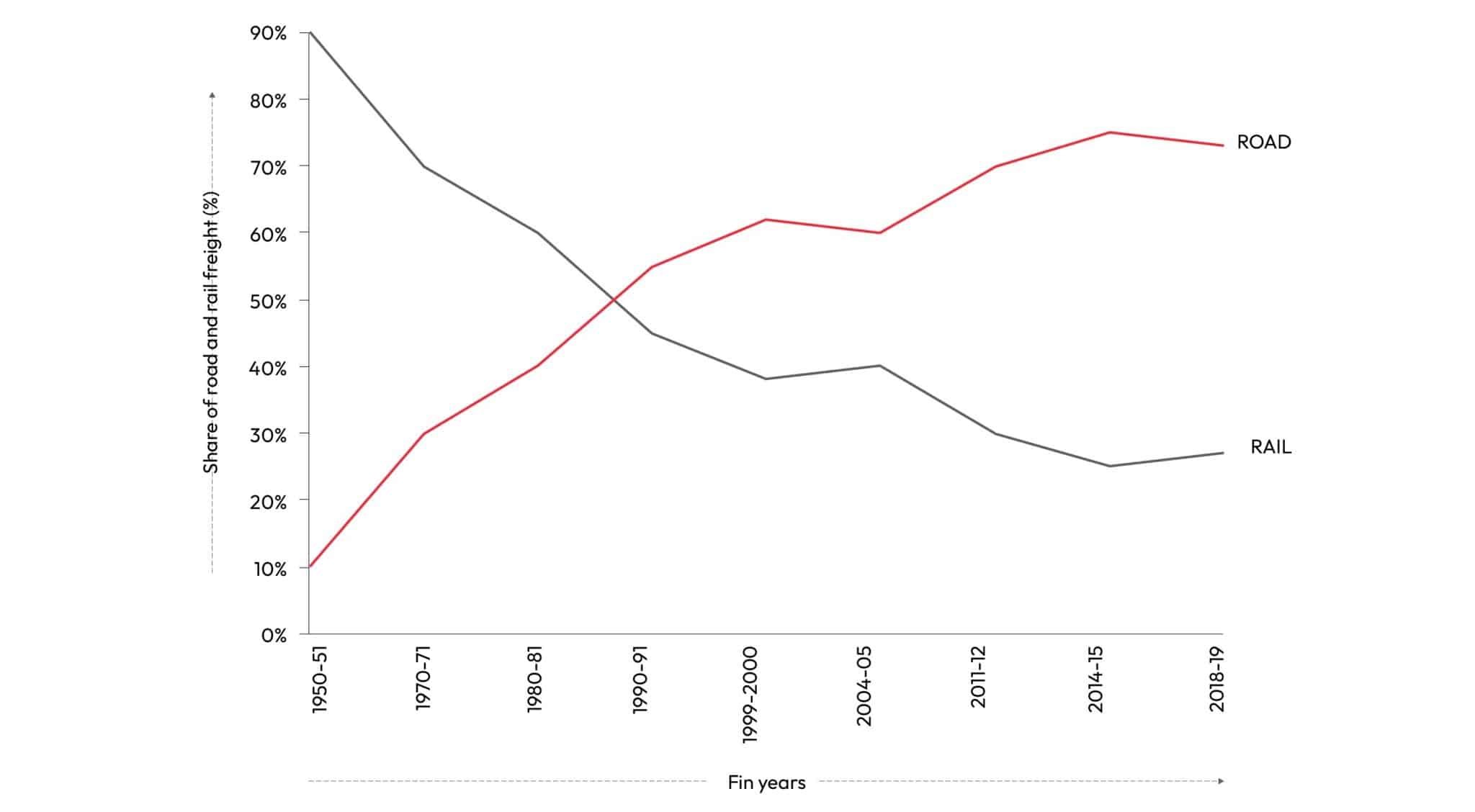

India has the second-largest road network in the world, with a sprawling 6.671 million kms of roads as of November 2023. It forms the backbone of India’s logistics sector, responsible for 46% of logistics activities as of Fiscal 2024. This dominance has been a gradual evolution, with road freight overtaking rail as the primary mode of transportation since the 1950s.

Share of road and rail freight

The trucking industry itself is massive, with around 12.5 million trucks on the road, operated by approximately 3.5 million truck operators. Freight movement via trucks in India is valued at $170 billion in Fiscal 2024, with an expected growth rate of 8-9% CAGR between 2024 and 2028. This growth is underpinned by higher consumption, expanding production, and an ever-increasing demand for reliable, point-to-point connectivity between industries, factories, agricultural centers, and urban hubs.

A Fragmented Bharat-Driven Industry

One of the most pressing issues that India’s trucking industry faces is its fragmentation. Around 75% of truck operators in India own fewer than five trucks, a pattern that is common not just in India but globally. Similar patterns are observed in China and the United States, where smaller operators dominate the sector. The fragmentation is driven by multiple complex operational challenges faced by truck operators, which include searching for loads, managing payments, overseeing maintenance, and handling working capital.

The trucking sector is fundamentally a Bharat-driven phenomenon, extending far beyond the confines of metropolitan areas and extending to the rural and semi-urban regions—home to 65-70% of the country’s population—that truly underpin this industry. Agriculture too necessitates robust trucking networks to transport goods from farms to wholesale markets. The geographic spread of truck operators is vast, with 80% of trucks spread across 80% of India’s districts, highlighting the importance of trucking beyond urban areas.

However, this geographical spread, combined with lower digital literacy and the need for localized support, further complicates the trucking ecosystem. A majority of operators are middle-aged, speak vernacular languages, and have limited access to digital tools. These demographics face considerable barriers in adopting digital platforms, further deepening the fragmentation and hindering operational efficiency.

Structural Challenges in the Trucking Industry

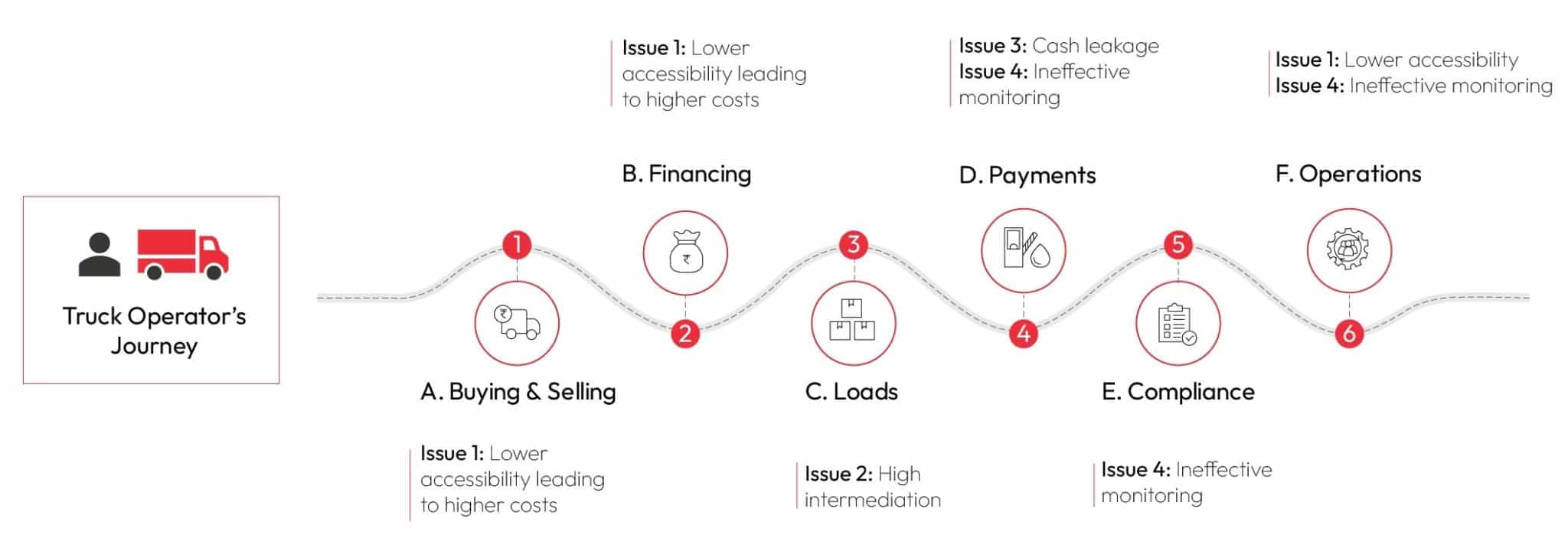

The trucking industry faces several structural challenges that contribute to its inefficiency and increased operational costs. These challenges are deeply ingrained in the industry’s fragmented nature and require innovative solutions to address them.

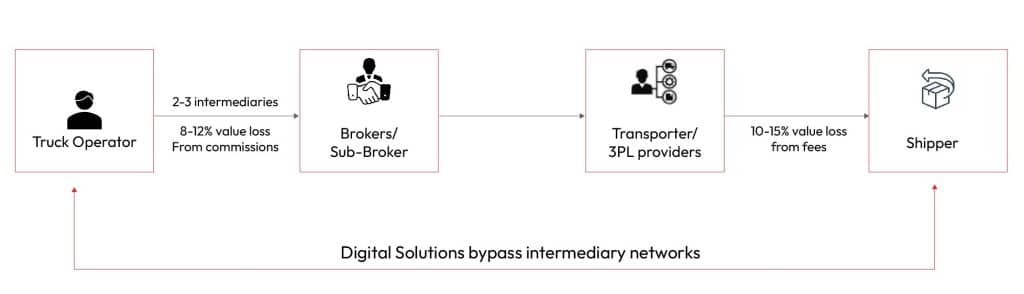

High Intermediation and Inefficiency

One of the most significant challenges in the trucking industry is the reliance on intermediaries. These brokers often facilitate load matching between truck operators and shippers, but this process is time-consuming, inefficient, and costly. Trucks in India spend, on average, 24-48 hours idle while waiting for loads, resulting in underutilization of resources. This inefficiency contributes to higher operational costs, with trucks typically running only 18-20 days a month, while the remaining time is spent searching for loads or idling.

Cash-Driven Operations:

The trucking industry in India is still heavily cash-driven, with cash transactions used for fuel payments, tolls, driver wages, and maintenance. This cash-based model not only leads to financial leakages and pilferage but also limits the ability of truck operators to streamline their operations. The lack of a reliable digital payment ecosystem exacerbates these issues, hindering financial transparency and increasing costs for operators.

Limited Technology Adoption

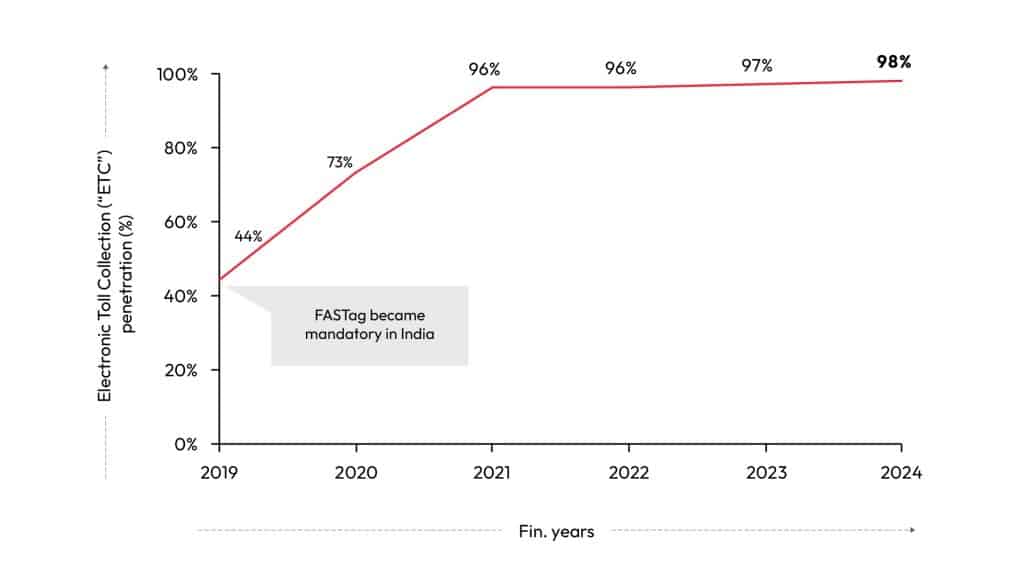

Despite advancements in technology and regulatory reforms like the introduction of FASTags for electronic toll payments, the adoption of digital tools in the trucking industry remains low. A significant portion of truck operators lack access to the internet or smartphones, and many are wary of adopting digital platforms. This digital divide further limits the sector’s ability to scale efficiently.

Lack of Fleet Monitoring and Maintenance Systems

Truck operators often manage their fleets remotely, especially when drivers are employed by third parties. This lack of direct oversight leads to inefficiencies in fleet management, including inadequate monitoring of driving behavior, fuel usage, and maintenance schedules. The absence of real-time tracking results in idle times at checkpoints, fueling stations, and rest stops, leading to wasted resources and increased operational costs.

The Road to Transformation: Opportunities in Digital Trucking

Despite the numerous challenges, India’s trucking industry presents significant opportunities for businesses, investors, and digital platforms that can address these inefficiencies. As the industry continues to evolve, several key areas offer immense potential for growth.

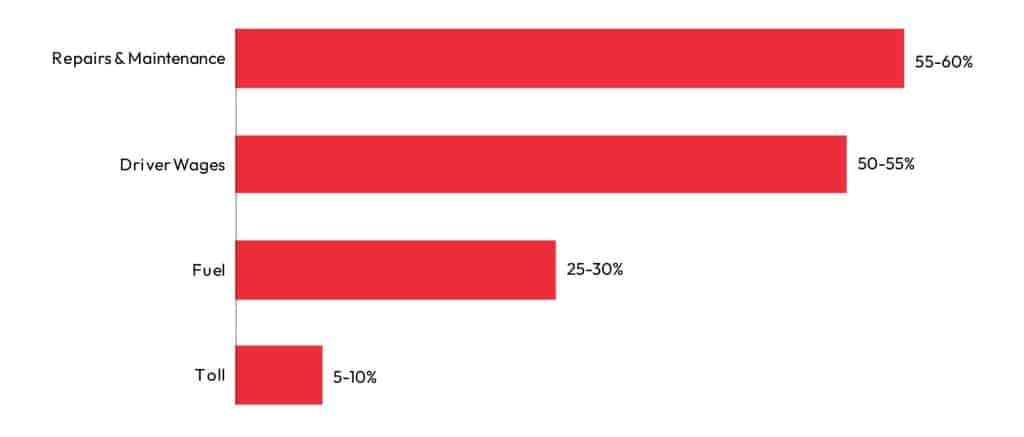

Digital Toll and Fuel Payments

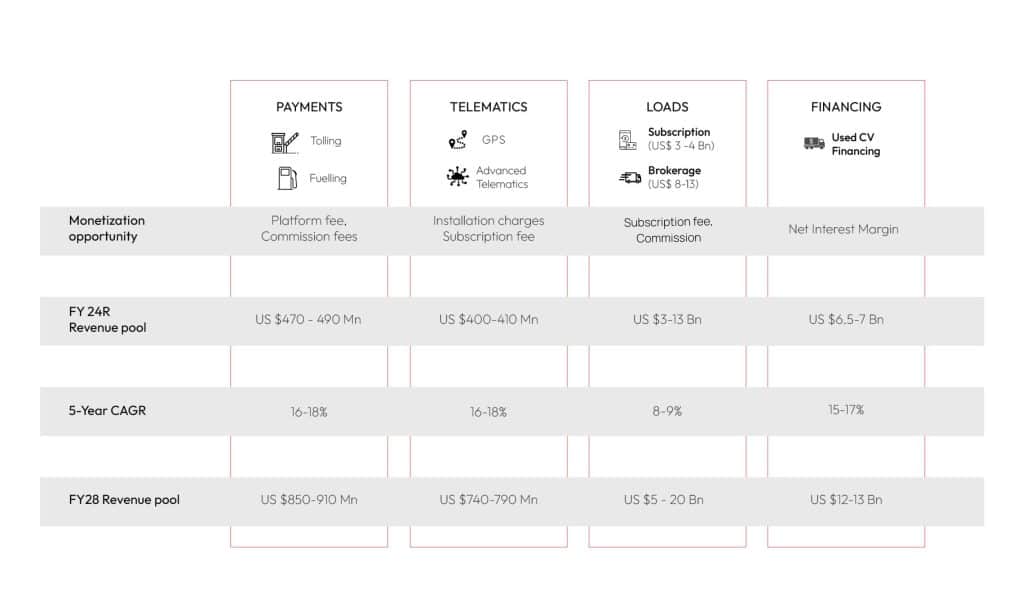

Toll and fuel payments represent almost 80% of a typical truck operator’s expense. The introduction of FASTags for toll payments and digital fuel cards is transforming how these transactions are managed. The total revenue pool for digital payments is projected to grow from $470-490 million in Fiscal 2024 to $850-910 million by Fiscal 2028, at a CAGR of 16-18%. Digital payment systems can help truck operators track and manage expenses more efficiently, reducing leakages and improving cost control.

Telematics and Fleet Management Solutions

The adoption of telematics solutions is rapidly increasing in India, with vehicle tracking systems expected to grow from a 20% penetration rate in Fiscal 2021 to 40-45% by Fiscal 2024. These systems allow truck operators to monitor vehicle performance, driving behavior, and maintenance schedules in real time. By providing truck operators with detailed insights into fleet performance, telematics solutions can help reduce fuel consumption, minimize wear and tear, and optimize fleet utilization. The revenue pool for telematics solutions in India is expected to reach $400-410 million by Fiscal 2024.

Digital Freight Platforms

The Indian road freight industry is dominated by offline brokers who charge hefty commissions for facilitating load matching. However, digital freight platforms that connect shippers and truck operators directly are beginning to gain traction. These platforms reduce the need for intermediaries, lower transaction costs, and enhance load-matching efficiency. The digital freight market in India is still in its infancy, with less than 2% penetration, but it is expected to grow at a CAGR of 8-9% between Fiscal 2024 and Fiscal 2028. These platforms offer a significant opportunity to streamline freight logistics, improving truck utilization and reducing idle time.

Vehicle Financing

The used commercial vehicle financing market is substantial, with an estimated value of $54-56 billion in Fiscal 2024. Traditionally, this market has been dominated by unorganized financiers who charge exorbitant interest rates. However, the emergence of digital financing platforms can streamline loan processes, reduce interest rates, and improve transparency. By leveraging data and analytics for credit assessment, digital lenders can offer affordable loans to truck operators, improving access to financing and reducing dependency on informal lending channels.

Key Success Factors for Digital Trucking Platforms

For companies looking to capitalize on the opportunities in the Indian trucking sector, a few key success factors are crucial:

Technology-Driven Scalability

Technology-led businesses have the potential to scale rapidly across India, bypassing traditional distribution challenges and offering customizable solutions that cater to regional languages and preferences. By utilizing data to optimize routes, payments, and fleet management, digital platforms can create efficiencies and enhance customer loyalty.

Building Trust Through Physical Presence

While technology offers scalability, a physical presence is necessary to build trust with truck operators, particularly in rural areas. A hybrid “phygital” approach—combining digital convenience with localized on-the-ground support—will be critical for digital platforms to succeed. This model ensures that truck operators receive the personal assistance they need while benefiting from the efficiency of digital tools.

Integrated End-to-End Solutions

One of the most significant opportunities for digital platforms in India’s trucking sector is the ability to offer integrated, end-to-end solutions that address the full spectrum of truck operators’ needs. This includes services such as toll and fuel payments, vehicle tracking, load matching, vehicle financing, and maintenance services. By consolidating these offerings on a single platform, businesses can reduce acquisition costs, improve unit economics, and drive greater value for truck operators.

The Road Ahead for India’s Trucking Sector

India’s trucking industry is obviously at a pivotal juncture. The country’s rapid economic growth, along with a shift towards digitalization and infrastructure development, presents substantial opportunities for businesses, investors, and digital platforms. While the sector faces significant challenges, particularly due to its fragmented nature, there is a clear path to a robust landscape. Digital platforms that can streamline operations, reduce inefficiencies, and offer integrated solutions are poised to capture significant market share.

At Redseer Strategy Consultants, we specialize in understanding the complexities of important sectors. The trucking and logistics industry is well-positioned to assist businesses in navigating these changes. Whether you’re a brand looking to expand your presence or optimize your growth strategy, or an investor seeking to enhance your portfolio with commercial due diligence, we can guide you in crafting a tailored solution that leverages the opportunities in India’s rapidly evolving trucking market.

Ready to drive your growth strategy forward? Let Redseer be your trusted partner in crafting strategies that set you apart in an increasingly competitive market.