In the race toward digital transformation, India finds itself at a crossroads—one where progress meets an unintended consequence. With every smartphone upgrade, every discarded laptop, and every obsolete appliance, the country inches closer to an environmental challenge that cannot be ignored: Electronic Waste or E-Waste.

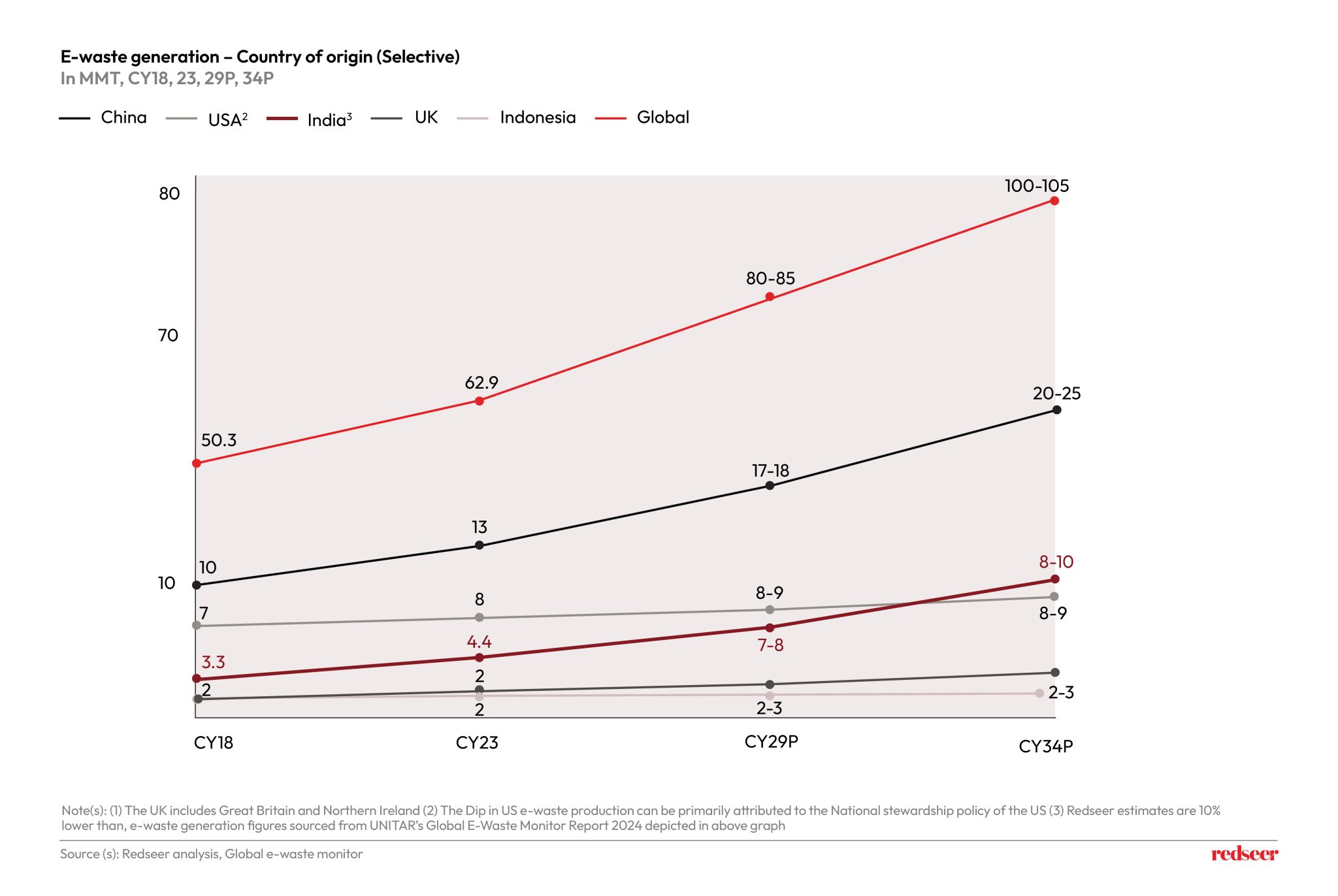

While rapidly advancing as a global technology powerhouse, India is also emerging as the third-largest producer of e-waste globally, trailing only China and the United States. India’s, e-waste generation has surged from ~2 to ~4 MMT between FY14 and FY24, driven by increasing urbanization and rising disposable income. As digital adoption continues at breakneck speed, e-waste generation will only accelerate.

Where is India’s E-Waste Coming From?

Have a question?

Our experts are just a click away.

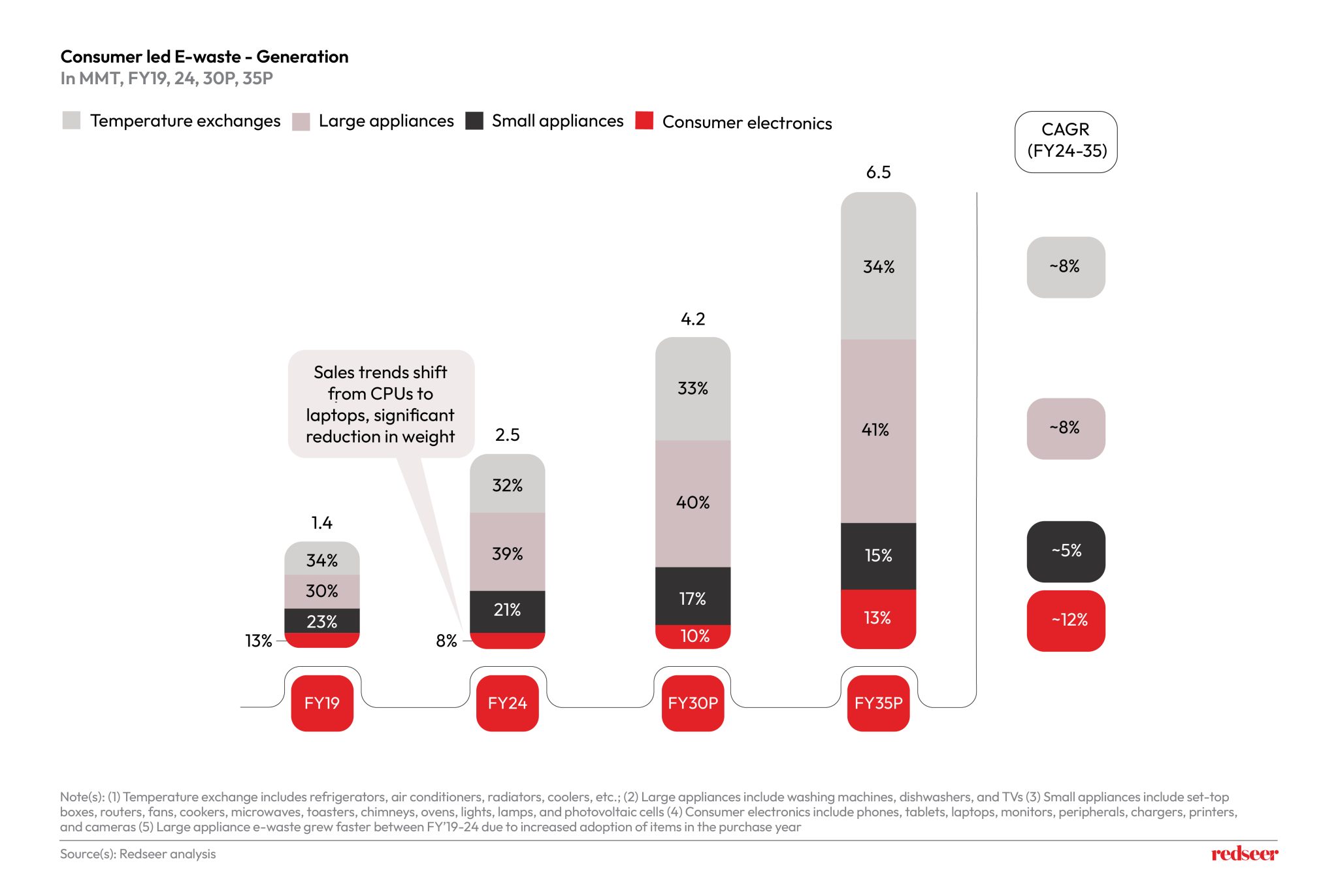

E-waste in India is predominantly generated through two channels: households and businesses. However, the consumer segment is the primary contributor, accounting for nearly 70% of the total e-waste generated in FY24. Consumer e-waste is broadly categorized into four segments:

- Temperature Exchange Equipment: Refrigerators, air conditioners, radiators, coolers, etc.

- Large Appliances: Washing machines, dishwashers, televisions.

- Small Appliances: Set-top boxes, routers, fans, cookers, microwaves, toasters, chimneys, ovens, lights, lamps, and photovoltaic cells.

- Consumer Electronics: Phones, tablets, laptops, monitors, peripherals, chargers, printers, and cameras.

A notable trend shaping e-waste generation is the shift in material intensity. While appliances are becoming more compact and lightweight, the sheer volume of discarded items is increasing. Additionally, over time, small appliances like microwaves have become more compact and are now manufactured using lighter materials such as aluminum and steel, replacing the heavier metals such as iron used in older appliances.

Tackling the E-Waste Challenge: The Opportunity at Hand

The ever-increasing e-waste in India presents a significant economic opportunity, highlighting the need for a structured and sustainable e-waste management ecosystem. A robust formal sector can play a key role in achieving necessary targets. Proper recycling and responsible disposal can not only mitigate environmental damage but also unlock economic value through material recovery, job creation, and the development of a circular economy.

The Informal Sector: A Challenge and an Opportunity

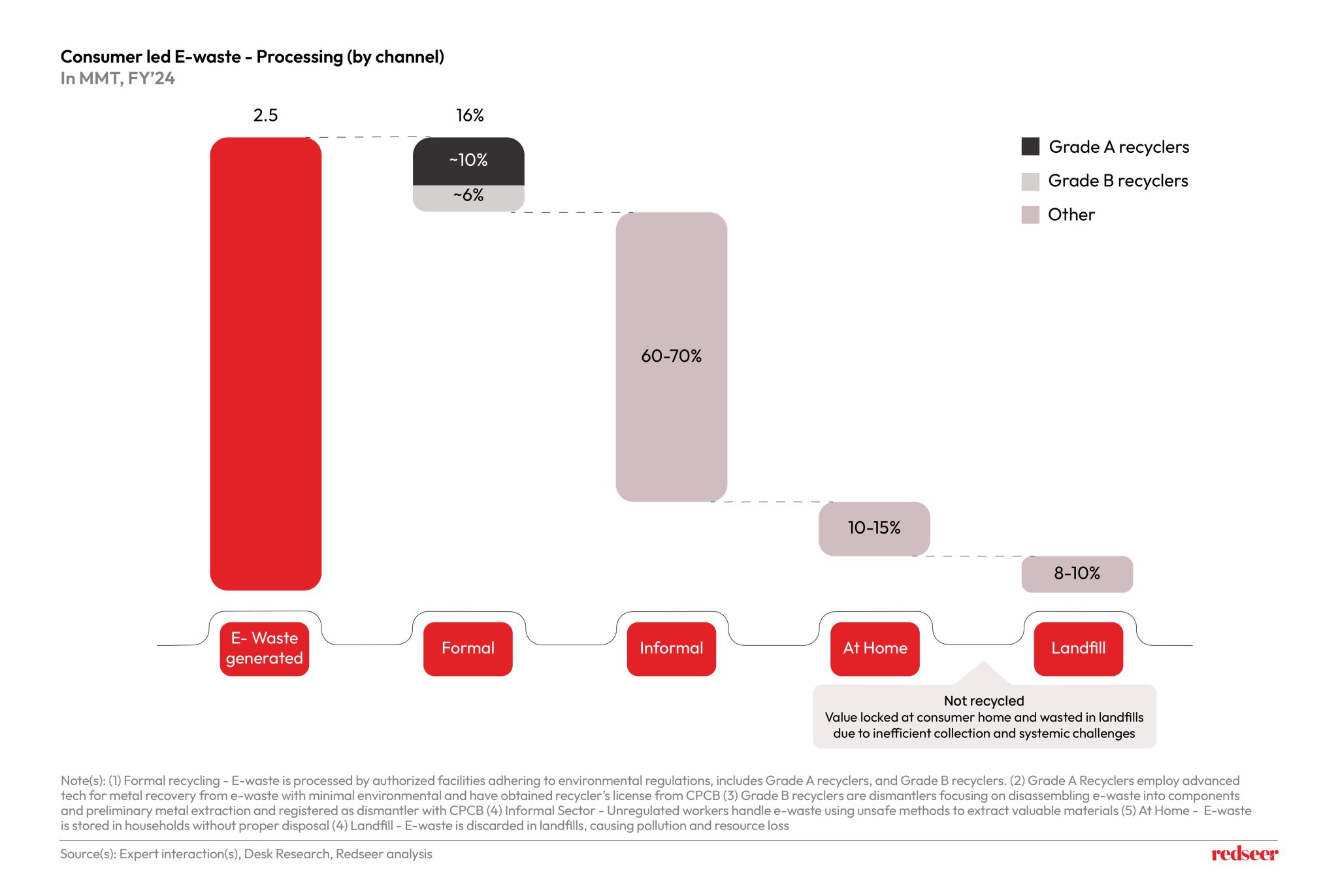

Despite the urgent need for structured e-waste management, only 16% of India’s consumer-led e-waste is processed through authorized recycling facilities. While awareness is growing, an overwhelming 60-70% of consumer e-waste still flows through informal channels, where unsafe extraction techniques lead to environmental pollution and severe health risks for workers. Additionally, around 10-15% of e-waste—mainly high-value consumer electronics like smartphones and laptops—remains stored in households, while another 8-10% of e-waste is discarded and ends up in landfills, further reducing overall recycling efficiency. Strengthening formal recycling infrastructure is crucial to tackling these inefficiencies and unlocking the full economic and environmental potential of e-waste management.

However, the dominance of the informal sector also presents a unique opportunity. These unregulated networks also play a crucial role in widespread waste collection, and integrating them into a structured, compliant framework could drastically improve recycling outcomes for formal sector.

The Growth of Formal Recycling and Its Roadblocks

Currently, only 16% of consumer e-waste in India is processed by formal recyclers. While the formal recycling sector is projected to expand at a CAGR of 17% by FY35, it is expected to handle just 40% of the country’s e-waste. Formal recyclers continue to face intense competition from informal players, who benefit from lower compliance costs and extensive collection networks.

The inefficiencies of informal recycling result in:

- Environmental Hazards: Toxic emissions from unsafe disposal methods pollute air, water, and soil.

- Health Risks: Workers handling e-waste without protective measures are exposed to hazardous substances.

- Resource Wastage: Inefficient metal recovery leads to resource loss, increasing reliance on fresh material extraction.

India’s e-waste recycling sector faces significant challenges despite growing recycling and sustainability demands. While the need for proper e-waste management continues to increase, the market remains dominated by informal players, with only a select few formal players having comprehensive collection and advanced processing capabilities. The formal recycling sector struggles with profitability due to high operational expenses, typically achieving only single-digit margins or sometimes operating at a loss. In contrast, informal recyclers maintain high-profit margins by keeping their operational costs minimal. For the formal recycling sector to expand and establish a stronger presence, it requires sustained financial support mechanisms.

Policy interventions on both the demand and supply sides will be critical in driving the growth of the formal e-waste recycling sector. On the demand side, establishing nationwide e-waste collection networks and incentivizing e-waste returns can significantly improve the volume of waste directed to formal recyclers. Meanwhile, on the supply side, stricter enforcement of Extended Producer Responsibility (EPR) regulations and mandating the use of green metals in manufacturing can enhance compliance and promote sustainable resource utilization. Together, these measures can accelerate the transition towards a more efficient and regulated e-waste management ecosystem.

EPR: A Step in the Right Direction?

Building a sustainable e-waste management ecosystem requires bridging gaps and empowering formal recycling. A key step in this direction has been the introduction of India’s Extended Producer Responsibility (EPR) framework. Initially launched in 2011 as a voluntary initiative, EPR has since evolved into a mandatory system with defined collection targets for producers. To drive compliance and strengthen formal recycling, the framework mandates that producers purchase recycling certificates exclusively from authorized recyclers, incentivizing collaboration and ensuring responsible processing. As EPR continues to evolve, it holds the potential to accelerate the transition towards a structured, efficient, and environmentally sustainable e-waste ecosystem in India.

Key milestones in EPR policy evolution include:

- 2016: Shift to a collection mechanism-based approach with nationwide targets.

- 2022: Introduction of EPR certification for recycling end-products like gold, aluminum, copper, and iron.

- 2024 & Beyond: Price regulation for EPR certificates and the launch of exchange platforms for trading recycling obligations.

While these policies aim to support the formal recycling industry, the EPR framework still has gaps. Low minimum EPR fees, insufficient formal recycling capacity to meet the targets, and weak enforcement dilute its impact. Strengthening these regulations is essential to ensuring long-term sustainability in India’s e-waste sector.

A Roadmap for the Future

As India’s e-waste landscape continues to evolve, stakeholders—including policymakers, industry leaders, and consumers—must collaborate to drive systemic change. Key focus areas should include:

- Strengthening Formal Recycling Infrastructure: Expanding certified processing facilities and incentivizing compliance.

- Engaging the Informal Sector: Integrating unregulated players into the formal ecosystem through structured partnerships and incentives.

- Enhancing Consumer Awareness: Educating consumers on responsible e-waste disposal to reduce home storage and landfill waste.

- Improving EPR Implementation: Enforcing stricter regulations and higher penalties for non-compliance.

By addressing these challenges proactively, India can transform its e-waste sector into a sustainable and efficient system that balances environmental responsibility with economic opportunity.

At Redseer Strategy Consultants, we specialize in providing data-driven insights to help businesses, policymakers, and industry stakeholders understand the challenges of a particular sector and turn them into opportunities. By leveraging our expertise in market analysis and strategic advisory, we enable our clients to drive growth and scalability.

As India continues its digital expansion, the need for a robust e-waste management system has never been greater. By leveraging proactive strategies and collaborative efforts, we can transform India’s e-waste sector into a sustainable, economically viable ecosystem that supports long-term environmental and business growth.