The cryptocurrency landscape is undergoing a fundamental transformation, shaped by consolidation, strategic acquisitions, and deeper integration with mainstream finance. What was once a fragmented market dominated by independent exchanges and fintech disruptors is now evolving into a more structured ecosystem, where traditional banks, telecom giants, and leading payment platforms are entering the space.

As we navigate this changing landscape, one thing is clear—crypto is no longer an industry operating in isolation but an essential part of the global financial infrastructure. In this edition, we explore how platforms are consolidating, payments are evolving, and remittances are being redefined, as digital assets move closer to mainstream adoption.

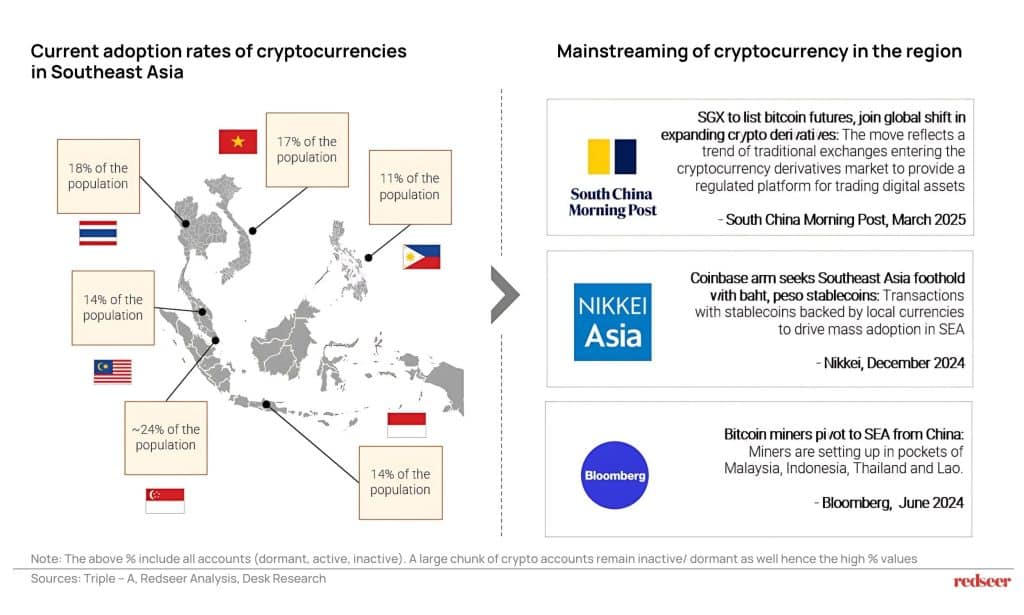

1. In terms of cryptocurrency ownership rates, the Southeast Asian countries are within the top 20 globally, with 4 countries being within top 10

Cryptocurrency adoption in Southeast Asia is one of the highest in the world. The adoption rates are further expected to rise as crypto offerings get more mainstreamed with legacy players entering the space, launch of a wider suit of product offerings and development of a holistic ecosystem.

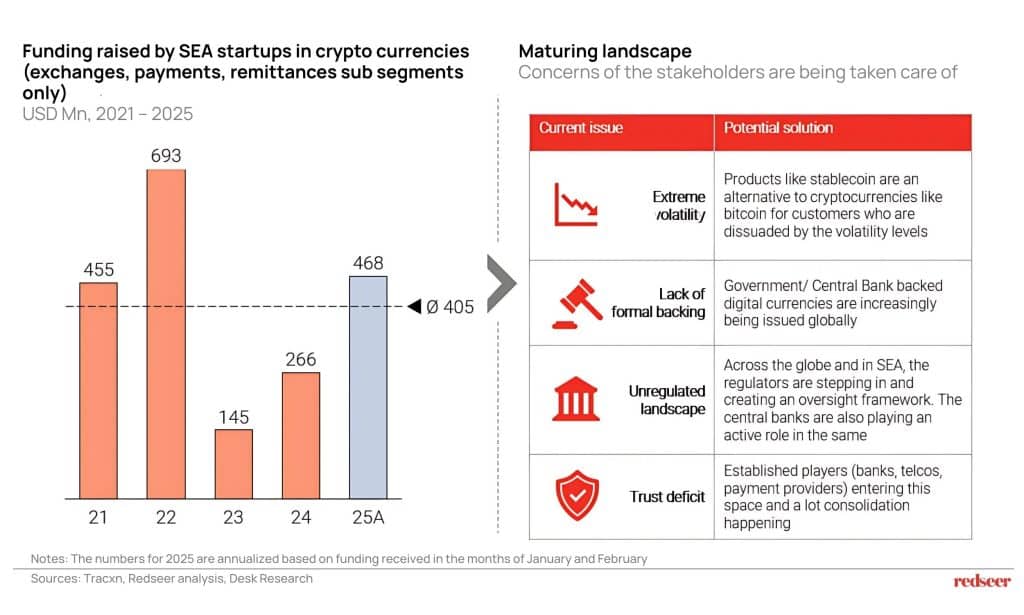

The funding and deal making activity within cryptocurrency space in southeast Asia are showing positive trends with major bounce back expected in 2025

Want to get strategic guidance?

The region is seeing a rise in funding and deal activity in the crypto space, with the annualized value for 2025 expected to be back at peak levels seen before the funding winter of 2023 -2024.

Further, a significant chunk of the fundamental concerns associated with cryptocurrencies are getting addressed via regulations, new product offerings, and integration of the crypto world with mainstream finance. This is further expected to drive deal-making (funding and M&A) in the sector as consolidations happen and traditional players enter the space.

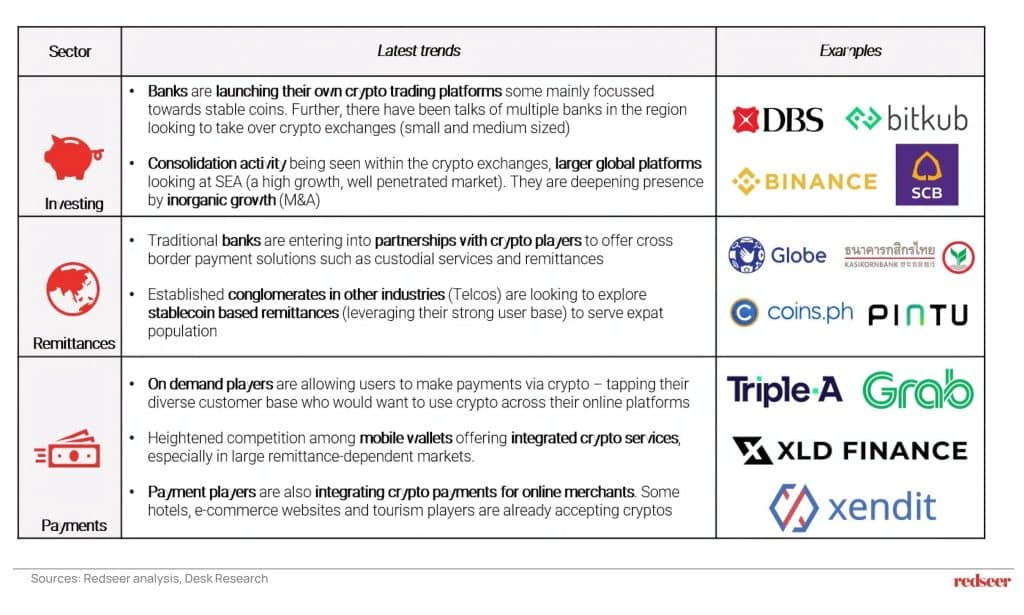

What is happening – consolidation and integration: There is a convergence of the crypto industry with the more traditional financial services industry players and offerings

The crypto industry in Southeast Asia is undergoing strategic consolidation and integration with traditional financial services, driven by M&A activity and institutional adoption. Banks are launching crypto trading platforms and acquiring exchanges, while telcos and financial institutions are leveraging stablecoins for remittances to serve expatriates. Payment players are embedding crypto transactions into digital commerce, intensifying competition among mobile wallets and fintech’s. This convergence signals a maturing ecosystem where regulated entities are increasingly shaping the future of digital assets.

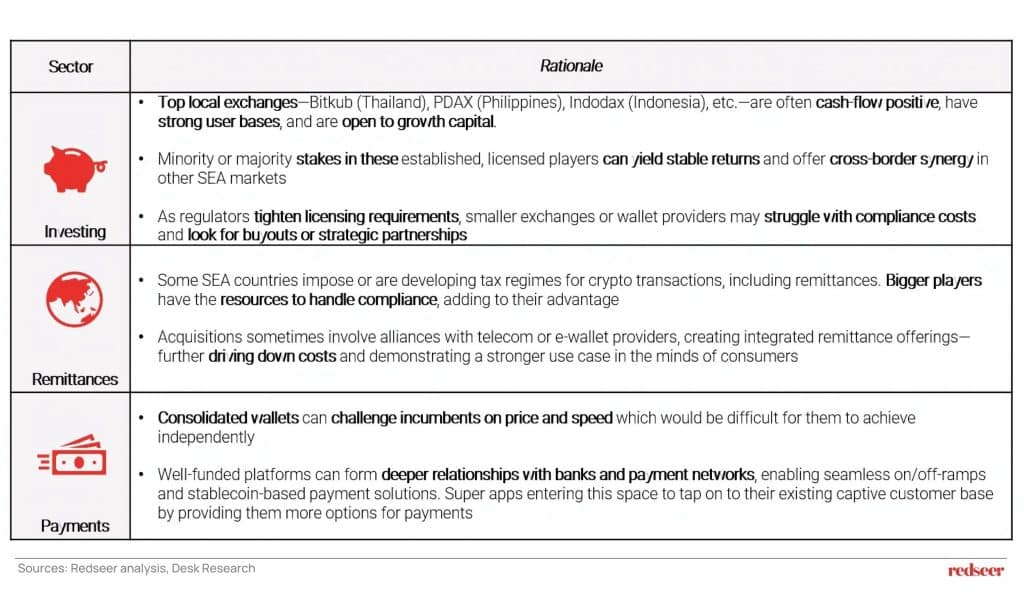

Why is it happening: Across sectors, M&A as a playbook is being applied to tackle regulations, solidify market positioning and deepen the existing customer wallet shares

M&A activity in the Southeast Asian crypto sector is being driven by regulatory pressures, market consolidation, and the need for financial synergies. Top local exchanges (e.g., Bitkub, PDAX, Indodax) are cash-flow positive and attract growth capital, while smaller players struggle with compliance costs, leading to buyouts and strategic partnerships. Larger firms in remittances and payments leverage their compliance capabilities and partnerships with banks/telcos to create integrated offerings, improving efficiency and consumer trust

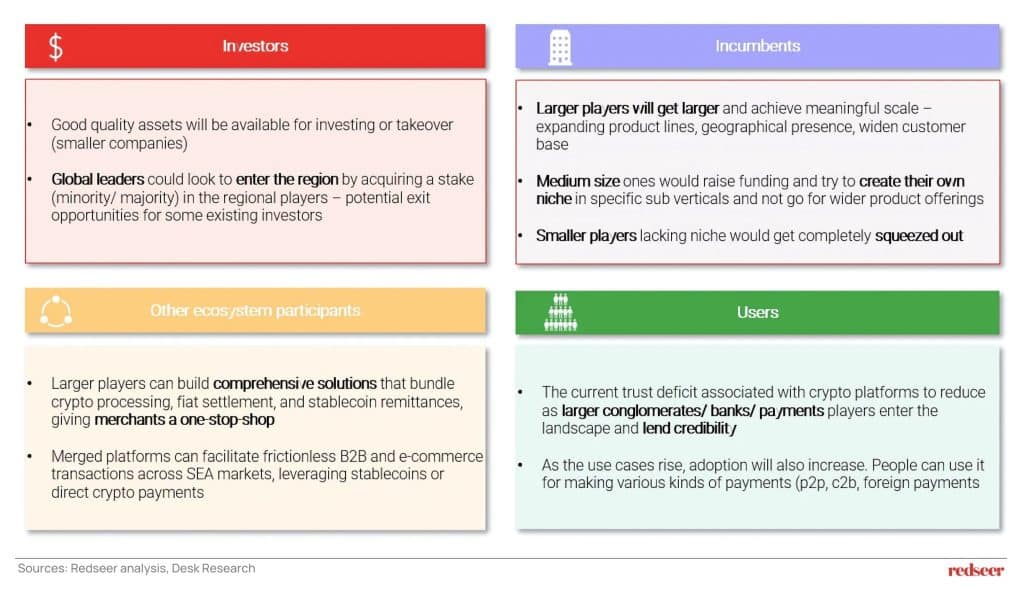

What does it mean: Larger players to get larger while smaller ones will get squeezed out, good quality assets available for investors at reasonable valuations, more choices for customers and merchants

The above image captures the various implications for the stakeholders and participants in the crypto ecosystem. On a net basis, the latest activities on the M&A and funding side will augur well for both the demand and supply side participants.