The GCC food delivery space is moving toward consolidation as scale becomes critical in an increasingly competitive and fragmented market. Jahez’s acquisition of Qatar-based Snoonu marks a strategic step in that direction.

We solve the strategy behind scale!

Qatar’s food aggregator market, valued at USD 1 Bn, accounts for 10% of the GCC total. Talabat leads the market with a GMV more than twice that of Snoonu. Jahez’s entry is expected to shake up the landscape, unlocking opportunities to innovate, expand offerings, and elevate the experience for customers, merchants, and delivery partners across the region.

Read on to explore the broader impact of the Jahez–Snoonu deal.

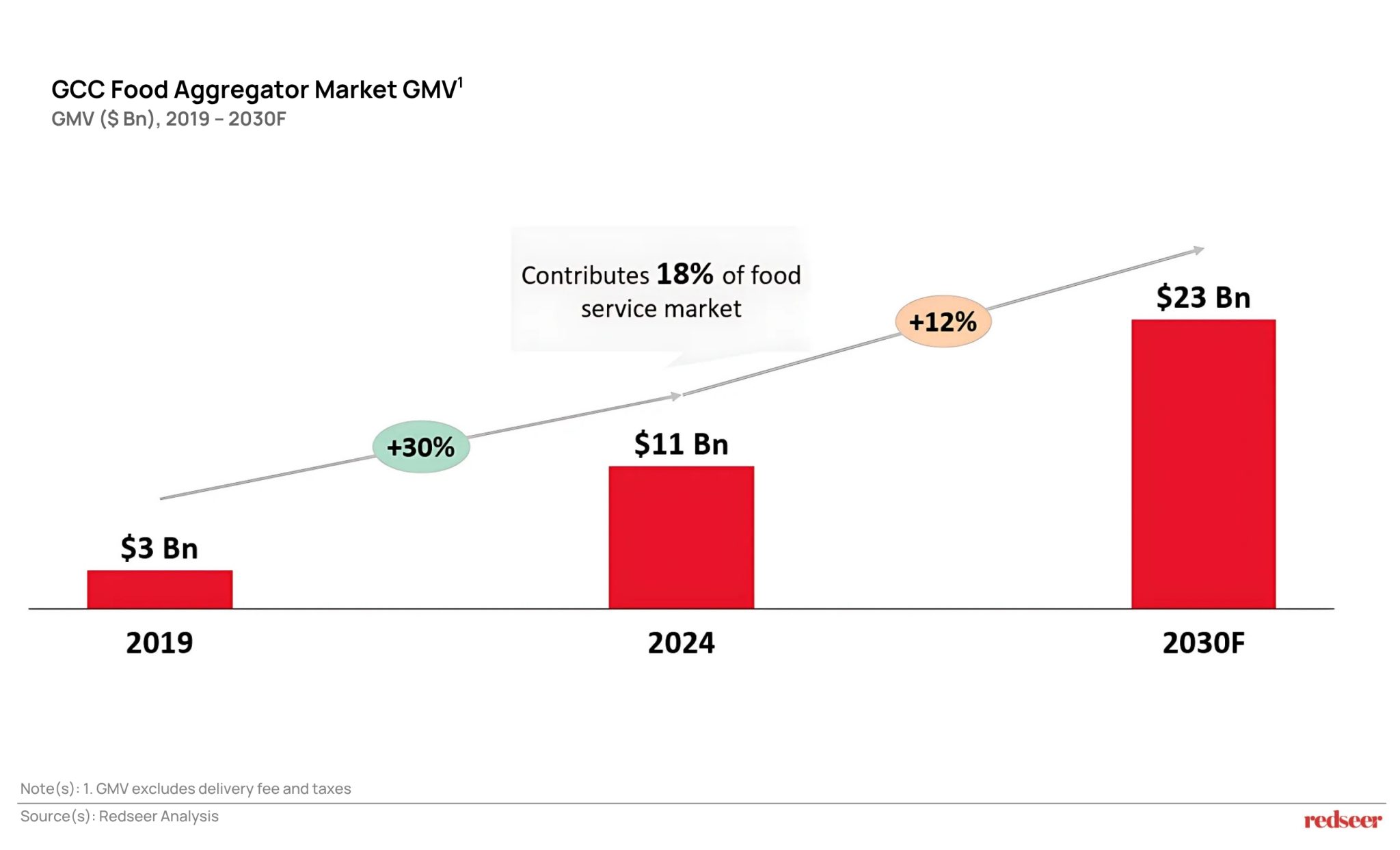

1. GCC food delivery aggregator market is large and expected to double over the next six years

The GCC food delivery aggregator market is currently valued at USD 11 Bn, with KSA accounting for nearly 50% of the total. Kuwait and Qatar are among the most mature markets, with delivery aggregators contributing over 30% of the overall food service sector. Looking ahead, the market is projected to grow at a healthy CAGR of 12%, with the bulk of this growth expected to come from KSA. In more mature markets such as the UAE, Kuwait, and Qatar, growth will primarily be driven by increasing spend per user.

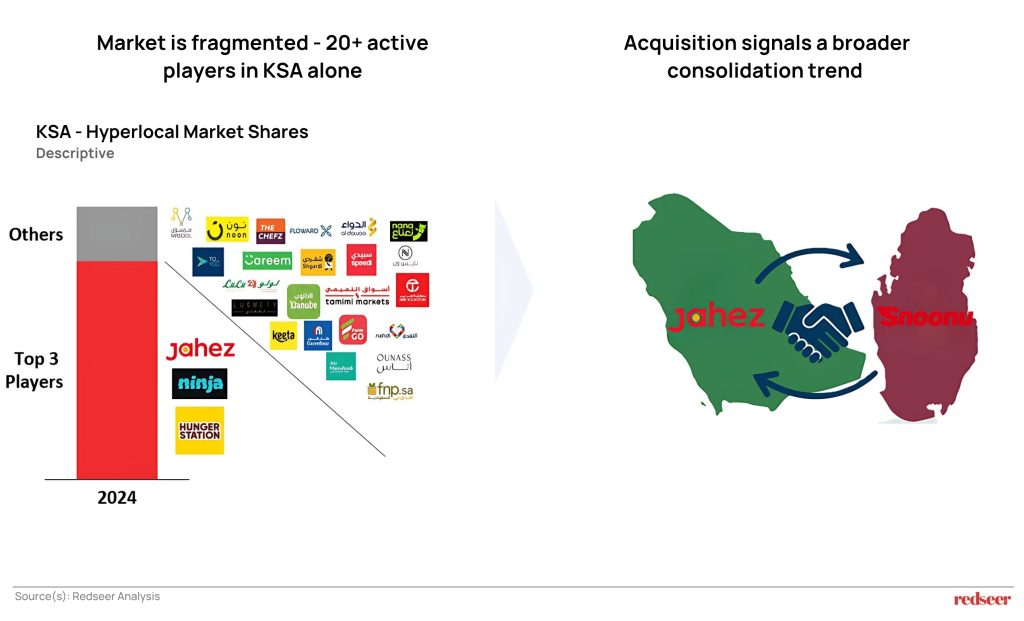

2. However, the market remains fragmented; Jahez’s acquisition of Qatar-based Snoonu reflects a broader shift toward consolidation

However, the Q-commerce market remains fragmented and highly competitive. The recent entry of Keeta, along with the expansion of local players such as Noon, Ninja, and Jahez into new markets, has intensified competition across the GCC. Jahez’s recent acquisition of Snoonu signals a broader shift toward consolidation and is likely to trigger similar moves regionwide as smaller players seek partnerships or acquisitions to stay competitive.

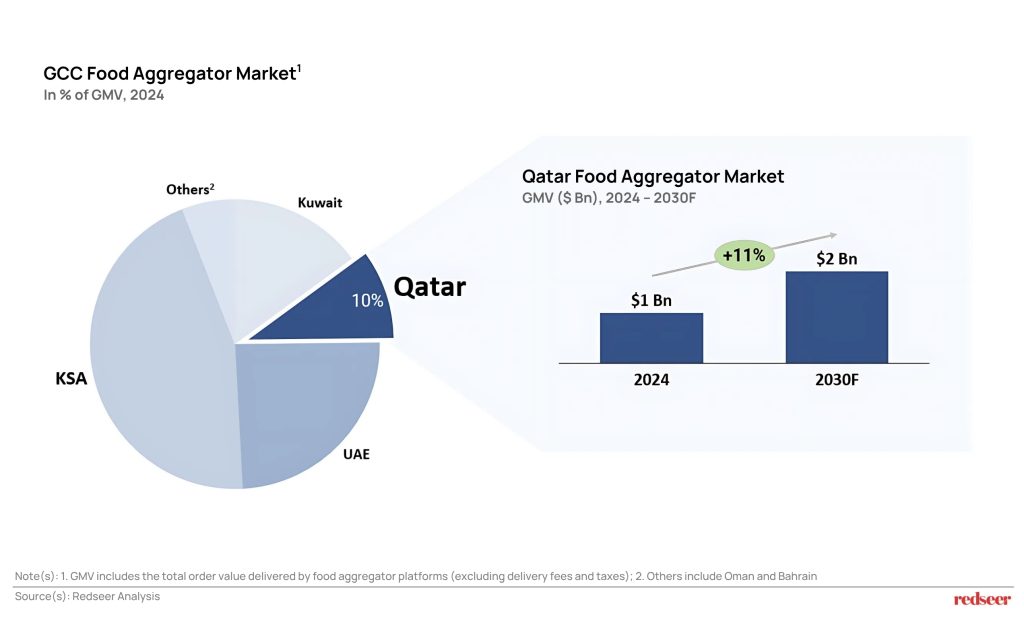

3. The deal took place in Qatar – GCC’s fourth-largest food delivery aggregator market

Qatar’s food delivery aggregator market constitutes 10% of the GCC market and is valued at USD 1 Bn. The market is relatively mature, with penetration around 30%, higher than in the UAE and KSA. It is expected to grow at a healthy rate of 11%, driven by increased consumer spending as players focus on subscription programs and multi-service offerings that create habitual exposure to food delivery, prompting unplanned food orders.

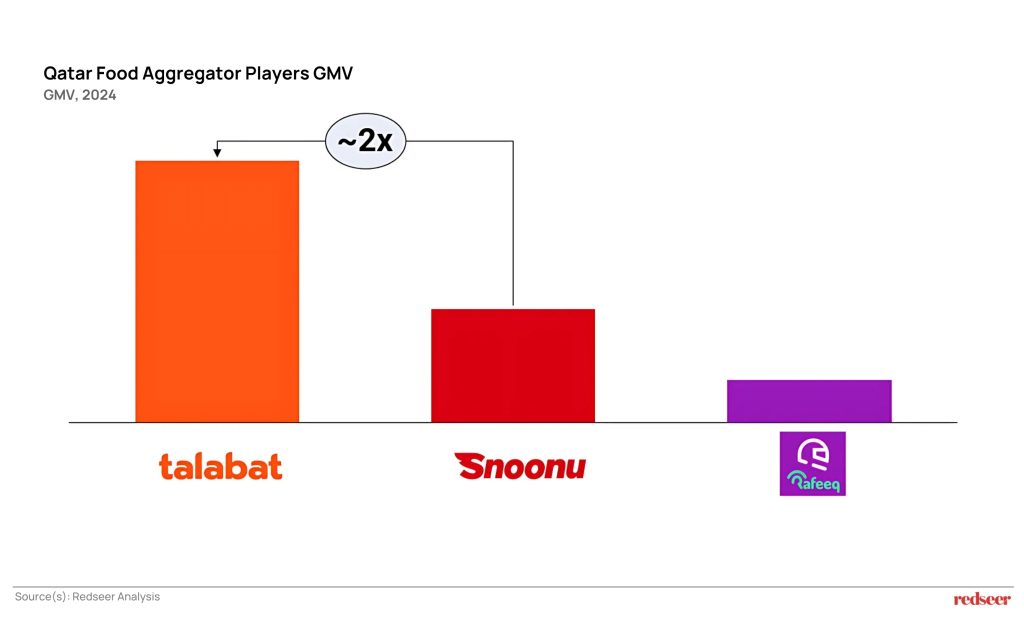

4. Snoonu is already half of the market leader (Talabat)

The competitive landscape in Qatar has been dominated by three key players, each carving out a distinct market position. Talabat leads the market, leveraging its established infrastructure and strong brand recognition. Since its inception in 2019, Snoonu currently holds half of Talabat’s share, demonstrating a remarkable growth trajectory with its GMV tripling over two years. Rafeeq holds a small but stable position, targeting discount-seeking customers through aggressive promotions.

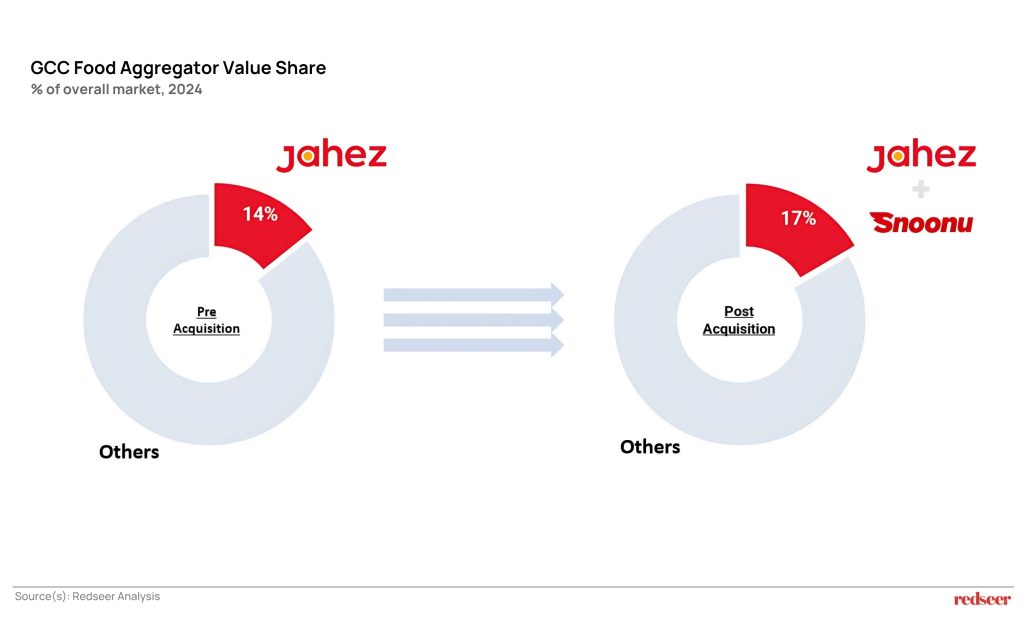

5. Jahez–Snoonu deal strengthens Jahez’s regional position, with 17% food delivery aggregator market share

Qatar’s startup ecosystem witnessed its largest transaction to date last week, with Jahez acquiring a majority stake in Snoonu, valuing the company at $320 Mn (QAR 1.16 Bn). The transaction reflects broader consolidation trends in the food delivery aggregator landscape—an evolution we had anticipated given the market’s increasing scale requirements and competitive intensity.

The combination is expected to expand Jahez’s share of the GCC food aggregator market from 14% to 17%, positioning it as a stronger regional player. It also places Jahez in a more competitive stance relative to Delivery Hero, which currently holds a leading position through Talabat and Hungerstation.

Overall, this deal reinforces the shift toward consolidation in the region and may prompt similar moves as players seek to strengthen their positions through strategic partnerships and acquisitions.

We hope you’ve found these insights helpful. For a more detailed discussion or to explore how these shifts may impact your business, feel free to reach out to us!