Executive Summary

What’s failed in other countries is scaling in India. India’s quick commerce (Q-commerce) has rapidly scaled into a $10B+ GMV market with 30M+ monthly users, becoming the fastest-growing retail format in the country. But beyond speed and convenience, Q-commerce is now shaping product discovery, brand building, and digital experimentation for both legacy and D2C brands. As brands recalibrate SKUs and pricing for faster, app-led selling, and metros drive 80%+ of GMV, the next challenge lies in unlocking profitable growth across non-metros. Redseer’s latest 3MQ report dives into what it takes to win in this channel.

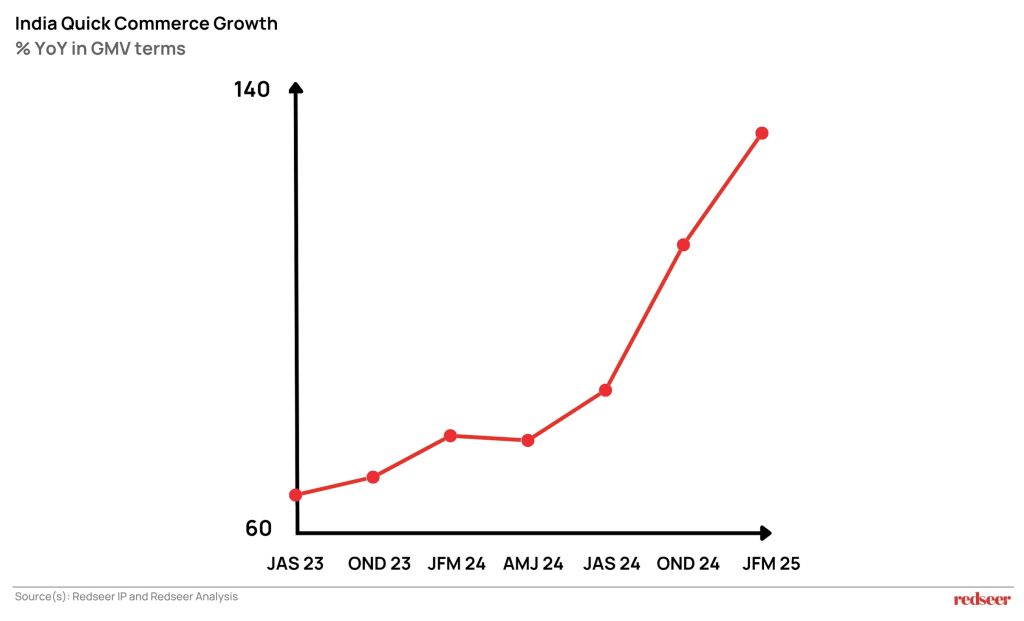

With 150% YoY growth and 80% metro dominance, is India’s Q-commerce hype masking a lurking profitability crisis?

Build new product innovation and market strategy.

What once acted as a top-up for our regular fulfilment is now the most important shift in how brands are built, how consumers shop, and how categories are monetised. With over $10 billion in GMV, 30 million monthly transacting users, and 15% share of all e-commerce GMV, Quick Commerce growth in India has scaled faster than any retail format India has seen in the last decade.

Quick commerce continues to grow at ~150% year-on-year during the first 5 months of this calendar year, driven by dark store footprint expansion, selection growth, category diversification, and fierce competition – all contributing to the provision of an affordable & wide product assortment to consumers at lightning-fast speed.

The Acceleration is Real. But the Implications Run Deeper.

Quick commerce is simply too significant to overlook. What really makes it stand out, though, isn’t just its size; it’s the incredible signal density it provides. Brands on Q-commerce platforms are now able to get real-time insights on assortment fit, pricing flexibility, and shifts in regional demand, insights that would typically take months to gather through traditional offline or even mainstream e-commerce channels.

This transformation is turning Q-commerce into a dynamic feedback loop for brands. This space is not just for distribution, but for experimentation, quick iterations, and fast-paced category development. We’re witnessing brands fine-tune their SKUs specifically for this channel. Challenger brands are bypassing traditional retail entirely, launching directly on Q-commerce to gauge market readiness. Some of the established players are attributing 20–30% of their digital sales to Q-commerce platforms.

The Shifting Consumer Behaviour

Our 3MQ: Macro, Models, Markets report reveals how the Quick Commerce market in India is adapting to new consumer behaviours. We’re seeing more frequent purchases, smaller ticket sizes, and a craving for instant gratification. These aren’t just quirky habits of urban shoppers; they’re becoming the new norm, thanks to trust in delivery services, a mobile-first approach to decision-making, and the power of algorithm-driven discovery.

As a result, Q-commerce is evolving from a “when-I-need-it” service to a “where-I-start” experience. For items like snacks, ice cream, eggs, personal care products, and even pet supplies, this transformation completely alters the marketing funnel.

This shift has significant implications for how brands need to rethink:

- SKU architecture (think smaller packs, better margins, quicker turnover)

- Inventory allocation (regional hubs versus national warehouses)

- Promotions and visibility (algorithmic search over traditional ATL awareness)

The Quick Commerce platform isn’t just a shelf. It’s like a storefront, a billboard, and a consumer insight engine rolled into one.

The Non-Metro Reality:

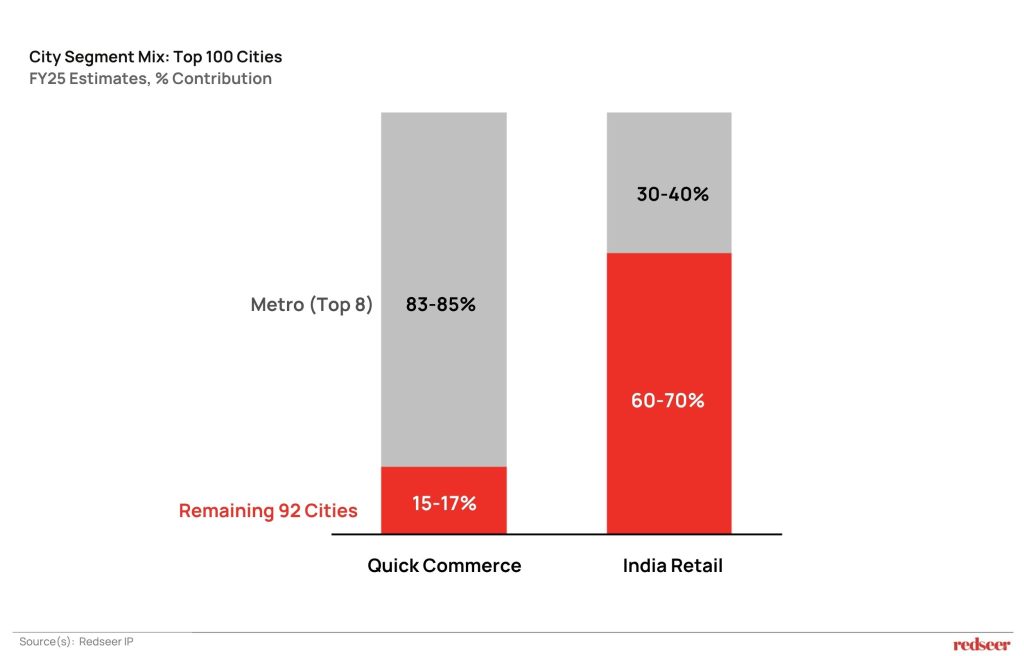

Despite this unprecedented growth at ~150% year-on-year and expansion of leading platforms to more than 100 cities, non-metro representatives of 90+ cities (excluding 8 metros from 100+ QC cities) contribute just over 15% of quick-commerce GMV.

While there is a large growth headroom for quick commerce when compared to their 60-70% contribution to the overall retail market in the top 100 cities, it also raises a few questions:

- How can quick commerce platforms effectively solve these challenges while scaling sustainably in the smaller cities?

- Is there enough demand for quick commerce in the current set of ~100 cities?

- At what scale of demand will quick commerce be able to create a profitable play in the long-tail cities?

From Scale to Profitability

Redseer’s view is that the Quick Commerce business is evolving into a strategic lever not just for brands, but for platforms and investors as well. The big question is, “What’s the path to sustainable profitability for platforms, brands, and investors?”

Platforms need to assess:

- Which models should they adopt?

- Which micro markets should they be considering or reconsidering? – There may be merit in rolling back from a few of the 100+ cities and solving for the remaining ones more deeply. Student hubs such as Prayag Raj & Varanasi, and upscale cities such as Chandigarh, reflect a strong, quick commerce demand – Double down on them.

- Improve Tech and Supply Chain.

- Build stickiness with users for reduced CAC and stronger LTV

Brands need to:

- Identify whether the Quick Commerce business model generates profit or runs into losses due to competitive pricing pressures

- Restructure the design and pricing accordingly – Right pack sizes and pricing

- Assess whether M&A will be a viable option for large CPG or Retail brands for their D2C play?

Investors need to:

- Identify the path to profitable exits

- With new Q-com players and eventual market saturation, what would consolidation in the market look like?

- Decode what the right moats are to look at for investable and portfolio brands as they rapidly grow in quick commerce

Redseer solves for the strategy behind scale for brands, platforms, and investors in quick commerce through GTM acceleration, benchmarking, and M&A support. We use deep category insights and robust data models to provide the right advice to our clients for actionable decision-making. Like we did for our client to convert high-intent non-users into online grocery buyers.

Check out our 3MQ: Macro, Models, Markets Report to gain deeper insights and guidance.

Speak to our consulting partners Mrigank Gutgutia and Kushal Bhatnagar, for their strategic guidance.