India has always been a market of many Indias, diverse in income levels, lifestyle, and digital readiness. This diversity makes it both one of the most challenging and rewarding markets for products and services. The emergence of the Instant Economy is a response to a new kind of demand: one that values immediacy, reliability, and seamless service. Quick commerce was the first to unlock this space, reshaping how consumers access everyday products. Now, Instant Home Services is stepping into the spotlight, offering similar convenience in entirely new contexts. While quick commerce has already proven its staying power, the Instant Home Services category is still at an inflexion point. How this market unfolds, what frictions and opportunities lie ahead, and how stakeholders navigate its complexity will define the next chapter of India’s service evolution.

India’s evolving urban consumer is demanding more from home services.

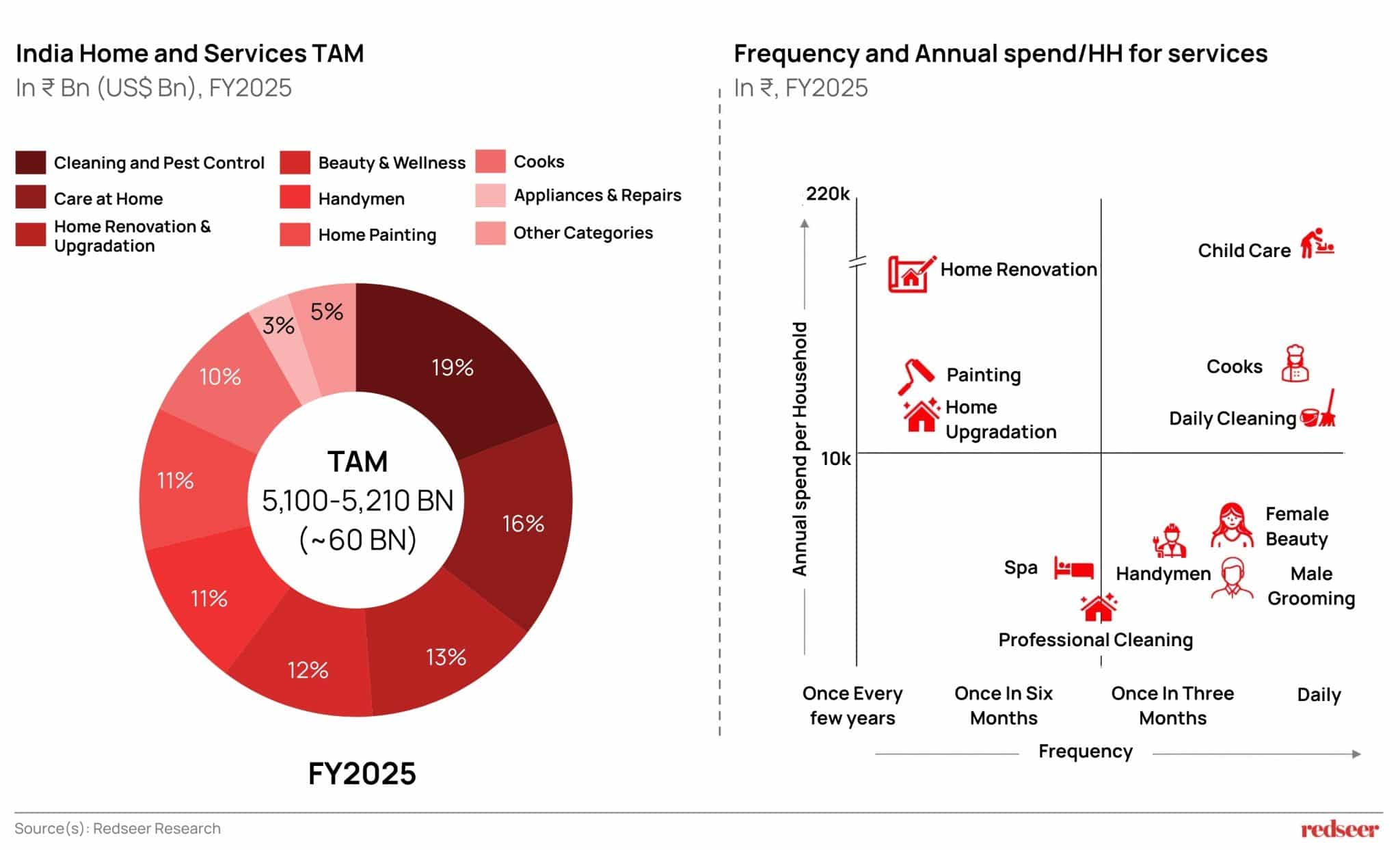

India’s home services landscape is undergoing a significant shift. With rising incomes, urbanisation, and time-constrained lifestyles, households are no longer satisfied with basic, ad-hoc solutions. There’s a growing demand for services that offer consistency, reliability, and speed. What was once a fragmented, informal market is now evolving into a structured ecosystem, with a total addressable market of ₹5,100-5,210 billion in FY2025, and projected growth of 10-11% CAGR through FY2030.

As service expectations evolve, so does usage. Depending on household incomes, orders for services in categories like beauty, appliance repair, deep cleaning, and home maintenance are seeing increased frequency, ranging from monthly to seasonal. High-income homes tend to use these services more frequently and across a wider range of needs, while middle- and lower-income homes are gradually increasing their engagement, especially for essential or event-based requirements. The broader trend is clear: home services are shifting from occasional tasks to regular, lifestyle-driven choices, creating a meaningful opportunity for platforms that can deliver with speed and consistency.

And yet, even in metro cities, online home services have barely scratched the surface, signalling vast headroom for growth.

Have a question?

Our experts are just a click away.

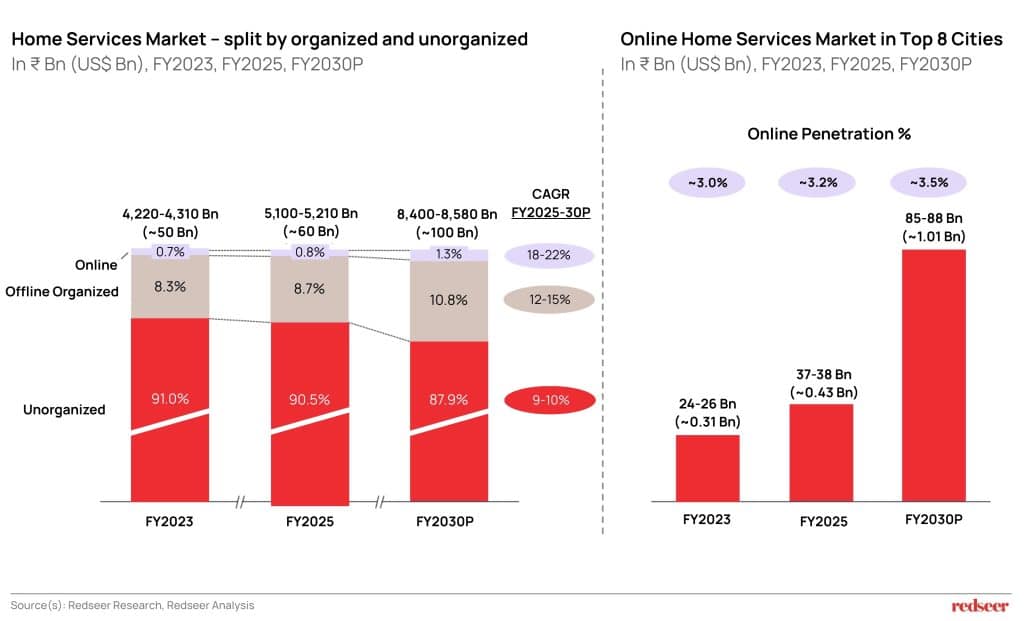

Despite the growing demand for organised, professional services, India’s home services industry continues to be predominantly unorganised and offline. As of FY2025, online penetration stands at less than 1% of net transaction value, highlighting how deeply entrenched traditional, informal service networks still are. The online segment, though growing, is still relatively small at ₹41-43 billion. However, it is expanding rapidly at a projected CAGR of 18-22% through FY2030, as consumers increasingly seek convenience, reliability, and accountability that offline alternatives struggle to provide.

India’s online home services segment is projected to grow at 18-22% CAGR through FY2030

Currently, India’s eight largest cities account for 85-90% of online home services demand, with penetration at ~3.2%, expected to reach ~3.5% by FY2030. These cities benefit from higher disposable incomes, dense demand clusters, digital familiarity, and trust in app-based platforms, making them more fertile ground for adoption. Interestingly, it’s the next 50 cities – beyond the top metros – that are emerging as high-potential growth engines. These cities are distinguished by rising dual-income households, aspirational consumption patterns, improving digital access, and lower competitive intensity. As consumers across segments increasingly value structured pricing, vetted professionals, and real-time tracking, online full-stack platforms are well-positioned to gain share.

India’s eight largest cities account for 85-90% of online home services demand.

The Rise of Instant Home Services in Urban India

As digital platforms bring structure to India’s home services sector, a new category is gaining traction: Instant Home Services. Unlike scheduled repairs or deep cleaning, this model is built around urgent, everyday household chores – cleaning up after a party, washing utensils when domestic help is unavailable, or quickly tidying the house before guests arrive. These are high-frequency needs that arise spontaneously and call for prompt solutions. In many ways, Instant Home Services acts like an on-demand household support system, bridging the gap between informal domestic help and structured service platforms.

This behavioural shift is not unprecedented. Much like quick commerce reshaped everyday buying – training consumers to expect delivery in minutes rather than hours – Instant Home Services is beginning to condition urban households to expect rapid fulfilment for their service needs.

The growing demand for Instant Home Services is underpinned by four overarching trends:

- A cultural expectation for immediate gratification, driven by the habit of quick commerce and other instant delivery platforms

- Increased focus on trust, safety, and verified service quality, especially in post-COVID urban India

- Rapid urbanisation is concentrating populations in already dense metropolitan areas, where limited space and resources increase the need for efficient service delivery – making digital discovery and accessibility essential, and much easier.

- A consumer mindset that is increasingly willing to pay a premium for services that eliminate effort, uncertainty, and friction

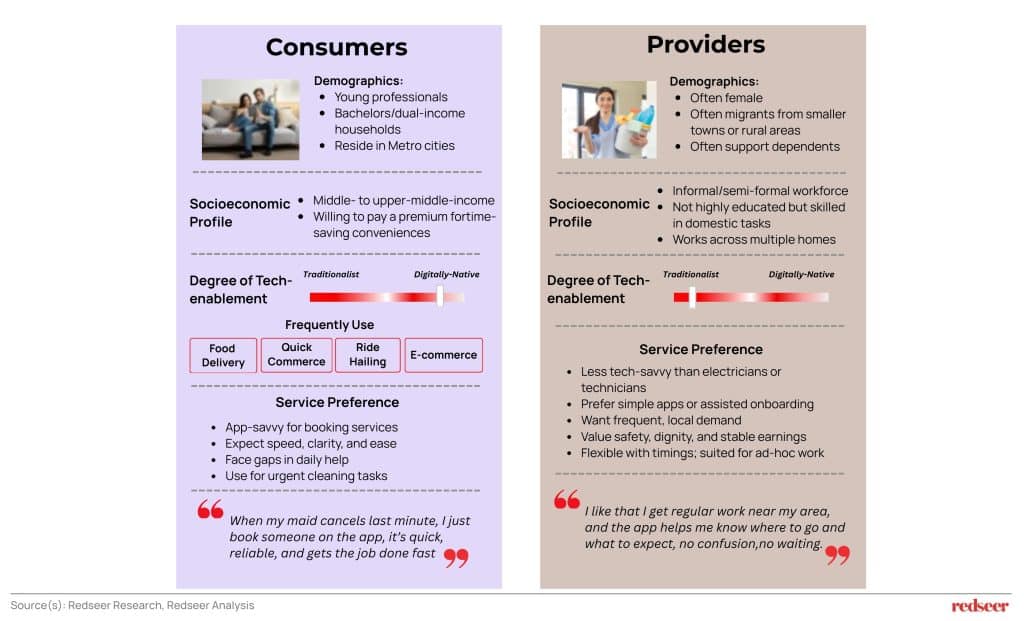

At the heart of this model are two key participants: the consumer, often a busy urban resident accustomed to digital convenience, and the service professional, typically from a less tech-enabled background, seeking consistent demand and accessible work. While they operate in very different sectors, both share a common dependence on predictability and immediacy. This is particularly relevant given rising labour costs and the growing preference for on-demand, part-time services over full-time staffing solutions. The consumer wants their need met immediately, and the provider wants steady, nearby work without uncertainty. The success of Instant Home Services lies in how effectively platforms can bridge this gap, not just with technology, but with design choices that respect both urgency and dignity.

The model isn’t without its frictions – and scaling it will require thoughtful design

The opportunity in Instant Home Services is substantial. However, unlocking it at scale requires navigating a range of operational, economic, and behavioural challenges. The very factors that make the model attractive also introduce complexity when applied across geographies and consumer segments. To move from promise to mainstream, platforms must address questions like:

- Will this service be confined to high-density micro-markets, and what are some of the model innovations that help it to scale in low-density locations too?

- Can the economics of high-frequency, low-value tasks remain viable without dense, predictable demand clusters?

- How can platforms maintain a stable hyperlocal supply, especially during high-demand hours? How can they onboard and support a workforce that may lack digital fluency, without compromising scalability or user experience?

- How can consistent service quality be maintained at scale, across diverse locations and varying provider capabilities?

- In the presence of strong informal networks, how can platforms establish trust, ensure safety, and differentiate meaningfully in the eyes of the consumer?

- Is a vertical play sustainable/scalable, or will platforms need to expand horizontally to other home services?

The answers to these questions will shape not just how the category grows, but whether it becomes a lasting fixture in India’s evolving service economy.

The path ahead hinges on smart expansion and deeper consumer understanding.

Overcoming the inherent frictions in scaling Instant Home Services, like micro-market concentration, cost-sensitive operations, and uneven demand across cities, requires strategic growth. The opportunity lies in expanding intelligently with a deep understanding of consumer behaviour, local dynamics, and operational constraints.

- Targeted micro-market expansion: Rather than stretching thin across geographies, platforms should prioritise markets with high digital penetration, growing dual-income households, and concentrated demand – mirroring the phased rollout model used by quick commerce players. Phased expansion enables platforms to consolidate reliable supply across micro-markets, improving cost-efficiency and helping address demand-supply imbalances in newer geographies.

- Tiered services, subscriptions and horizontal play: Introducing differentiated service tiers (basic vs premium), bundled offerings with other home services, or subscription models can help improve margins and build repeat usage. This directly offsets cost pressures tied to high-frequency, low-ticket use cases while offering consumers flexibility and value.

- Localised service design: Platforms must leverage granular data to adapt pricing, language, service mix, and promotional strategy to each region. Just as FMCG and Q-commerce players localise offerings for cultural and economic relevance, Instant Home Services must do the same to build trust and preference – especially in cities beyond the top 8.

As urgency, convenience, and digital trust increasingly guide urban decision-making, the Instant Home Services category sits at the intersection of evolving expectations and everyday needs. In a fast-unfolding instant economy, this may well be the next frontier of how India takes care of their homes.

We Solve for New and What’s Next – For companies at the edge of innovation, Redseer helps define the future, not just respond to it.