Every year, there are several occasions such as Diwali, IPL, World Cup etc. where online food delivery is integral to the celebrations. These days are mission-critical for online food delivery platforms and brands alike. While the demand spikes are significant, platforms and brands also gain new users.

This is especially relevant for chain restaurants and cloud kitchens (especially house of brands) from a consumer habit-building perspective. Moreover, customer experiences during these days tend to be sticky, so there is a need for sustained planning and strong execution. 31st December 2023 or New Year’s Eve 2023 (NYE23) was record-breaking for online food delivery in multiple aspects.

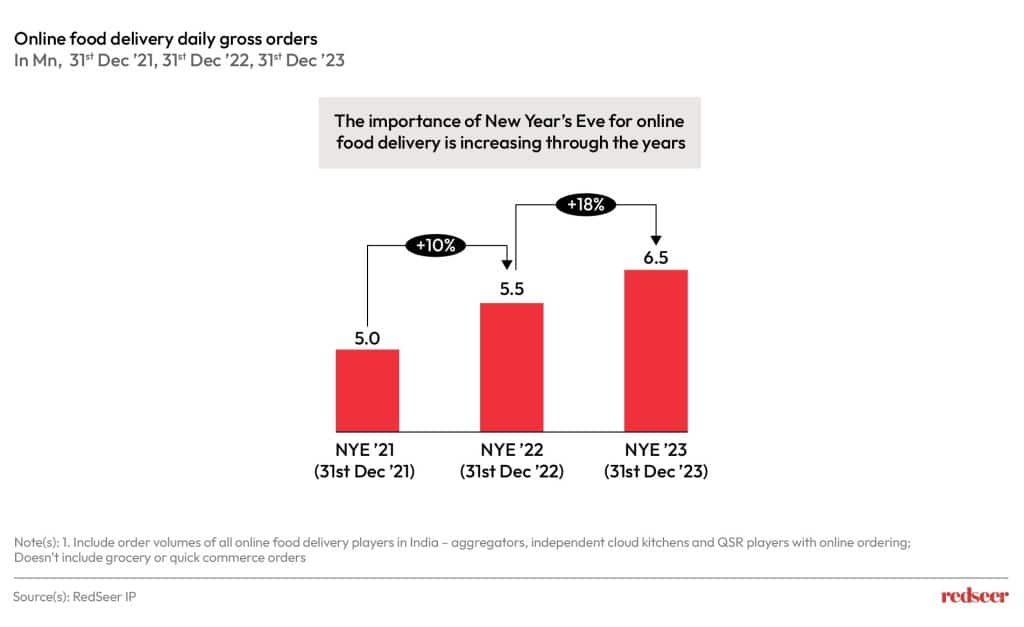

NYE23 saw ~6.5 million orders – the highest ever on a single day

Every NYE sees new records being set with more consumers choosing online food delivery for their celebrations. The number of orders on NYE23 were 18% higher than that of NY22, which in turn was 10% higher than that of NYE22. This is a reminder that online food delivery is a celebration-essential for Indian consumers.

To put things in perspective, 6.5 million orders in a day is more than 8 times the average daily order volume as of 5 years ago (in CY18). Yet, the online penetration of food services in India is ~10%, which underscores the growth headroom for online food delivery.

Redseer’s Big Data analysis on Consumer Behaviour notes that the spike in food delivery orders on NYE23 was a nationwide phenomenon as Metros, Tier-1 cities and rest of Indian cities exhibited almost similar growth rates. This speaks to the merit of anchoring during the right occasions which can help gain market depth in smaller Indian towns.

Average order values (AOV) jumped up to 30% vs. a normal day of the year – amongst the highest ever spikes for a single day

Redseer’s Big data analysis observes that the average order value on NYE23 was up to 30% higher than a normal day of the year. This was driven by people coming together and ordering to celebrate New Year’s Eve, and the increasing prominence of desserts in the day’s orders. Another dimension to premiumization was people ordering from high-end restaurants to treat themselves during the day.

This is crucial as the higher AOV cushions the efforts and the operational overheads required to service the spikes in demand, while being an additional incentive to restaurant partners to serve customers despite pressure across channels. For brands, higher AOV enables incentives that ultimately maximize customer delight.

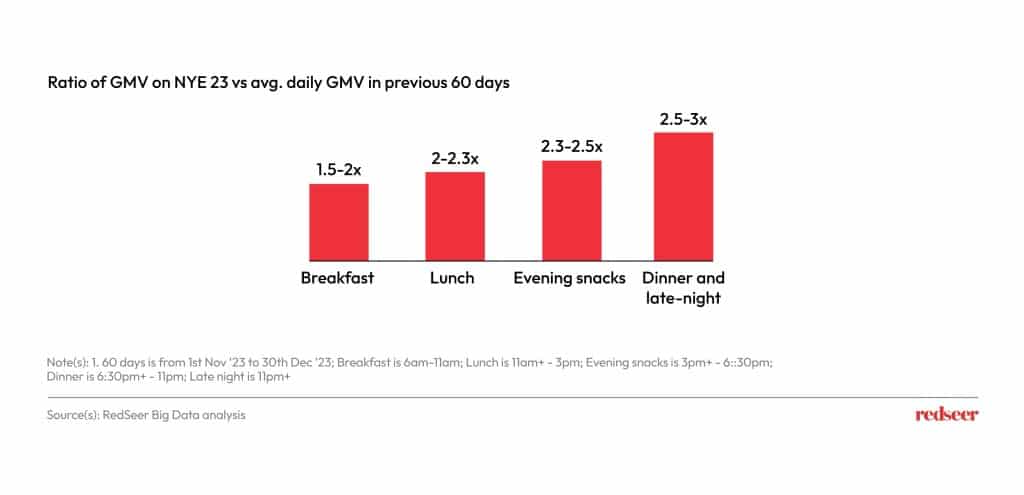

GMV for dinners and late-night orders was 2.5-3x of a normal day, yet consumer experience was maintained at a high level across city tiers

While the day started with GMV in breakfast being 1.5-2x of a normal day. GMV peaked in the dinner and late-night orders, being 2.5-3x of a normal day. The players also put their best foot forward as the day went on. For instance, Swiggy announced free deliveries all through the night of NYE23.

These are extremely sharp spikes that can stress the capabilities of players. As platforms battled it out to deliver significantly large volumes, customers across city tiers reported positive experiences to show their appreciation for early delivery, impressive discounts, good quality food and customized (for the day) packaging despite every hour being a peak hour of sorts. This was a day where good brands differentiated themselves by superior execution. This has significant notable benefits in the long term as customer delight on these important occasions leads to higher consumer stickiness.

As consumption habits evolve, online food delivery is finding its way into the festive spreads of families across the nation. Peak days are important from a business and customer service perspective. Increasing spend during peak periods benefits platforms and brands alike as they look to provide consumer delight on these milestone occasions.

Being able to compete on such spike days is a strategic imperative for the online food delivery ecosystem as it tries to tap into the fast-growing Indian food services market and grows at high-teens for the rest of this decade.