The recent surge in high-level endorsements from key figures in Southeast Asia has significantly amplified our excitement for the alternative protein sector in the region. Statements like the Bezos Earth Fund’s declaration of Singapore as an “absolute powerhouse” to Malaysian PM Anwar’s clear commitment to developing the plant-based meat ecosystem and the Thai government’s “Future Food” roadmap actively supporting alternative protein innovations, a powerful narrative emerges. These political and business domain updates compelled us to dedicate our latest newsletter to this dynamic theme in Southeast Asia.

Have a question?

Our experts are just a click away.

The global meat and seafood market, valued at approximately $2 trillion, dwarfs the current alternative protein market, which stands at ~$13-18 billion (less than 1% market penetration). It is estimated that the market share for alternative protein would reach 5-7% by the 2030s. This amounts to an incremental USD 100 Bn worth of market up for grabs.

From plant-based meat to emerging cultivated and insect protein innovations, we’re witnessing the mainstreaming of alternative proteins across the globe, including in Southeast Asia. For investors, this means identifying players who will capture the outsized gains as the global food system reshapes.

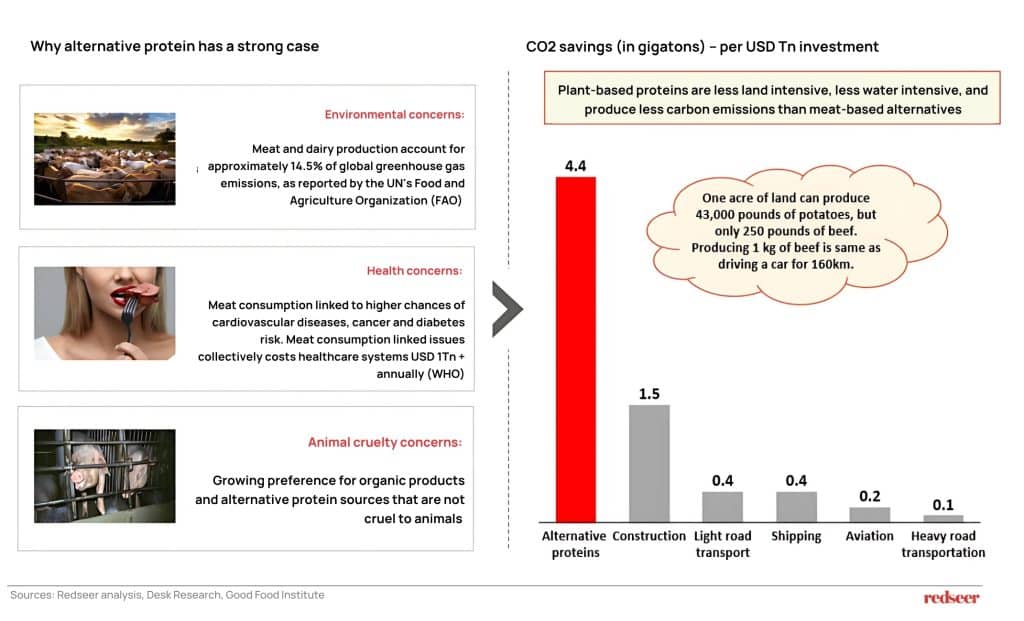

More than a food trend: Alternative protein offers the best ROI for environmental protection, apart from the various health and psychological benefits

For every dollar invested, alternative protein delivers an unparalleled return on CO2 reduction, vastly outperforming sectors like green transport and construction. This exceptional climate ROI is amplified by its alignment with pressing health and ethical consumer demands. The strategic imperative is therefore to prioritize capital towards food system transformation for maximum impact. This positions alternative protein not just as a food choice, but as the most efficient engine for decarbonization

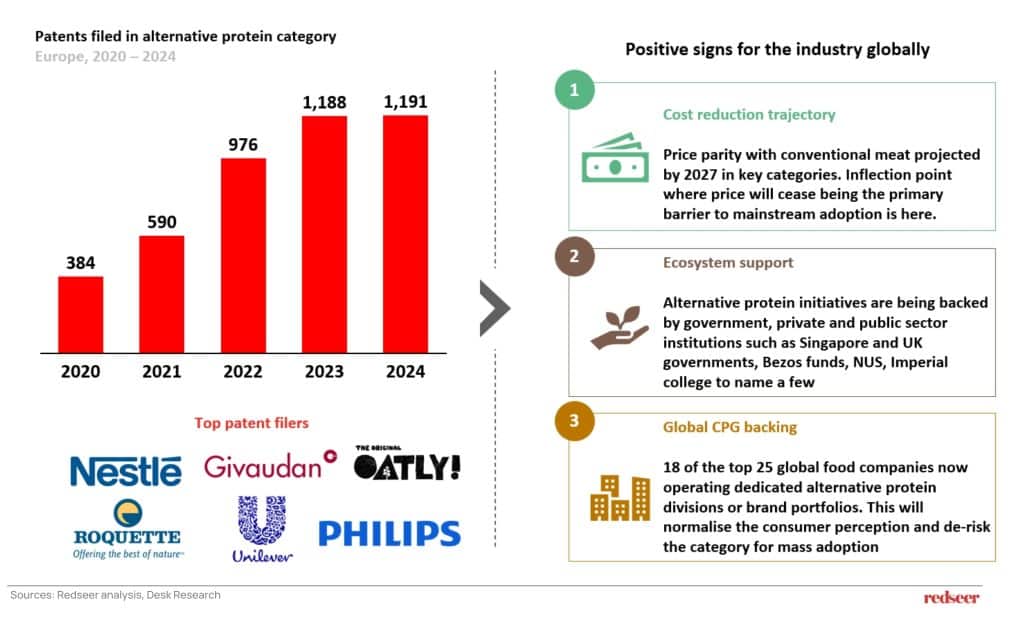

Stakeholder support, greater production efficiency, and entry of global CPGs are sustaining the positive outlook for alternative protein, from niche play to possible mass adoption

Although there had been a decline in funding, other indicators from the global market signal that the alternative protein sector has a fundamentally strong thesis for mass adoption, and the story remains robust. A surge in patent filings, led by CPG giants like Nestlé and Unilever, highlights a deep, strategic commitment to innovation.

Further, lowering of product costs and sustained support from key stakeholders will enable the development of the alternative protein ecosystem in terms of consumer adoption.

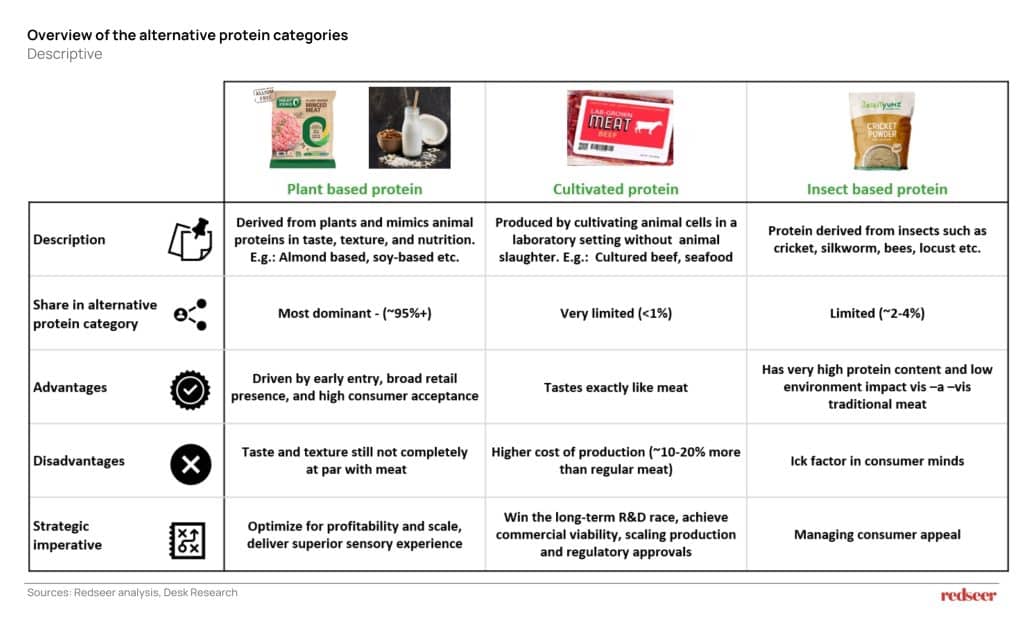

The current alternative protein landscape is essentially the story of plant-based meat (comprising ~95%+ of the market), but there are emerging categories

While today’s alternative protein market is overwhelmingly dominated by plant-based products, future growth will come from a multi-category landscape. The primary strategic challenge for cultivated meat is a long-term race for cost-parity and scale, whereas for insect protein, the battle is cultural, not technical. A winning portfolio strategy must therefore address these different realities: optimizing the core (plant-based), investing in the future of taste (cultivated), and overcoming psychological barriers for new niches (insects)

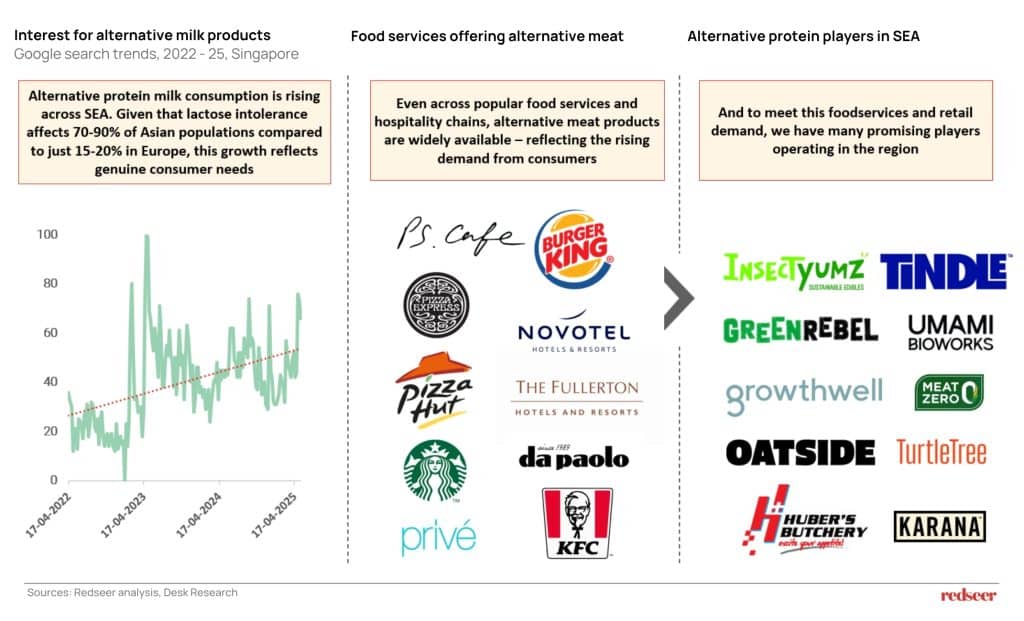

And even in Southeast Asia, the mainstreaming of alternative protein is real; leading food services and hospitality chains across the region have alternatives on their menu

The mainstreaming of alternative protein in Southeast Asia is no longer a forecast; it’s a reality, evidenced by its adoption in major food service chains like Burger King, Starbucks, and Novotel.

Alternative protein will continue to grow in popularity in SEA with the support of strong brands across production and distribution (retail and food services).

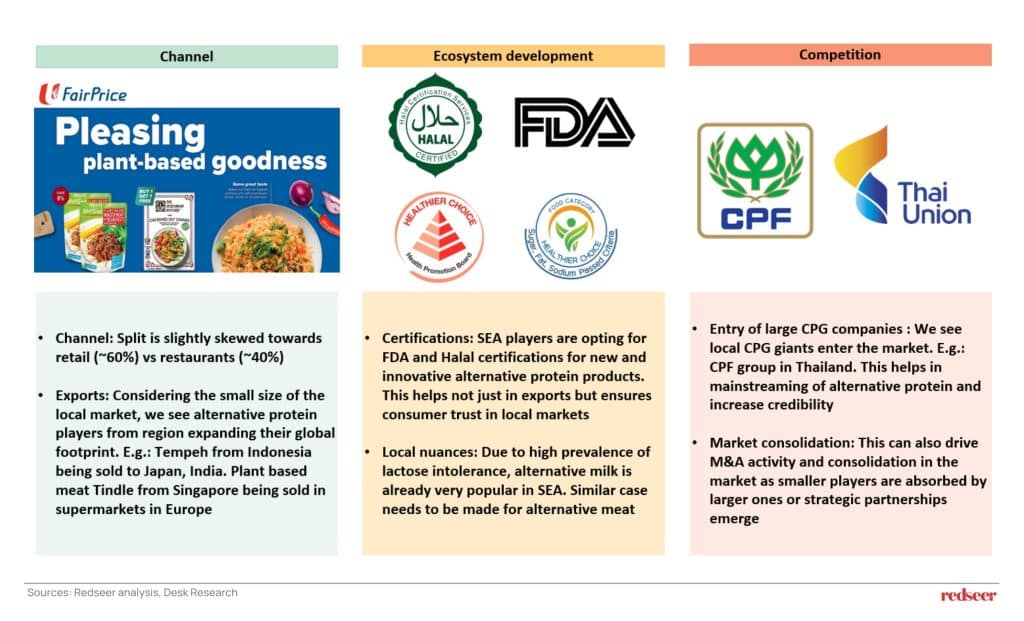

Further, SEA’s alternative protein story is not just localized but has a global outlook; regulatory certifications and strategic partnerships remain critical to drive cross-regional growth

To succeed in this rapidly evolving market, SEA players must prioritize robust certification for consumer trust and export readiness, strategically leverage local dietary preferences, and prepare for increased competition and potential M&A activity as larger players consolidate the market.