Southeast Asia IPO: A Turnaround Ahead in 2025

Hello Readers, presenting to you the Redseer Southeast Asia IPO index 2025!

Want to get strategic guidance?

After a subdued 2024 (Road to IPO), public market listings in Southeast Asia’s consumer internet and digital sectors are expected to rebound in 2025.

Improving macroeconomic conditions, such as lower interest rates and political stability, are providing positive momentum. Additionally, companies are achieving better revenue scale and profitability, making them more appealing for public markets.

A return to a more typical number of listings seems likely, particularly driven by Indonesia, which will provide timely exits for private market investors and stimulate activity in the private market.

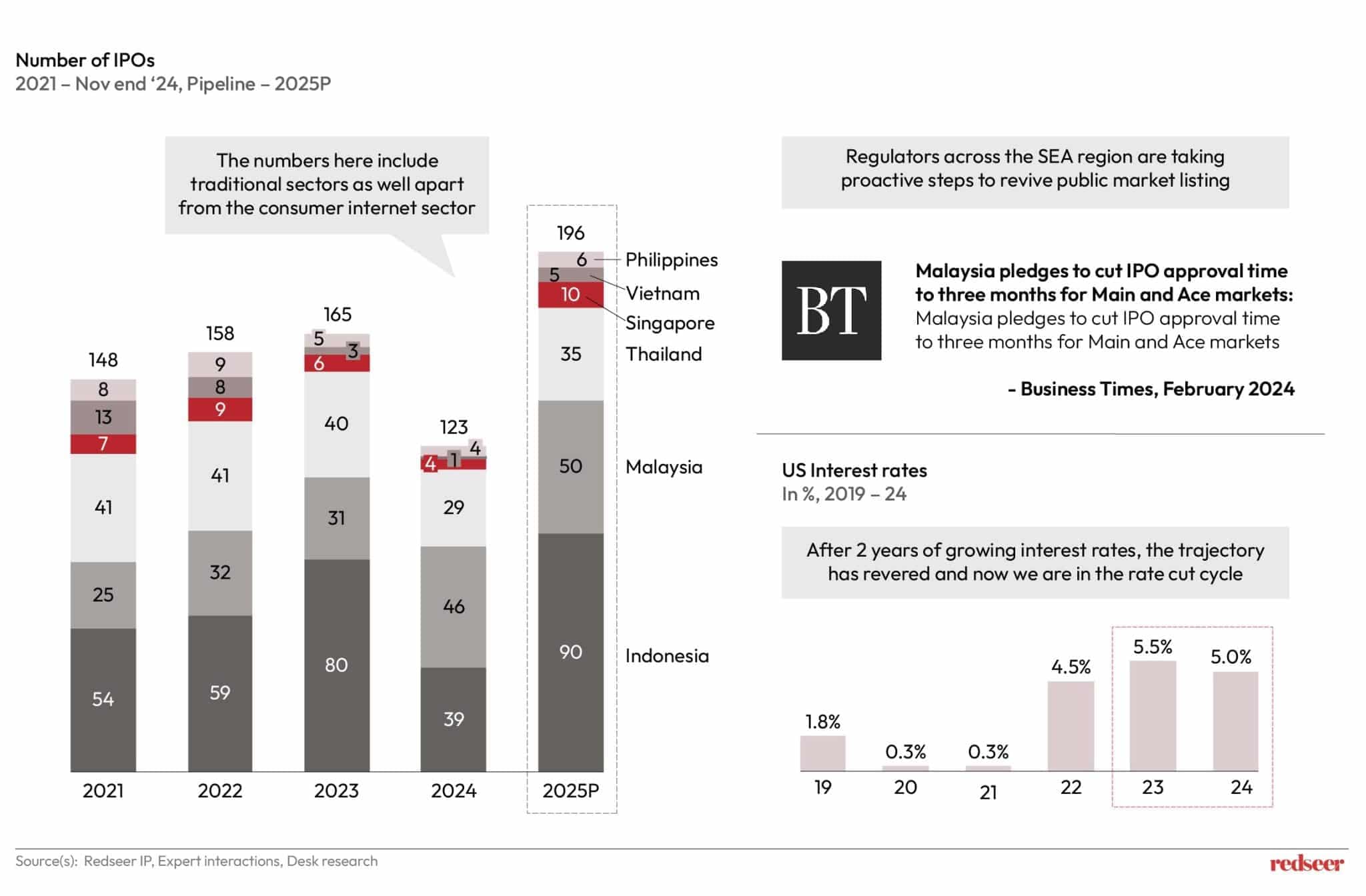

We estimate that there will be 196 IPOs (including traditional sectors) in Southeast Asia in 2025, a significant increase from 123 in 2024 (till Nov end). Fintech and e-commerce are expected to dominate the new economy IPO landscape.

Interestingly, discussions with private market stakeholders indicate a cautious optimism for 2025, potentially setting the stage for positive surprises. ��

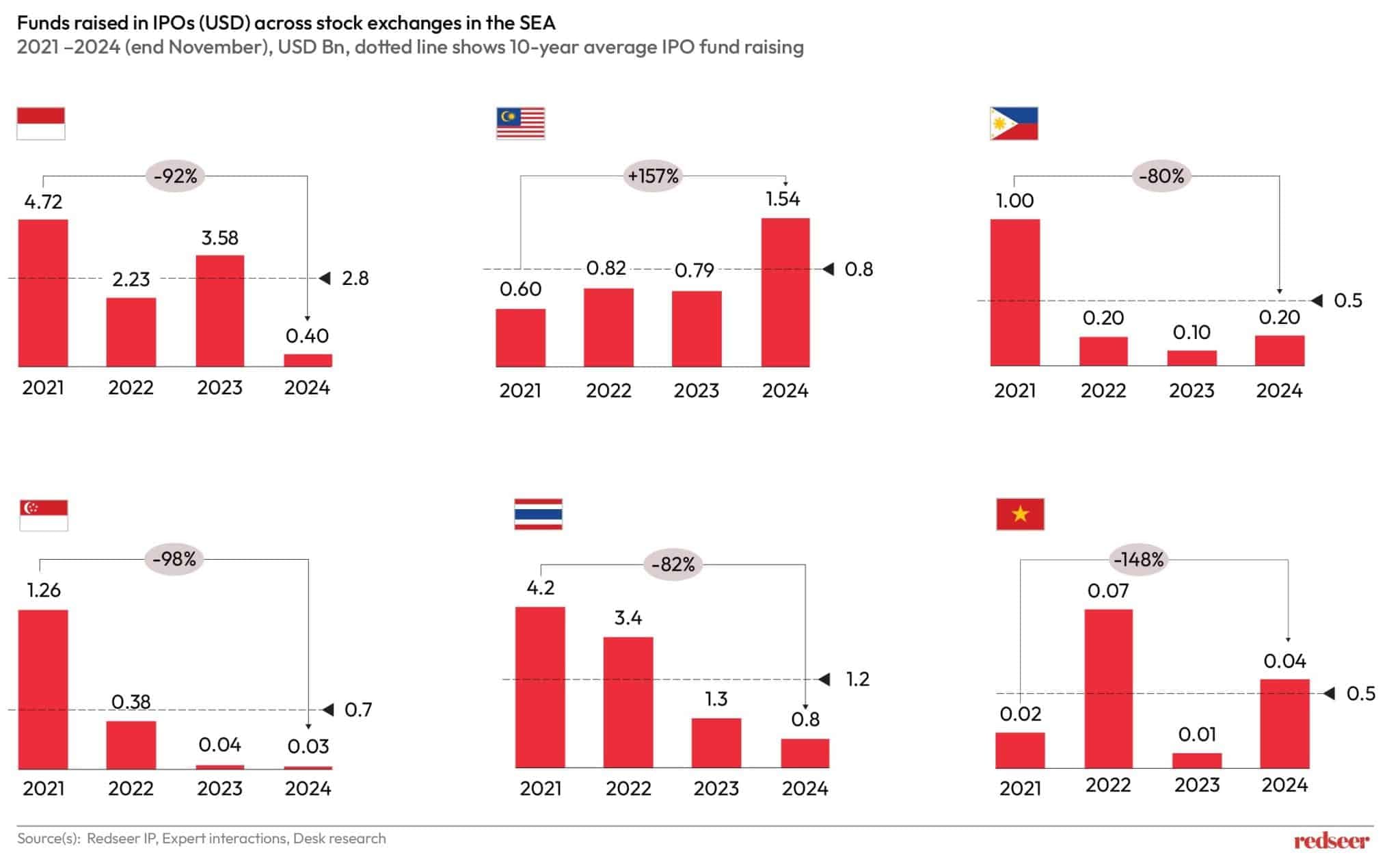

1. IPO activity in Southeast Asia (SEA) has been muted in the recent years…

Post 2021, things have been tough for the private markets. The private fund-raising activities have been muted while the public markets listings have touched historical lows. In the last decade, 2024 has been the first year in which no new unicorn has been created in the region.

2. However, there are signs of positive sparks in the market that has already rejuvenated the IPO pipeline in southeast Asia

There have been various positive events in the broader markets that can act as a catalyst to boost the consumer tech IPOs in the region:

- The IPO pipeline looks stronger than ever with the number of IPOs in 2025 expected to surpass the previous highs

- Regulators across countries – Malaysia, Indonesia, Singapore are taking steps to attract capital and make listing a smooth process

- The interest rates after being at multi year high, have started with the downward trajectory.

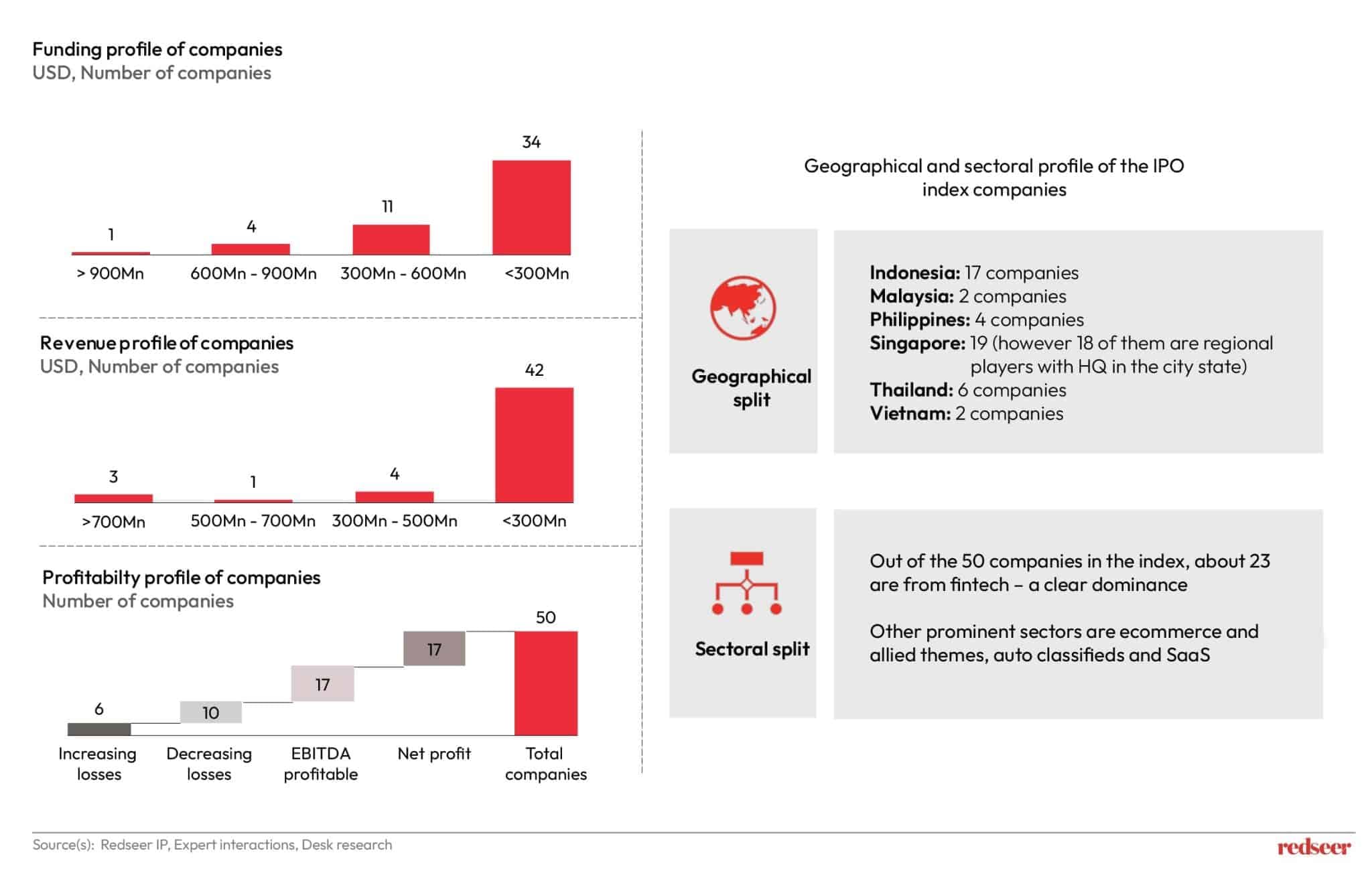

3. And through our Redseer IPO index, we have identified ~50 names within the consumer internet sector showing high potential for an IPO in coming years

To create the index, we looked at the revenue, profitability, investor base, regulatory landscape, industry nuances of 200+ consumer tech companies to arrive at the final 50.

While the SEA companies in the index are doing well on the profitability front – 34 out of 50 companies showing profit, players need to cautiously work on their revenue scale without disturbing the profit profile.

Out of the 50 companies on the index, we can expect about 15 names to get listed within the next 18 months, while the rest would need some work on their financial and operational metrics and can target a potential listing within the next 36 months.

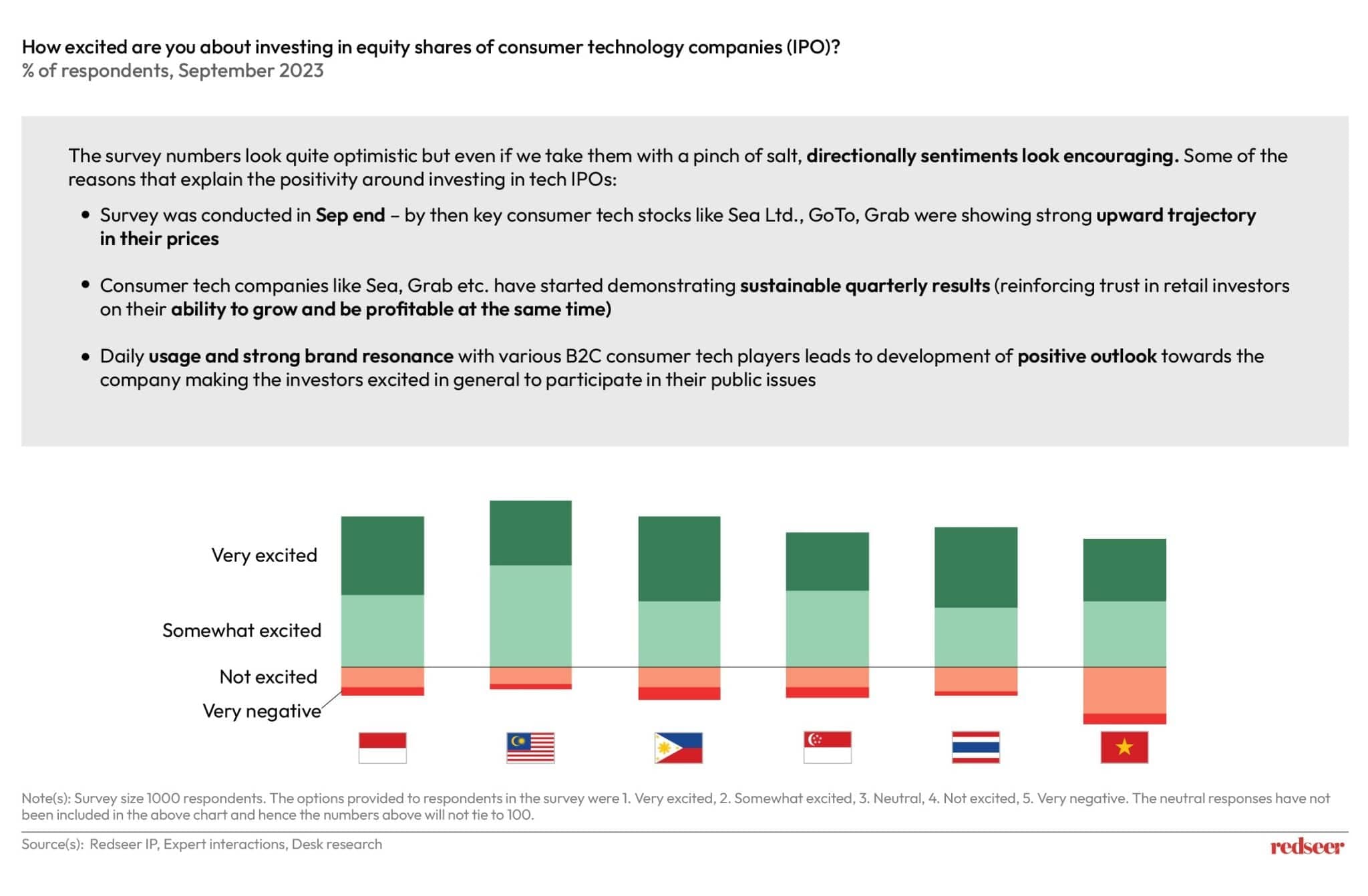

4. Further this momentum is also backed by retail investor sentiments which directionally remains encouragingly positive

We ran a survey in September to understand how retail investors feel about investing in consumer tech stocks across the region. Needless to explain but the numbers in the above chart demonstrate how positively the investors are looking at potential digital economy IPOs. With major positives being seen in stock prices, profitability prospects of exiting listed players – the investors are looking at the sector with renewed interest levels

5. With emphasis on sustainability, the bar has been set high for companies as investors ready their portfolio. Scope for positive surprises remains

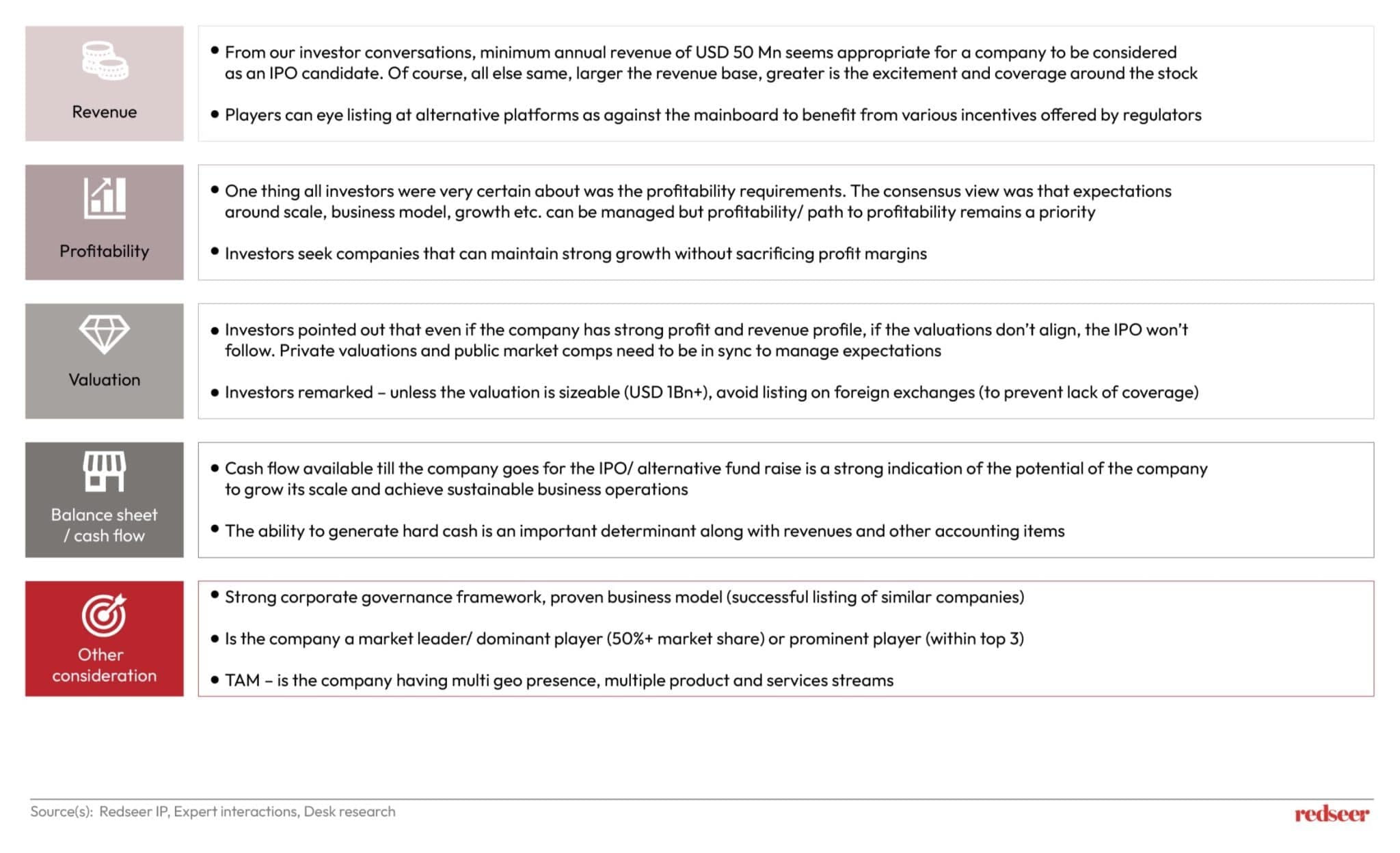

Apart from looking at the company financials, investors, business segment and regulatory landscape, we spoke to 25+ industry stakeholders to validate our thesis and get their views on the companies forming part of the index.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me

Dark Stores Can Be Profitable. GCC Is Where It Happens First.

India’s Gated Communities: Gateway to $900 Bn Consumption Unlock

Beauty & Personal Care in Quick Commerce: From Convenience to Everyday Relevance