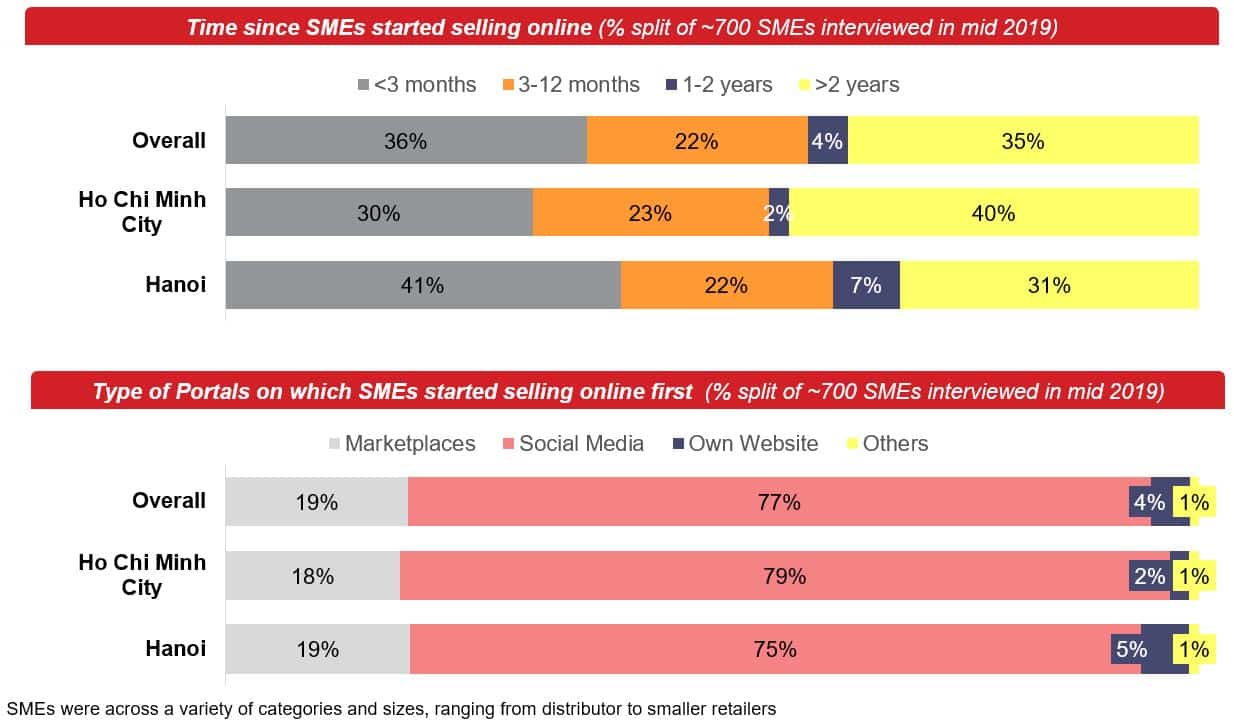

1. Vietnam SMEs are still early into their online retail journey; social commerce is their typical starting point

Published on: Oct 2019

- A significant share of SMEs started selling online very recently, with HCMC SMEs are slightly more mature in their online journey

- Most SMEs make their online foray via social commerce, however formal marketplaces are increasingly becoming their first point of call

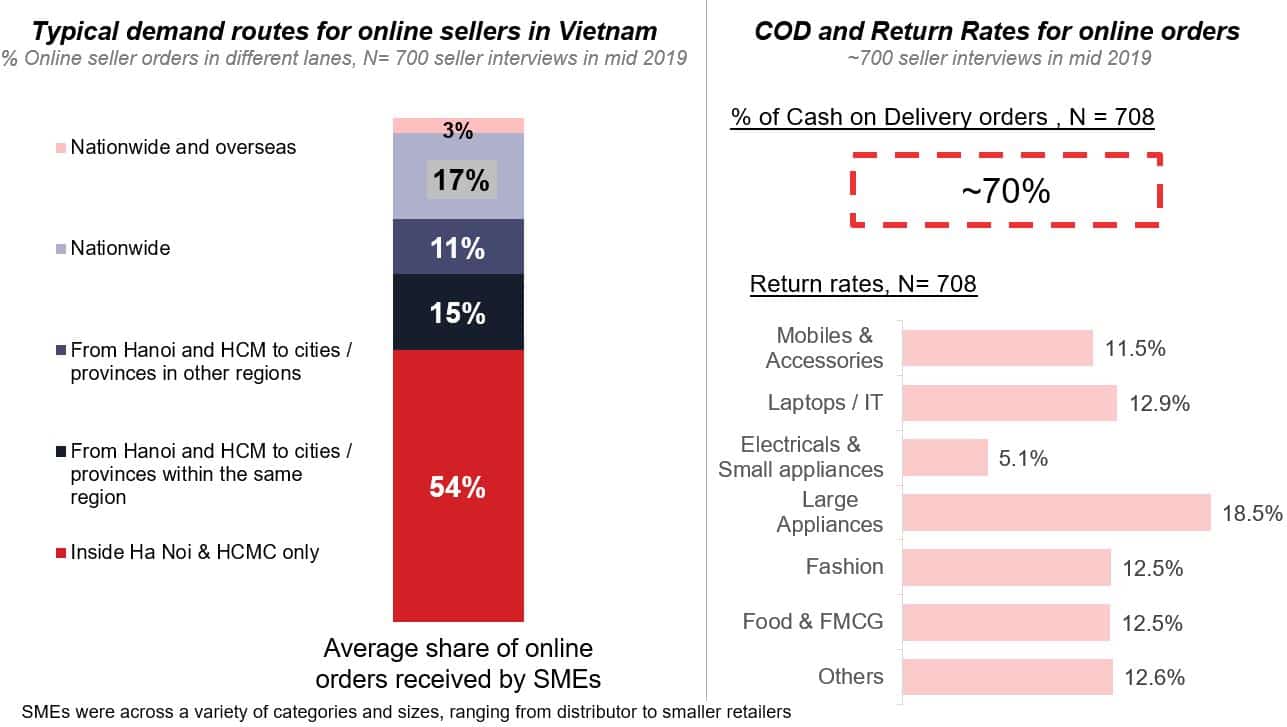

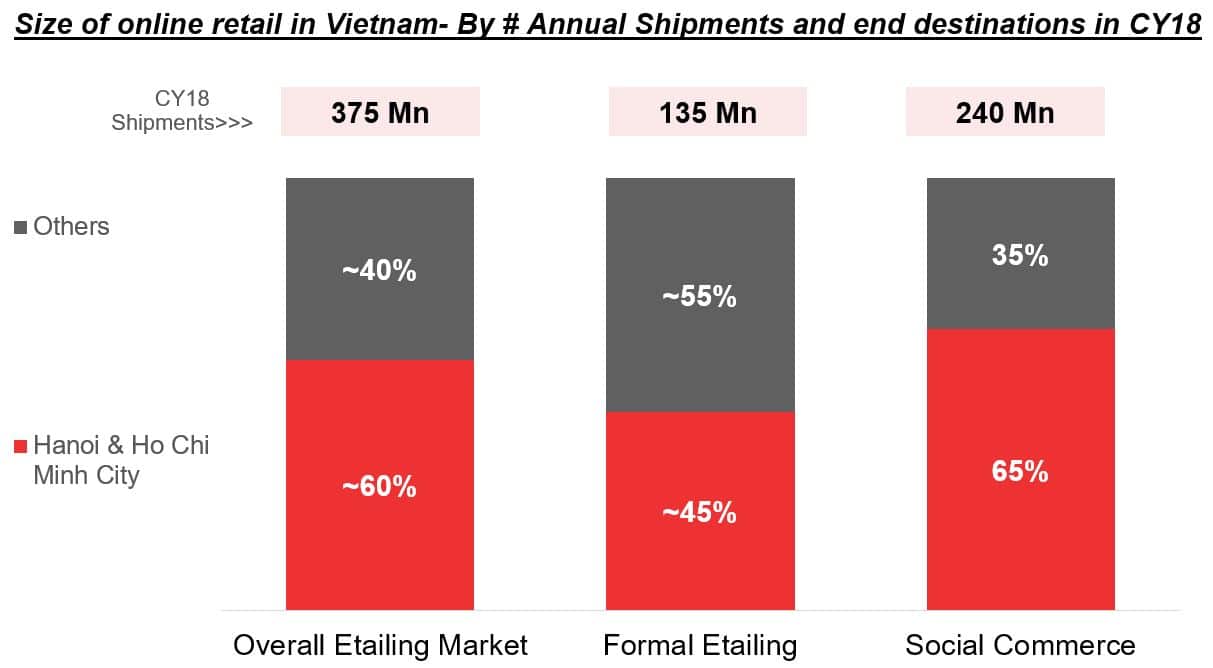

2. A large chunk of online retail in VN (including social commerce) still flows within Hanoi/ HCMC; COD and return rates are high

- COD and return rates are even higher for formal e-tailing, as large chunk of orders is fulfilled outside bigger cities (in lower trust environments)

3. Social e-commerce is heavily dependent on Hanoi/HCMC, while formal e-tailing is a more country-wide phenomenon

- 65% of all online retail orders were on social commerce in 2018

- Formal e-tailers have been able to drive e-tailing demand beyond HCMC and Hanoi, driven by superior supply chain coverage and delivery speeds

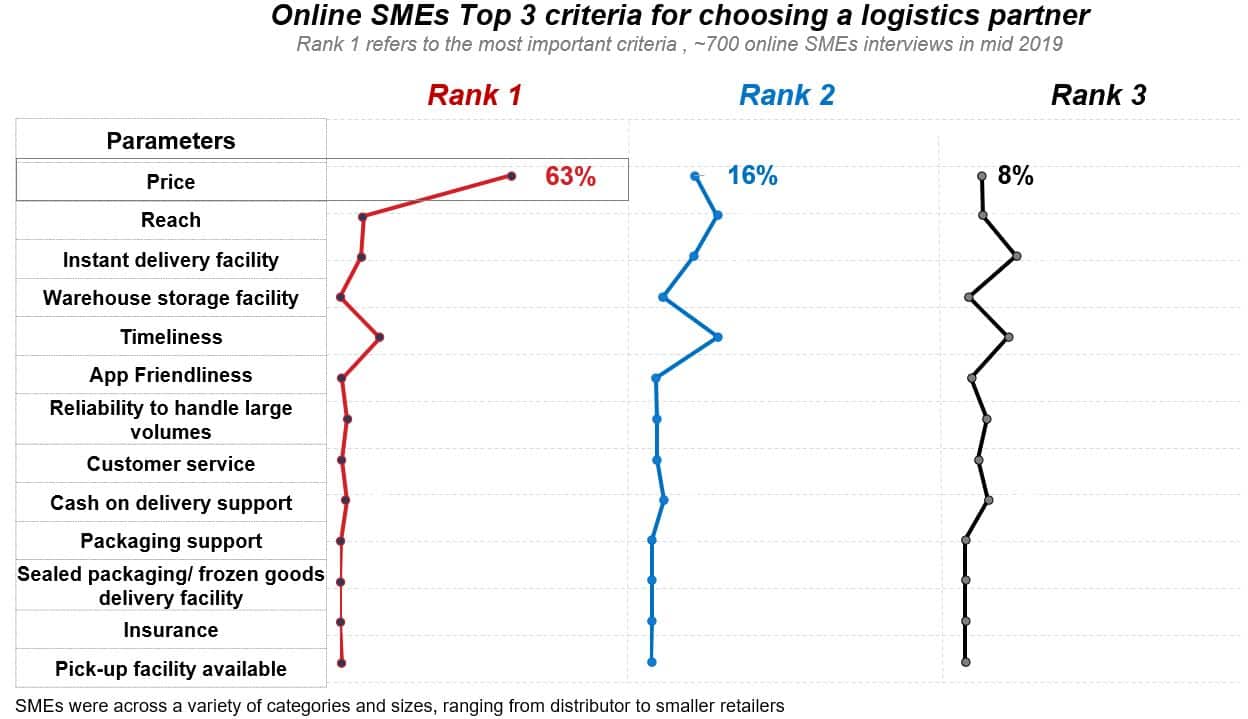

4. For online SMEs, the price still remains the overwhelming most important parameter when choosing a logistics partner

- 65% of all online retail orders were on social commerce in 2018

- Formal e-tailers have been able to drive e-tailing growth beyond HCMC and Hanoi, driven by superior supply chain coverage and delivery speeds

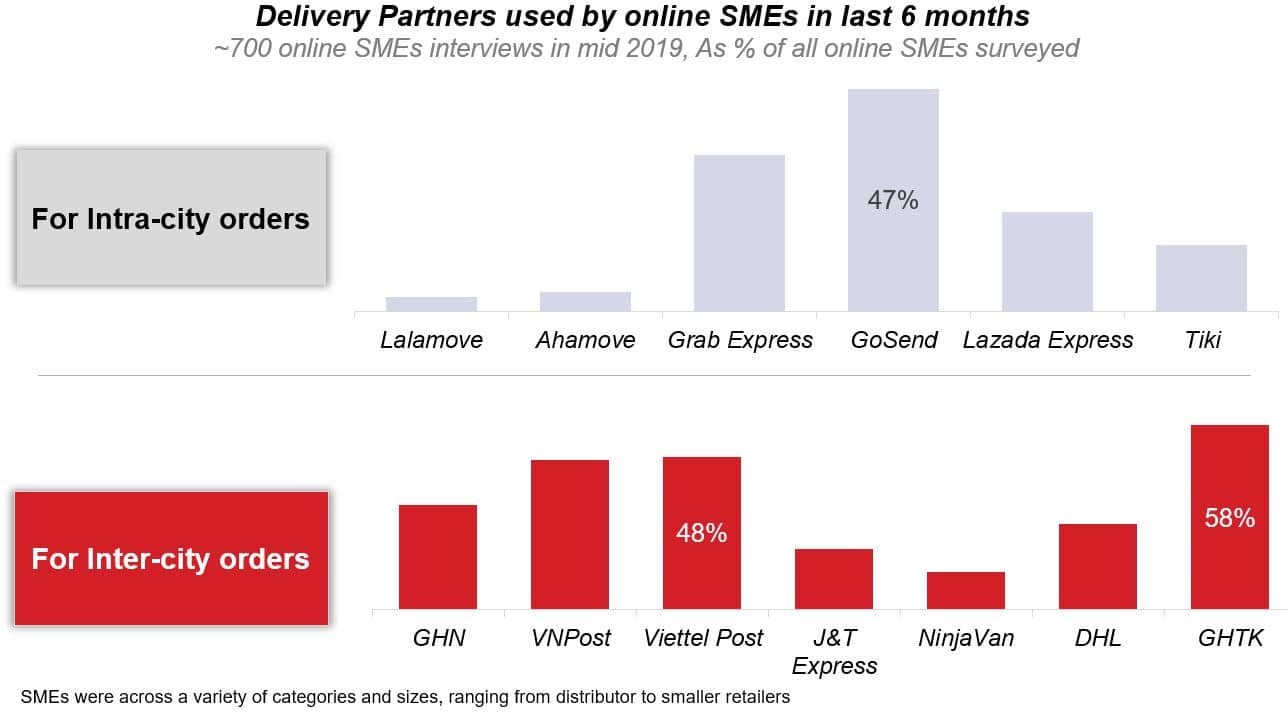

5. GoJek and Grab are most popular logistics partners for intracity routes while GHTK, VN and Viettel Post are popular in intercity routes