What’s Brewing in Southeast Asia’s Coffee Chains?

As we celebrated International Coffee Day, we revisited the vibrant world of Southeast Asia’s coffee scene. With a surge of investments and cross-country expansion, the region’s coffee market is evolving rapidly.

Want to evaluate new investment and M&A opportunities?

Over the last year, industry players have focused on consolidation and improving profitability. Now, these leaner and more efficient companies are poised to capitalize on the growing opportunities both domestically and internationally.

In this update, we examine current consumption patterns, compare coffee markets across Southeast Asian countries, and explore emerging business models and potential competitive advantages in the industry.

1. How does Southeast Asia drink coffee?

We observe 3 key markets that investors/companies should be excited about:

- Indonesia: Traditionally tea-dominant market, it’s experiencing rapid coffee culture adoption. And with the biggest population base in the region, perhaps it is the biggest TAM. The interesting part here is that the new age of coffee drinkers in the region are directly opting to purchase their warm cup of joe from their nearest coffee shop. Hence, it is becoming an attractive market for the number of coffee startups operating in the region with the highest growth in out-of-home consumption for coffee.

- Singapore: It’s been a relatively mature coffee-drinking market with high affordability levels. With high out-of-home consumption, it’s definitely a market wherein coffee brands can find a stable home. While the overall growth in the market might not be as exponential. We find pockets of high growth in premium offerings and at-home experiences.

- Philippines: The country has had a deep-rooted coffee culture (they consume the greatest number of cups per person across SEA). Now with an increase in income and a young population – out-of-home consumption is growing rapidly. Outside of home consumption, we see a rapid upgrade in household drinking patterns as well as moving away from instant coffee to a more premium offering. Overall coffee opportunity growth is the highest in the region.

2. The Philippines’ coffee market is a volume game!

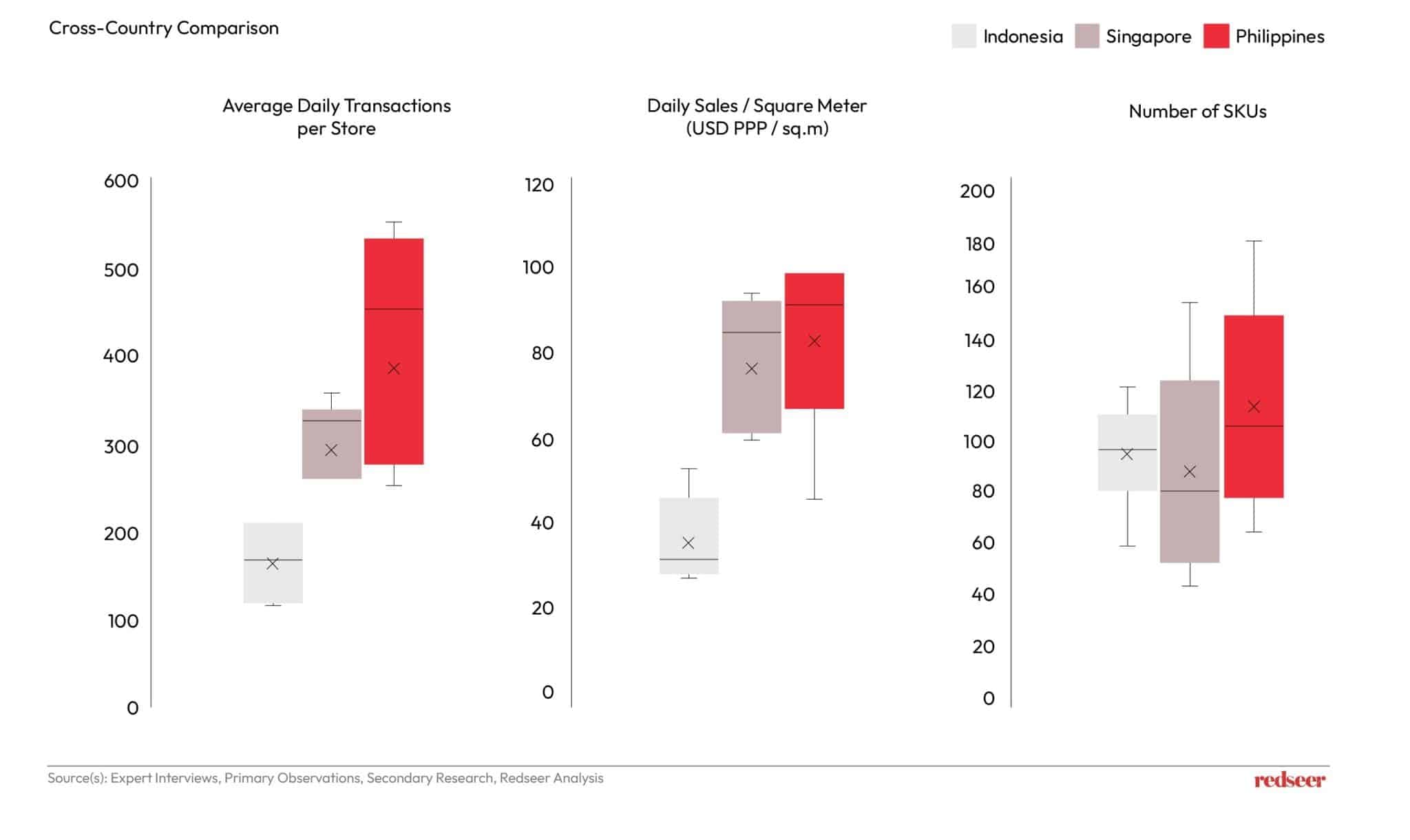

Looking at how different coffee chains are performing across the region, we see the Philippines as an outlier leading the average daily transactions per store. This also translates to a leading sales per square meter across the regions.

While that being said, the local consumers also want a lot of customization to their drinks with the outlets in the region having the highest number of SKUs.Whereas, in Indonesia – over the years we have seen consolidation in the SKUs offered by brands as they chase profitability.

In Singapore, we see that upselling other products such as food items and drink customizations is the highest which drives up the AOV. Something, other geographies are trying to replicate

3. Whereas, we have seen sizeable challenger brands emerge in Indonesia

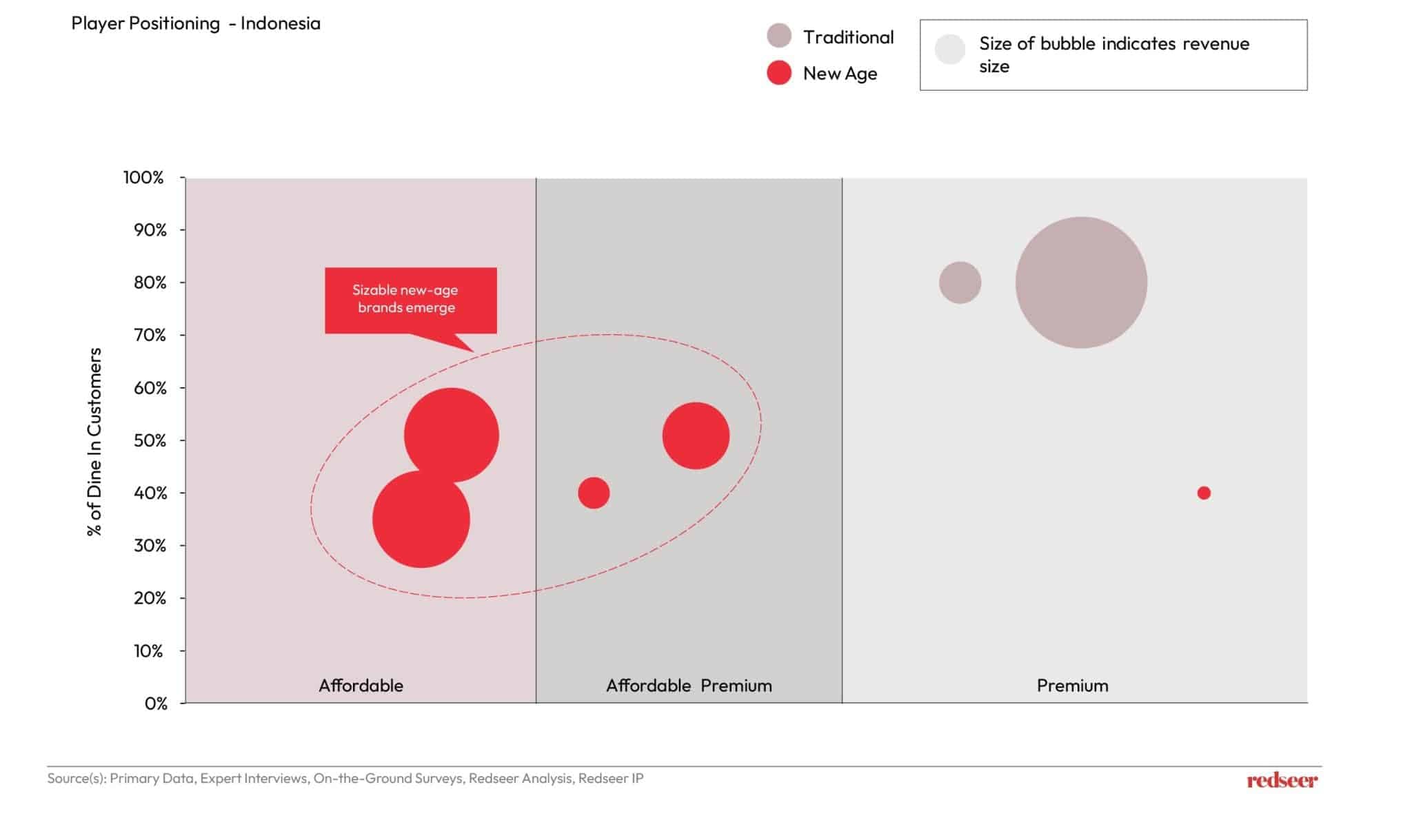

Despite the increasing competition, Indonesia has seen the rise of a few sizable challenger brands that have managed to scale well and are either profitable or looking at profitability.They have been able to corner a big and rapidly growing opportunity in the Affordable & Affordable premium segment.

Interestingly, takeaway forms a big part of their revenue – allowing them to further operate smaller more profitable outlets.With their business models honed over the past couple of years, these brands are now primed to expand outside of Indonesia to other countries.

Singapore has yet to see a local challenger brand scale up. In, the early days in the Philippines, we are seeing local players do well and grow.

4. Consumer Perspective: Perhaps Brand & Food are the key to a customer’s heart rather than coffee?

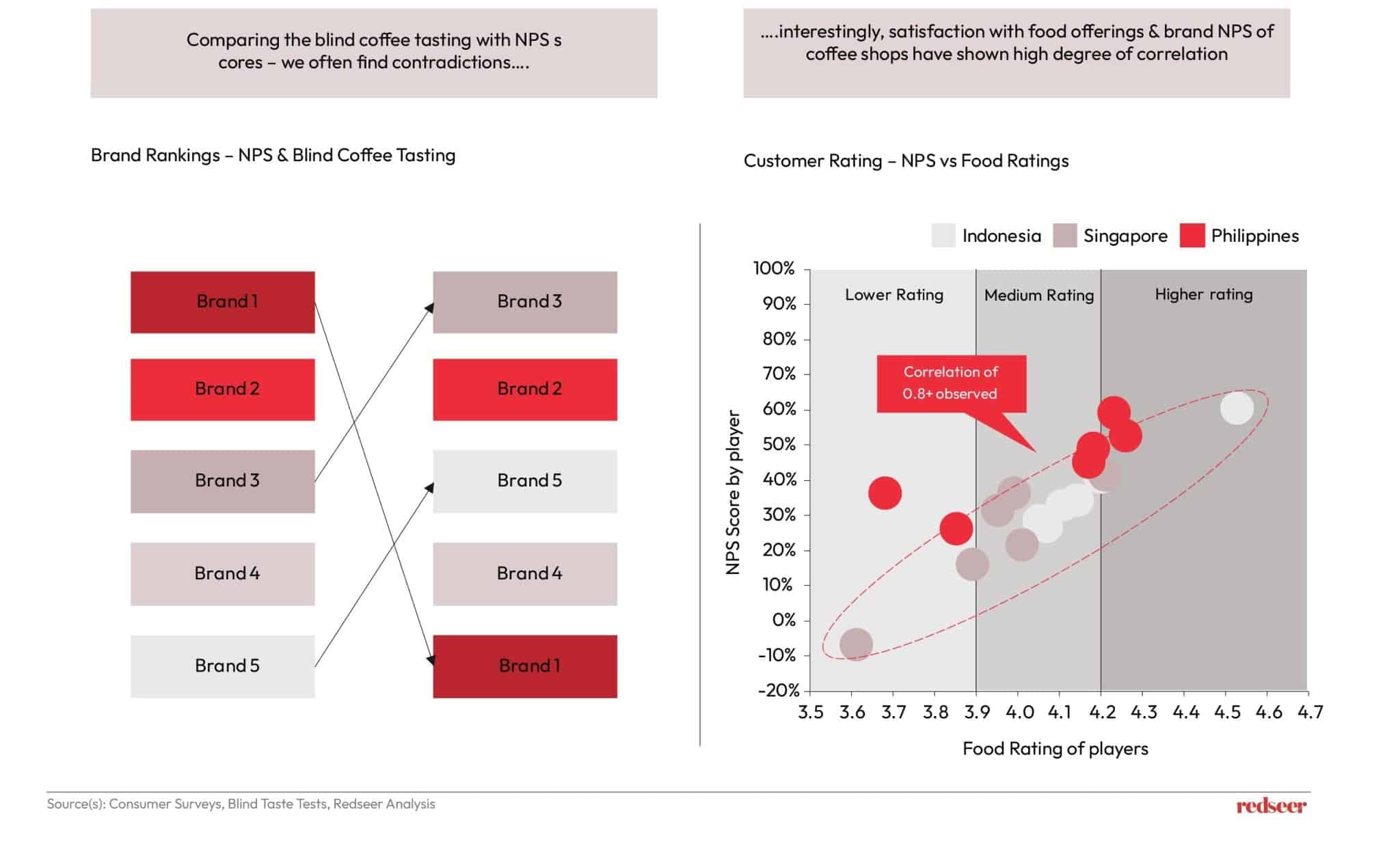

Comparing the results of blind taste tests with the brand’s NPS score shows that – while consumers claim the taste of the coffee matters most to them. Realistically the brand perhaps is the biggest decision-making driver.

We found that local challengers often were rated higher in blind taste tests than global giants. Perhaps – local brands to focus more on brand building to create a moat especially as competition intensity increases along with finding strategies to better communicate their superior & value-for-money offerings.

Food is another lever that brands should focus on, especially as it helps drive up average order value and profitability. We observed a correlation greater than 0.8 across regions. We find that there is a highly positive relationship between the quality of food and the Net Promoter Score (NPS) in these countries, suggesting that customer satisfaction with food directly impacts their likelihood to recommend the coffee outlet.

5. Carts for the win? We are seeing an onslaught of cart-based models takeover, not just for coffee but also beyond!

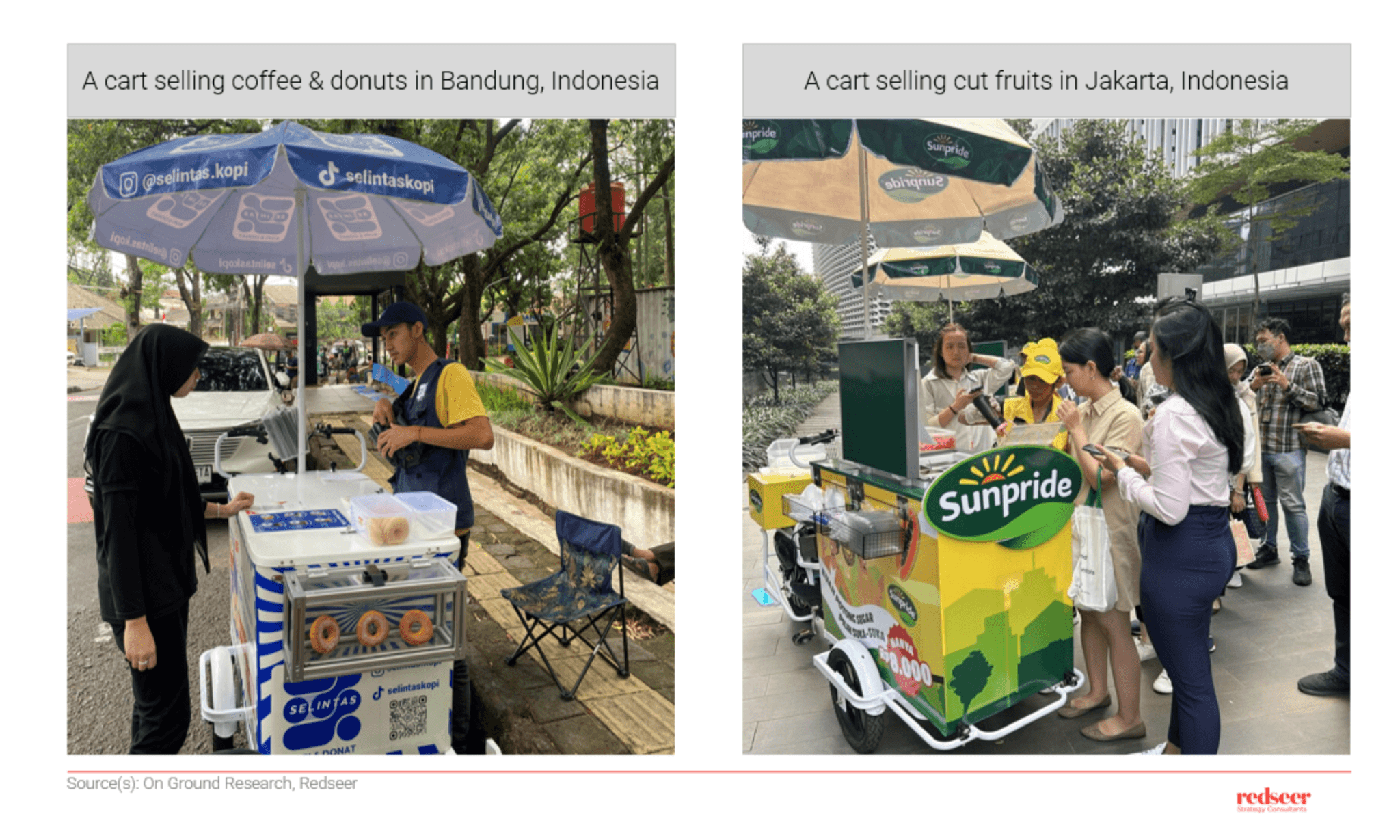

Across Asia, many of us have fond memories of buying ice cream from street carts as children. However, these carts seemed to disappear in recent years.

Now, they appear to be making a comeback, with several coffee brands launching cart-based services.

Priced under 10,000 Indonesian Rupiah, these offerings fill a niche between instant ‘Kopi Susu’ and convenience store coffee. The strategy seems successful, with carts selling around 100 cups daily.

Some brands are even expanding their menus to include snacks.

Why is this model effective?

- It provides accessible, affordable coffee. (Customers avoid food delivery fees)

- The taste is considered good for the price.

- It caters to morning commute and post-lunch demand.

- Carts are typically located in parks, near offices/schools, and at public transport stations, making them more cost-effective than traditional storefronts

We’re also seeing this concept expand beyond coffee. For instance, there’s a fruit cart pictured on the right. And the que speaks for the potential demand!

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me