The global mobile telecom market is ripe for disruption, especially on the roaming plans, which have been lucrative for telecom operators. With physical SIM cards gradually being phased out, eSIM adoption is set to surge. This has resulted in a new category – eSIM aggregators such as Airalo, Nomad, Holafly, and MobiMatter. These eSIM aggregators are currently winning tourists with better pricing and seamless UX. In fact, Airalo’s recent $220 million funding round, including its unicorn status, is a strong vote of confidence from global investors.

GCC is also not far behind in this trend. Airalo has its roots in GCC, and MobiMatter is headquartered in the UAE. However, the GCC landscape is very different compared to other parts of the world. This article captures those differences – read below for the details.

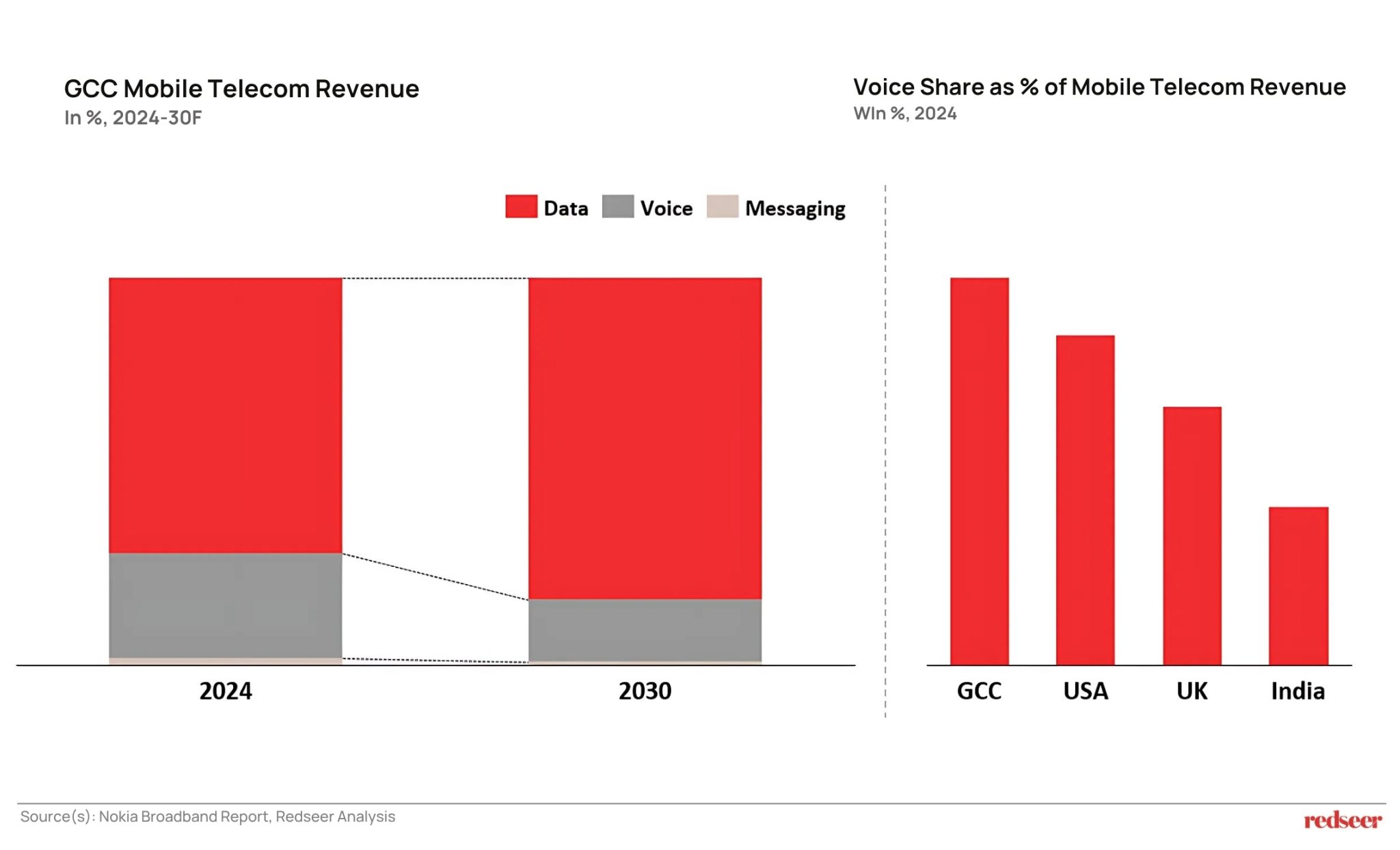

1. GCC mobile telecom market will be driven by rising data usage

Currently, mobile telecom revenue in the GCC is primarily driven by data usage, which contributes ~70%, as consumers increasingly rely on mobile data for communication and information access. However, the share of voice revenue remains relatively higher in the GCC, compared to markets such as the US and UK. This is due to restrictions on VoIP services and the continued promotion of bundled voice plans by regional telecom operators. Looking ahead, the share of data revenue is expected to rise further as data use cases expand, driven by growth in streaming, gaming and other digital sectors.

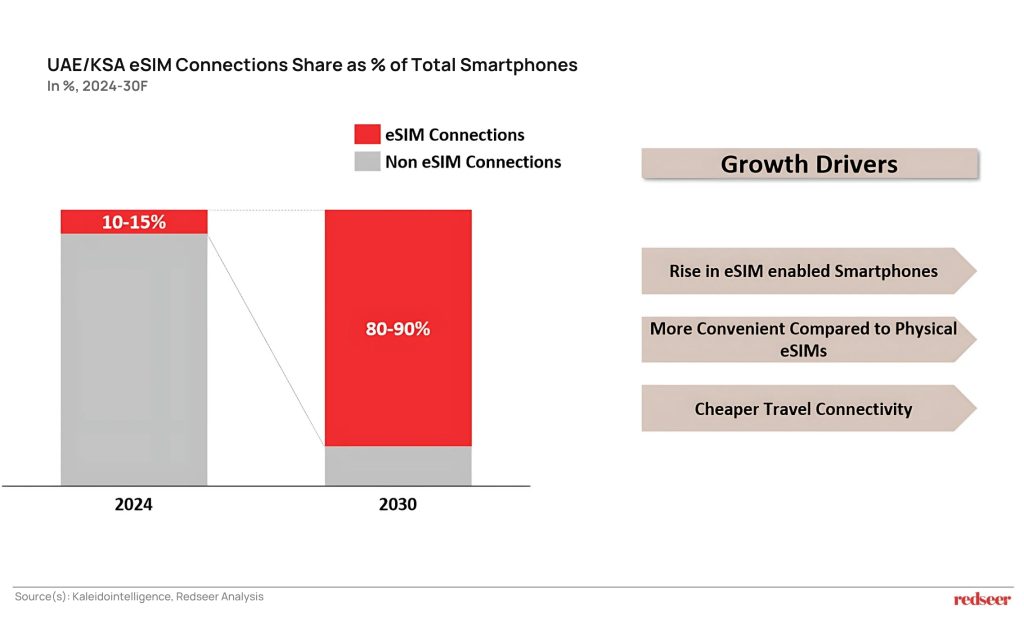

2. This data growth will be further shaped by the rise of eSIMs

eSIM helps consumers avoid the hassle of physical SIM cards, enabling them to activate multiple lines on a single device and making number portability more seamless. Currently, eSIM penetration stands at around 10–15% of smartphones in the market, constrained by limited consumer awareness and the fact that only select devices, mainly iPhones and flagship Samsung Galaxy models, support the feature. However, penetration is expected to grow as more smartphone models integrate eSIM functionality, telecom operators push for broader adoption to reduce their operational costs, and new players such as eSIM aggregators offer more competitive and flexible options to consumers.

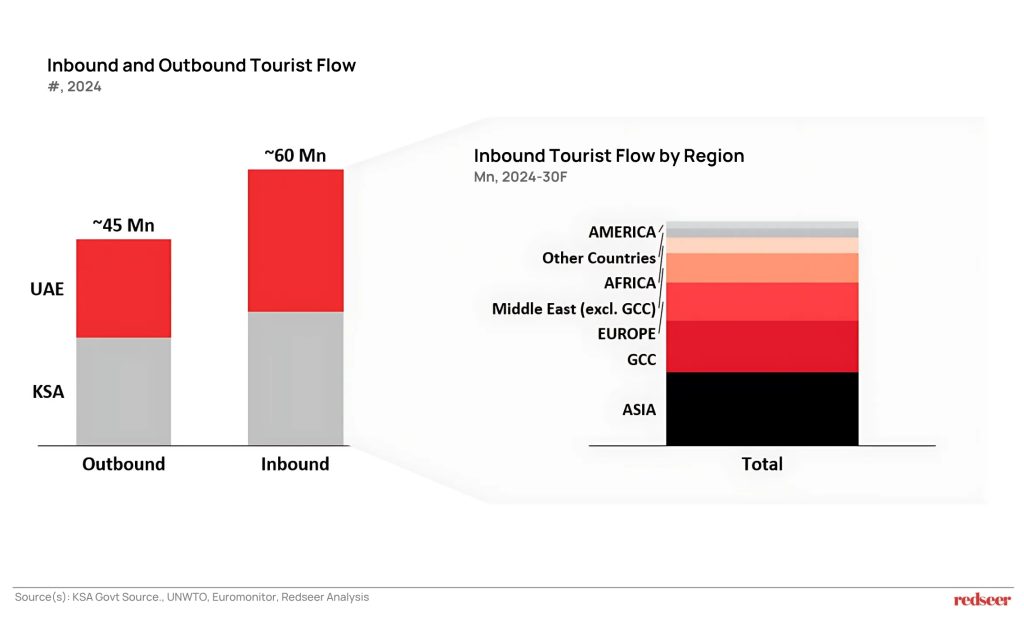

3. Tourism is the biggest near-term use case

Tourism represents the most immediate use case for eSIM providers, with nearly 100 Mn inbound and outbound tourists flow across the UAE and KSA annually. For inbound travel, key source regions include Asia, the GCC, and Europe, together accounting for over 60% of total arrivals. However, eSIM aggregators face limitations in fully tapping this opportunity, as eSIM activation remains restricted within the UAE and KSA, posing regulatory and operational barriers to seamless onboarding for tourists.

4. eSIM players are addressing this opportunity by offering an attractive value proposition

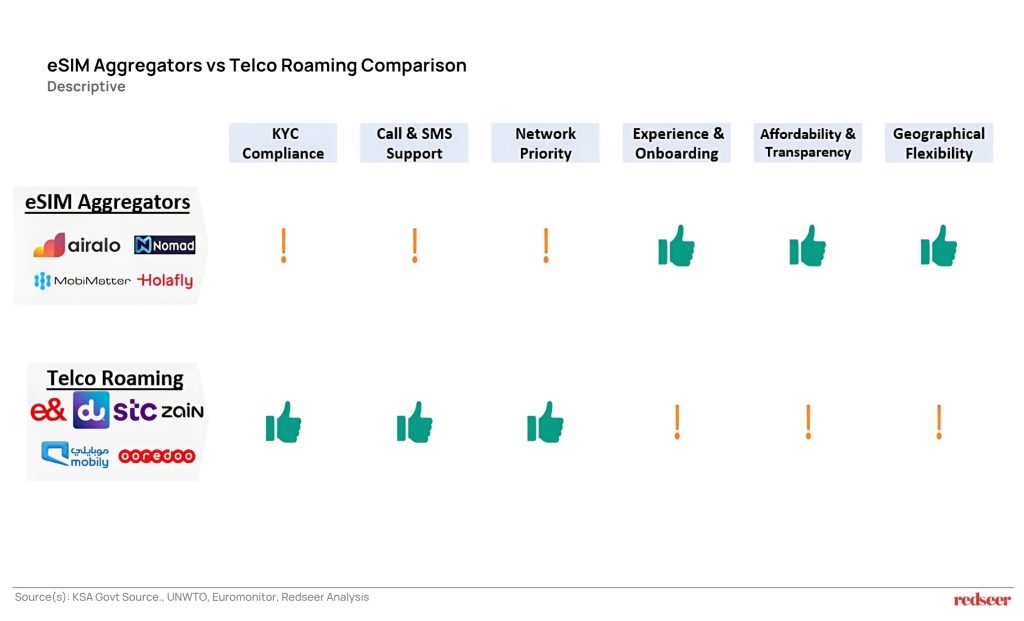

Both telcos and eSIM aggregators are actively developing solutions to meet the evolving needs of global travelers. Telcos offer features such as retaining a home-country number while abroad, access to priority networks in partner geographies, and full KYC compliance in each operating market. On the other hand, eSIM aggregators like Airalo, Nomad, MobiMatter, and Holafly are gaining traction by offering more affordable data packages, seamless UI/UX experience, and instant activation. Notably, Airalo recently became a unicorn following a $220 million funding round led by CVC, signaling growing investor confidence in the eSIM aggregator ecosystem. For the market to scale further, collaboration between telcos and aggregators can be essential to deliver a seamless and high-quality experience for consumers.

We hope you’ve found these insights helpful. For a more detailed discussion or to explore how these shifts may impact your business, feel free to reach out to us!