When we had our groceries delivered at our doorstep, a lot of us thought “this is it… technology cannot make life any simpler”. All we had to do was order our groceries online, and it was delivered to us in a matter of days. But we were wrong. India’s grocery retail market has been shaken once again by technology and has paved the way for a new and exciting sub-segment: Quick commerce. So now, we have our groceries delivered to us… in minutes!

In this article, my colleague Abhishek Gupta and his team decode the explosive growth of quick commerce in India!

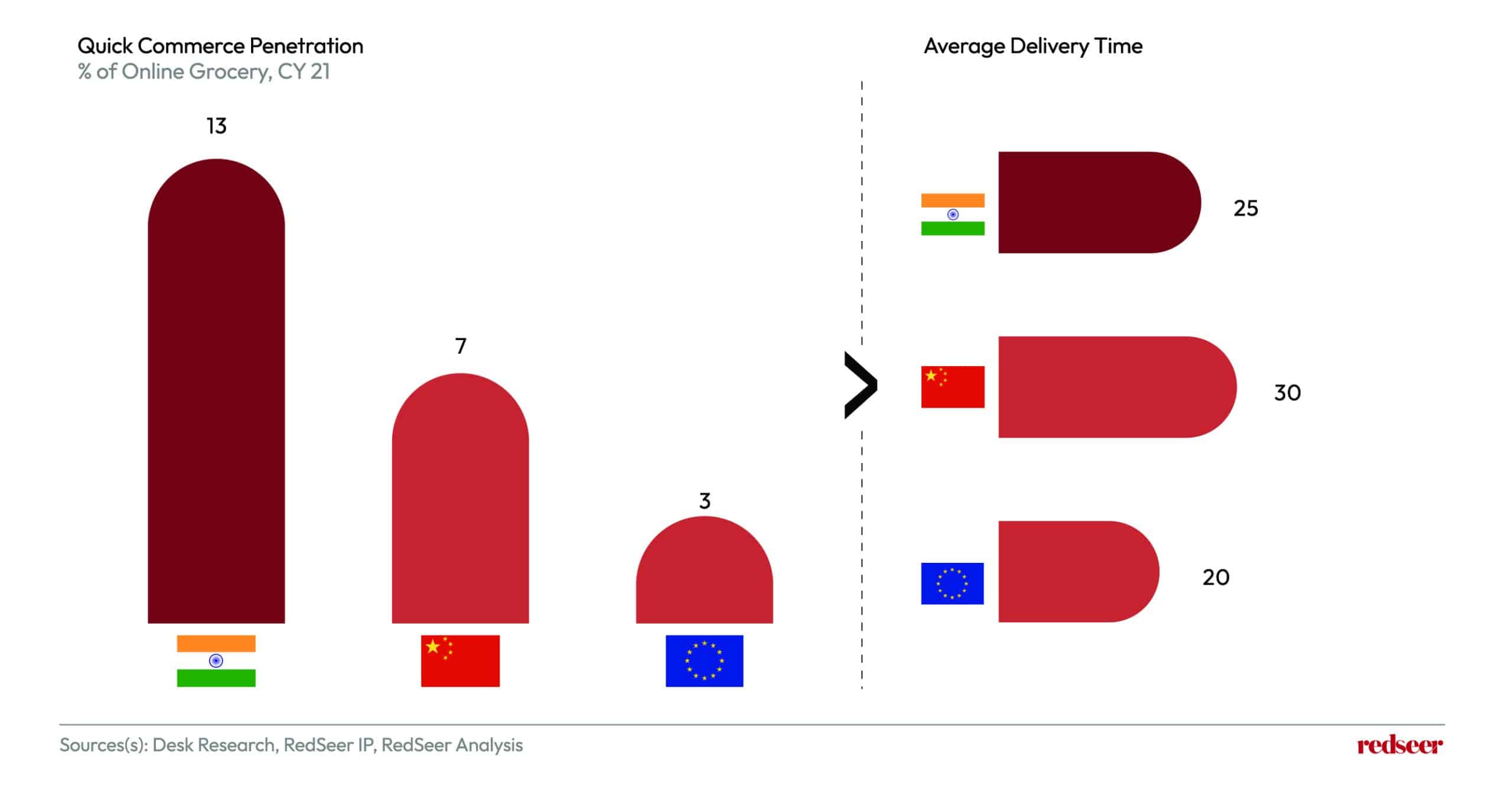

1. India’s quick commerce market is all set to astound us with a 10-15X growth by 2025, reaching a market size of close to $5.5 Billion, leading other markets (including China) in terms of quick commerce adoption

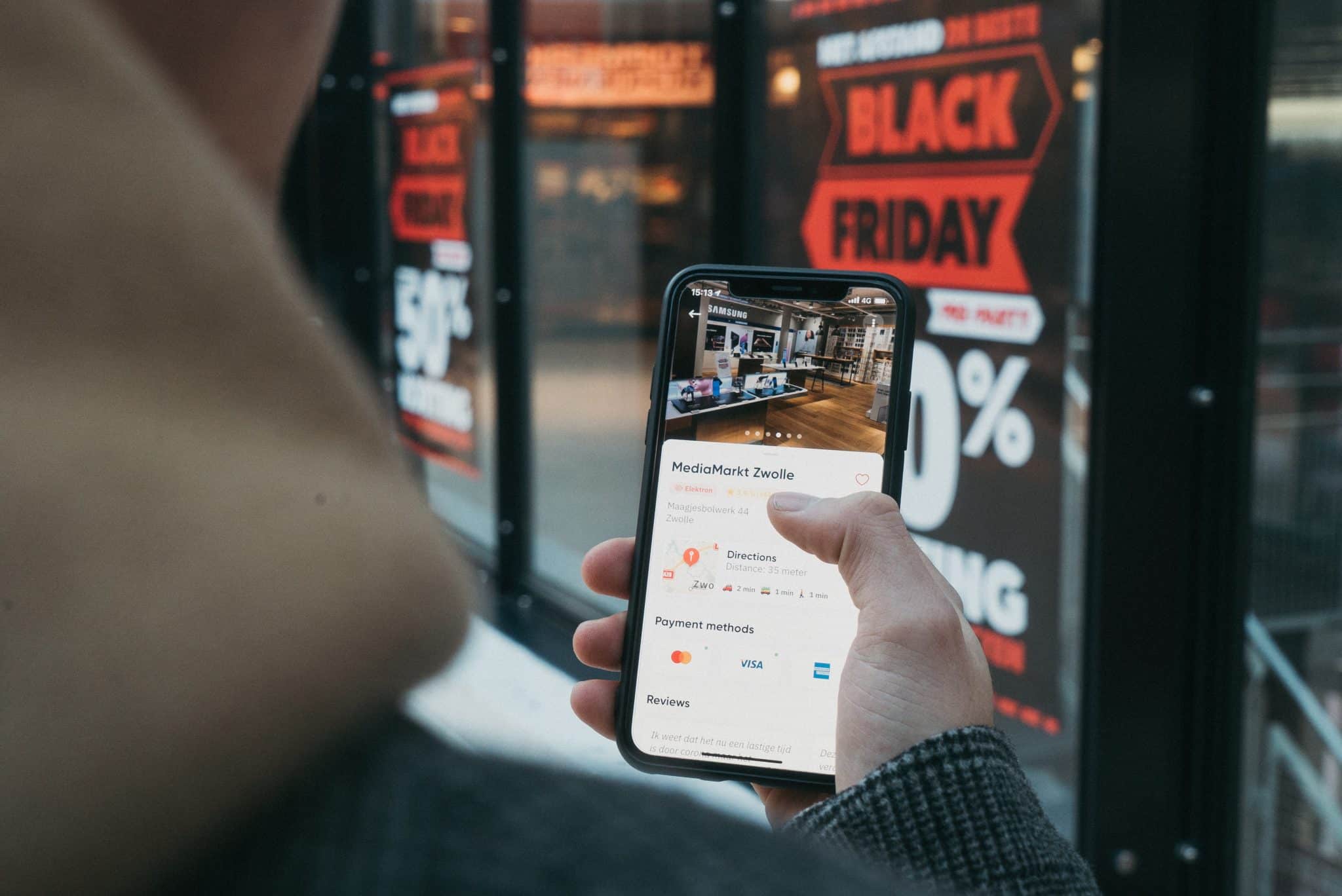

Quick commerce is becoming the next major segment as players realize the massive potential it has. Emerging as one of the fastest growing e-commerce models, quick commerce is fundamentally changing consumer purchase behavior and the grocery retail market on the whole by providing faster delivery options (in as little as ten minutes) as well as a more convenience-driven shopping experience.

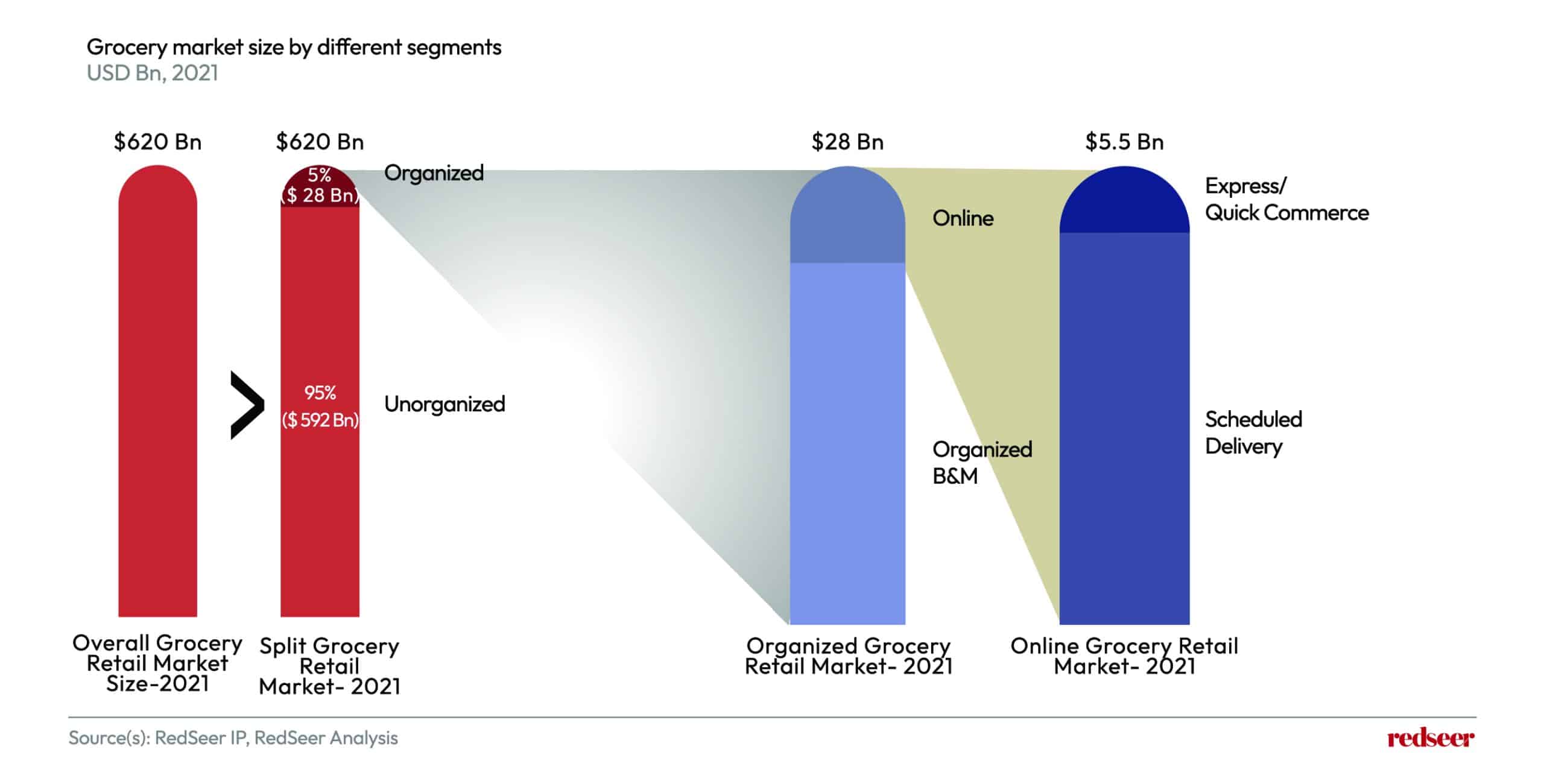

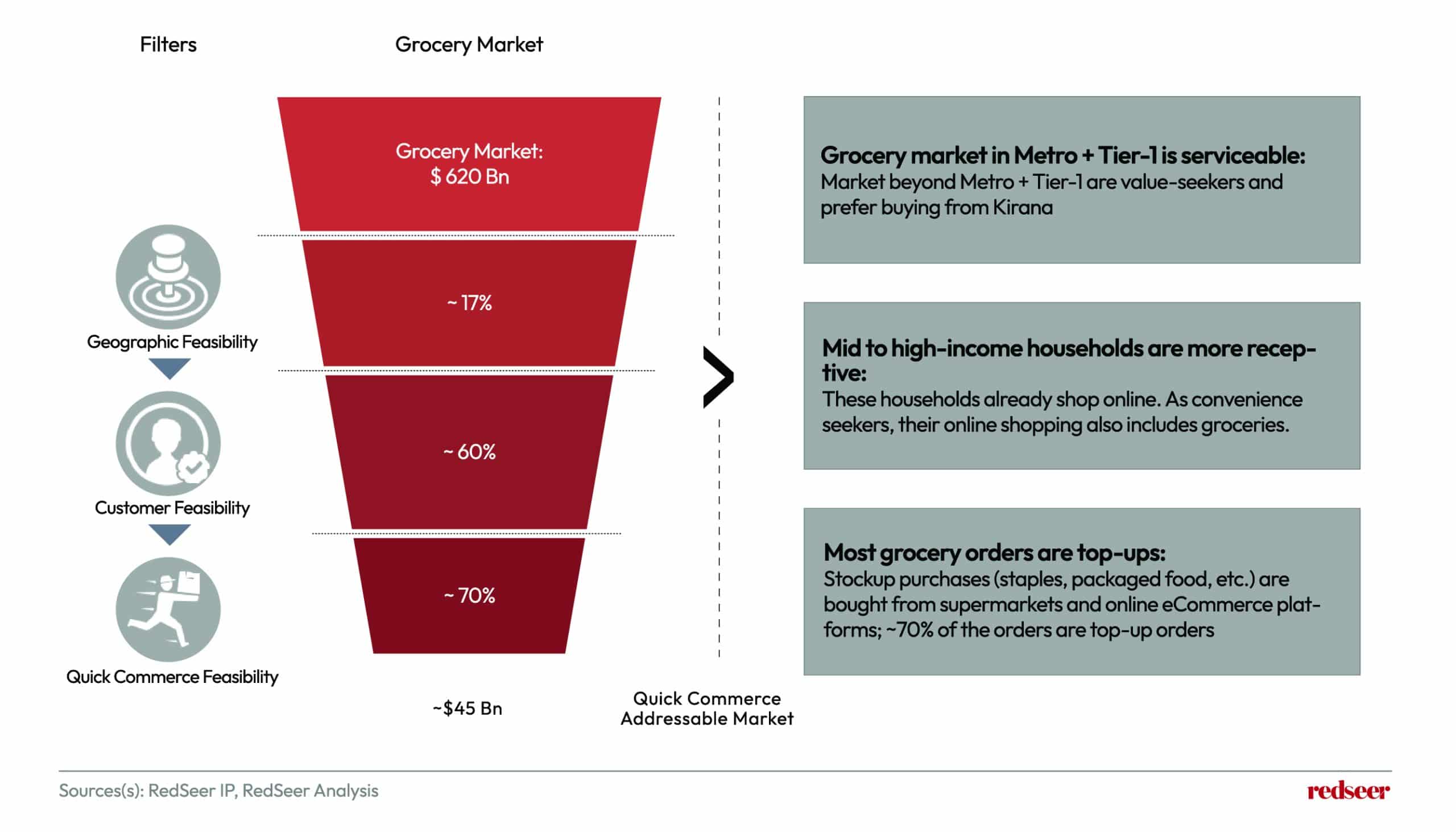

2. Previously a far-fetched dream, quick commerce is now a ~$45 Bn TAM reality, with massive headroom for growth!

The Total Addressable Market for quick commerce in India stands at ~45 Bn, and Metro & Tier 1 cities drive this market on the back of mid-high-income households. Quick commerce is satisfying the latent needs of its customers in a way that traditional commerce never could, the report said. It gives people exactly what they want, when they want it, without forcing them to wait days or weeks for delivery. The convenience and speed of quick commerce is a key reason why customers love it and why the segment is only bound to soar upwards.

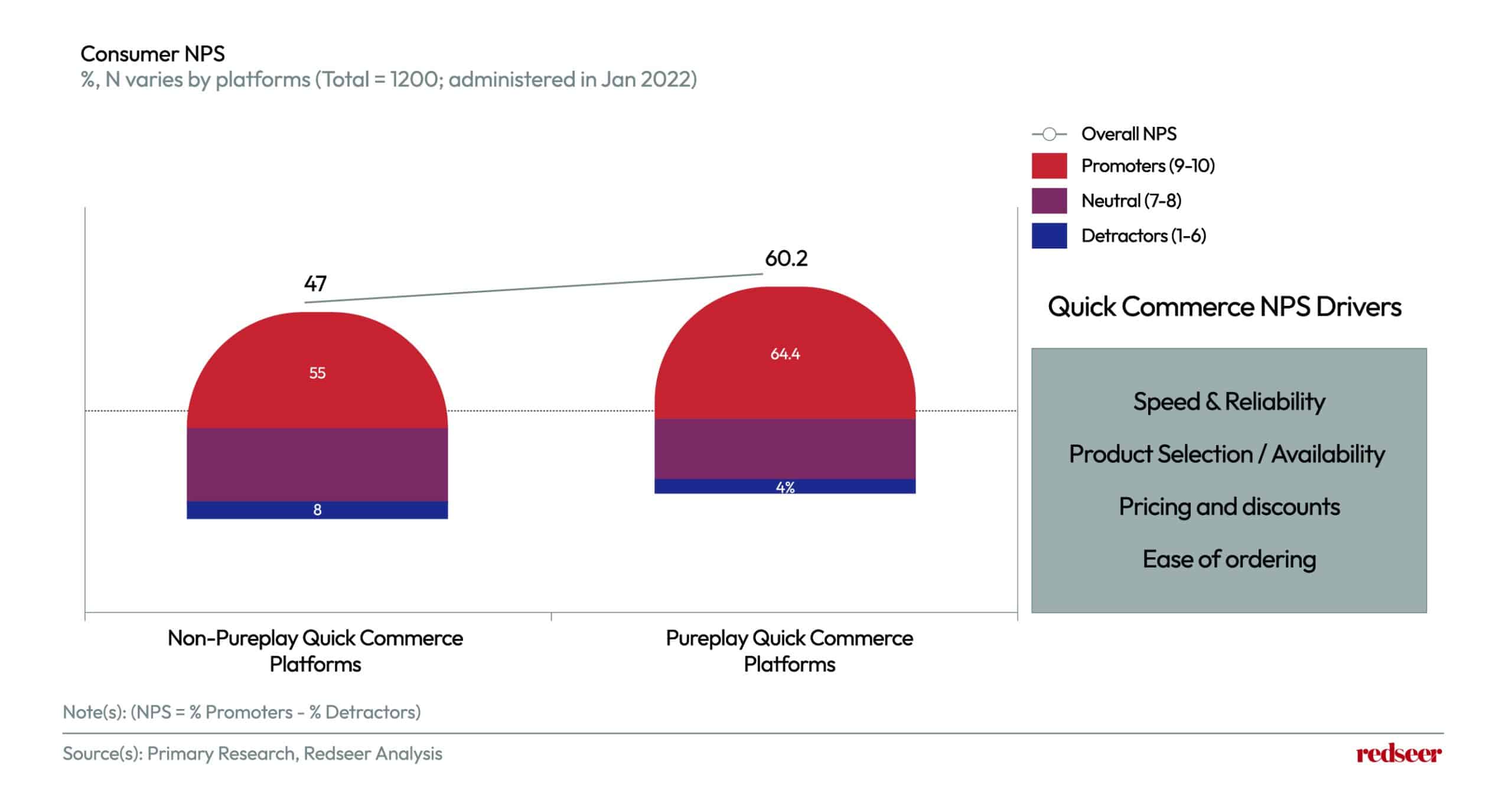

3. Customers love quick commerce: Quick commerce platforms have significantly higher NPS than eGrocery incumbents

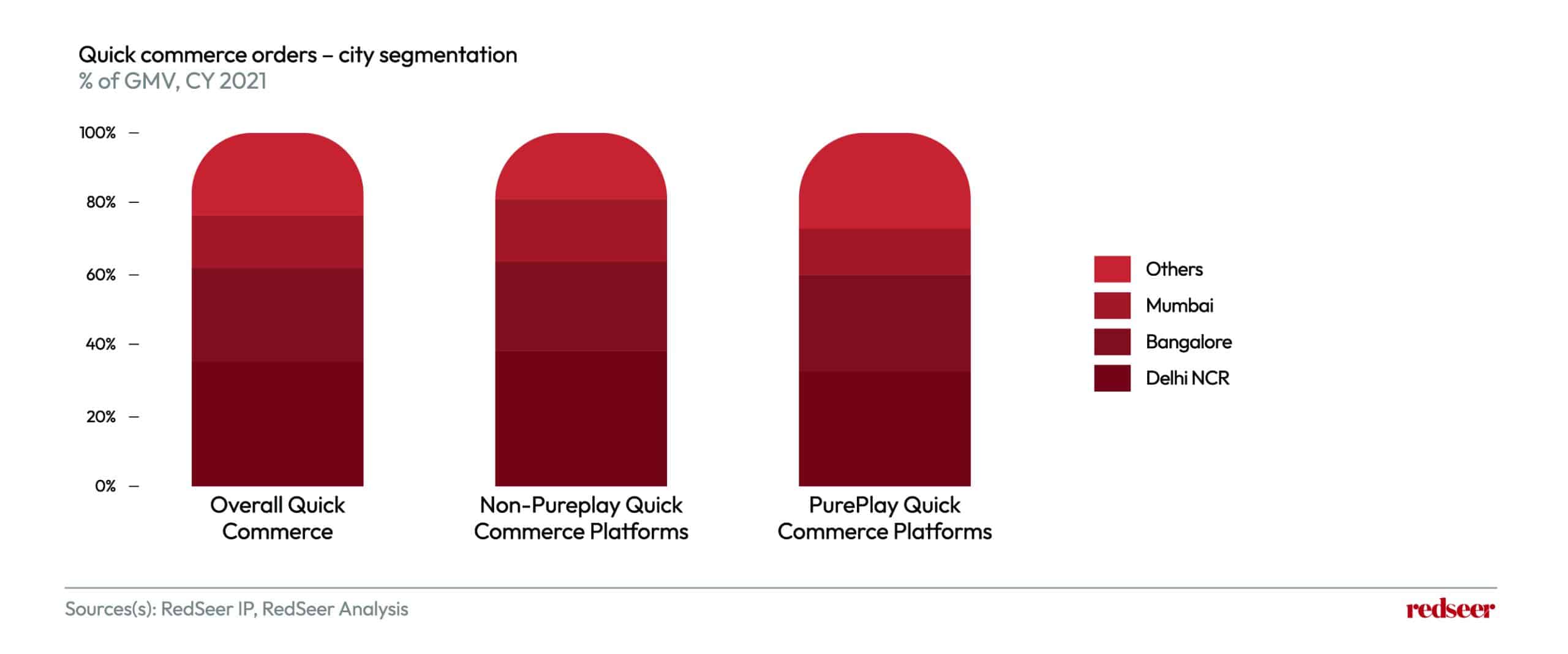

4. Quick commerce is fundamentally changing consumer purchase behavior in metros and creating delight

Over the last two years, quick commerce has seen a significant uptake in urban areas, with major cities such as Bangalore, Chennai, and New Delhi enjoying most of the offerings.

5. The way forward for Quick commerce:

Quick commerce players can up their game by going beyond just grocery and extend their offerings to other consumables, electronics, newspapers, and more. Further, it is imperative that quick commerce extends beyond just metros. Private label play to boost unit economics and margin, and ride safety to win the trust of riders and increase retention are the other key areas that need to be addressed largely.