Quick Commerce in SEA: How Early Movers Are Building the Next $35B Giants

When we look across various new-age industries and markets, two key factors have always stood out in shaping customer choices: speed and price. Whether you’re catching a ride, ordering a meal, or groceries, consumers tend to see how fast they can get what they want and how much it’s going to cost them.

Have a question?

Our experts are just a click away.

This is the foundation of some of the most successful tech business models we have witnessed in the past decade. For example, ride-hailing platforms compete on ETAs and fares. Food delivery apps win customer loyalty by showing the quickest options with high discounts. The formula is simple, but impactful: immediacy + affordability = conversion.

Quick Commerce is a success of this model!

These platforms are all about providing that instant gratification at a price that feels fair. And if you have been following the trends in India and the Middle East, you would have noticed that once consumers experience the ease of getting everyday essentials under 15 minutes, their shopping behaviour changes, their stocking habits change, their brand loyalty changes, and platform stickiness increases.

However, even though Southeast Asia is next in line with the potential to unlock USD 30–35 Bn in GMV by 2030, it is not an opportunity that can be copied and pasted from India. The success of Q-Commerce in SEA will depend on the local know-how, solid unit economics, and demand density. Those who act swiftly and make a strong hold before the market matures will gain a lot.

In this article, we break down the business case and the playbook required to win.

The Anatomy of a ‘Wow Moment’

Our research shows that when delivery times are under 15 minutes, it really taps into that quick, instinctive decision-making process we all have. Consumers don’t just value speed; they also appreciate how smooth and seamless the whole experience is. And all of this with just a few taps on your smartphone. This is more than just satisfaction; it creates instant gratification, almost like a dopamine hit making them want to come back for more.

It’s this “Wow Moment” when delivery is faster and more convenient that drives habit formation and customer retention rather than a trip to the nearby store or a supermarket.

Take India’s success with Quick Commerce as a prime example. They have got their “Wow moments” right across several use cases. Nowadays, users there are spending 2 to 3 times more each month on Q-Commerce platforms compared to traditional eCommerce. So, what’s behind this shift? How did this happen?

1. Under 15-minute delivery for MiniMart items

2. Under 30-minute delivery for supermarket-sized baskets

3. Price parity with organized retail

4. Discount grocery formats launched within the Q-Commerce sector

5. Food deliveries in under 15 minutes

6. A highly sticky user base and a notable shift in household stocking behaviour

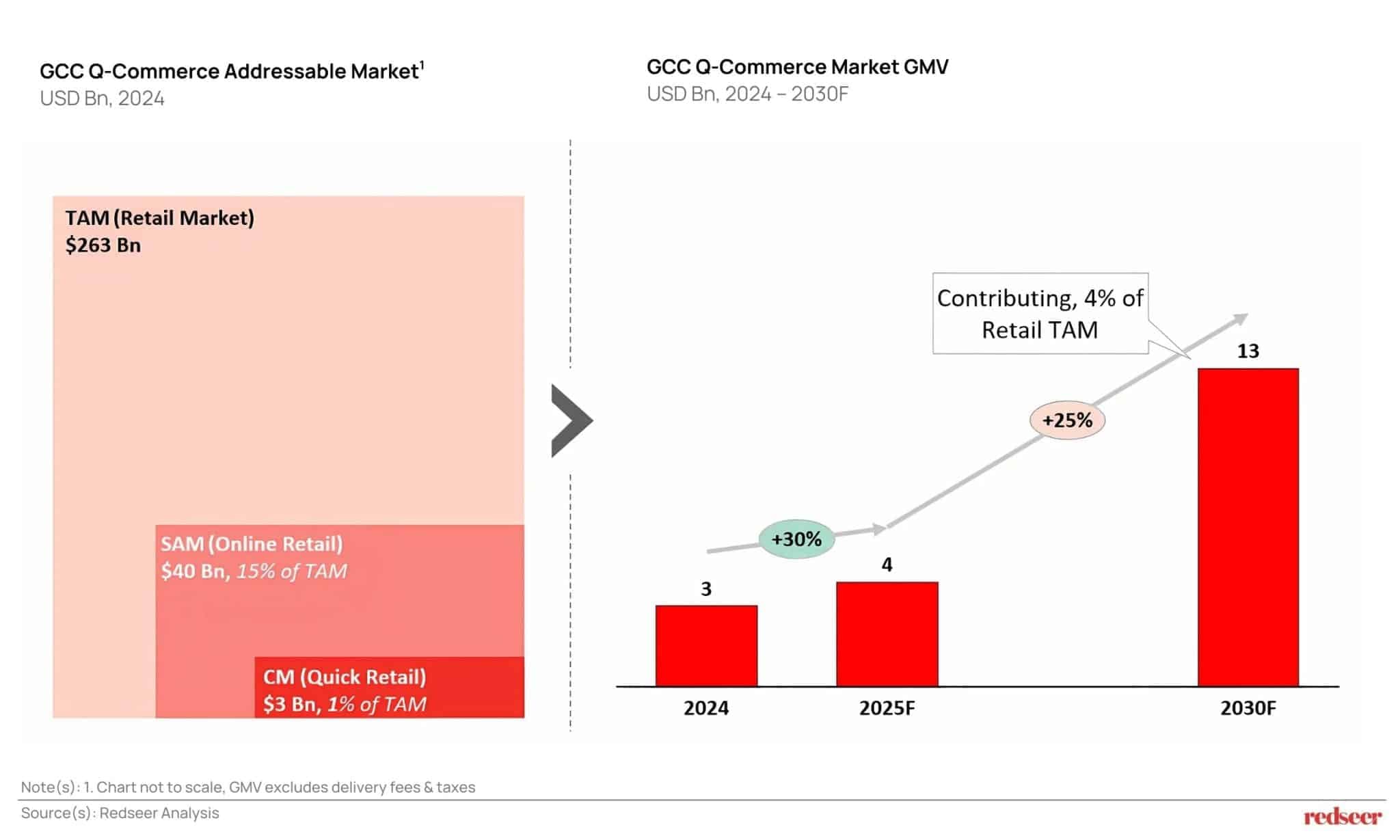

Similar momentum is now brewing in the GCC, where Q-Commerce already accounts for 1% of the total retail market and 13% of the grocery segment.

How Southeast Asia is Positioned to Make Big Advancements in this?

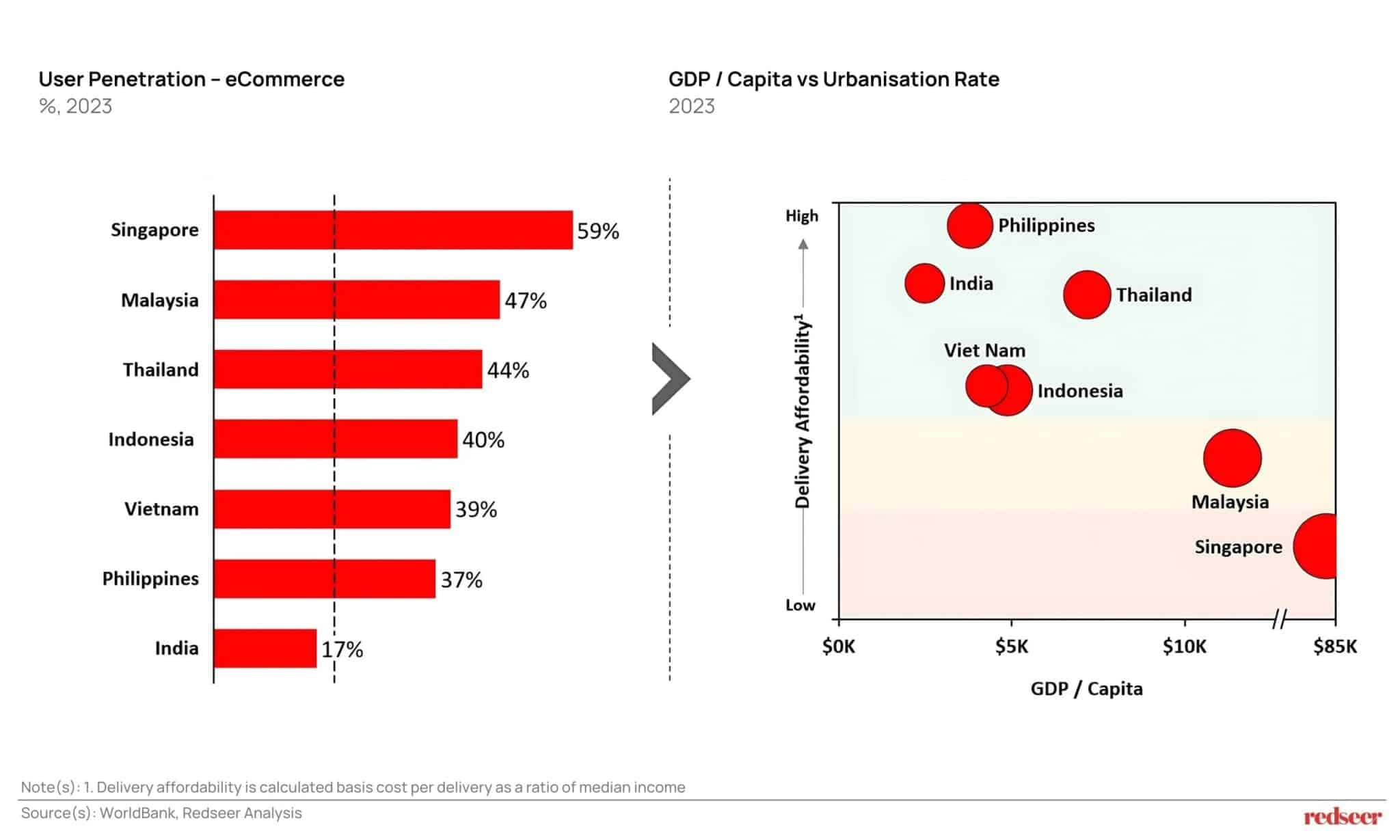

Southeast Asia might even be better suited for Q-Commerce than the early adopters:

- Urbanization and Traffic Congestion: Cities in SEA are growing rapidly, and it often takes longer to venture out shopping than to place an order online.

- High Mobile Penetration and Digital Adoption: A large, digital-savvy population, with high mobile internet access that also provides a strong user base for q-commerce.

- E-commerce Growth Trajectory: The booming e-commerce growth in Southeast Asia positions Quick Commerce as a natural step for faster deliveries.

- Changing Consumer Behaviour in South East Asia: People here value convenience and speed , and are hence willing to shell out more for immediate access to essential goods.

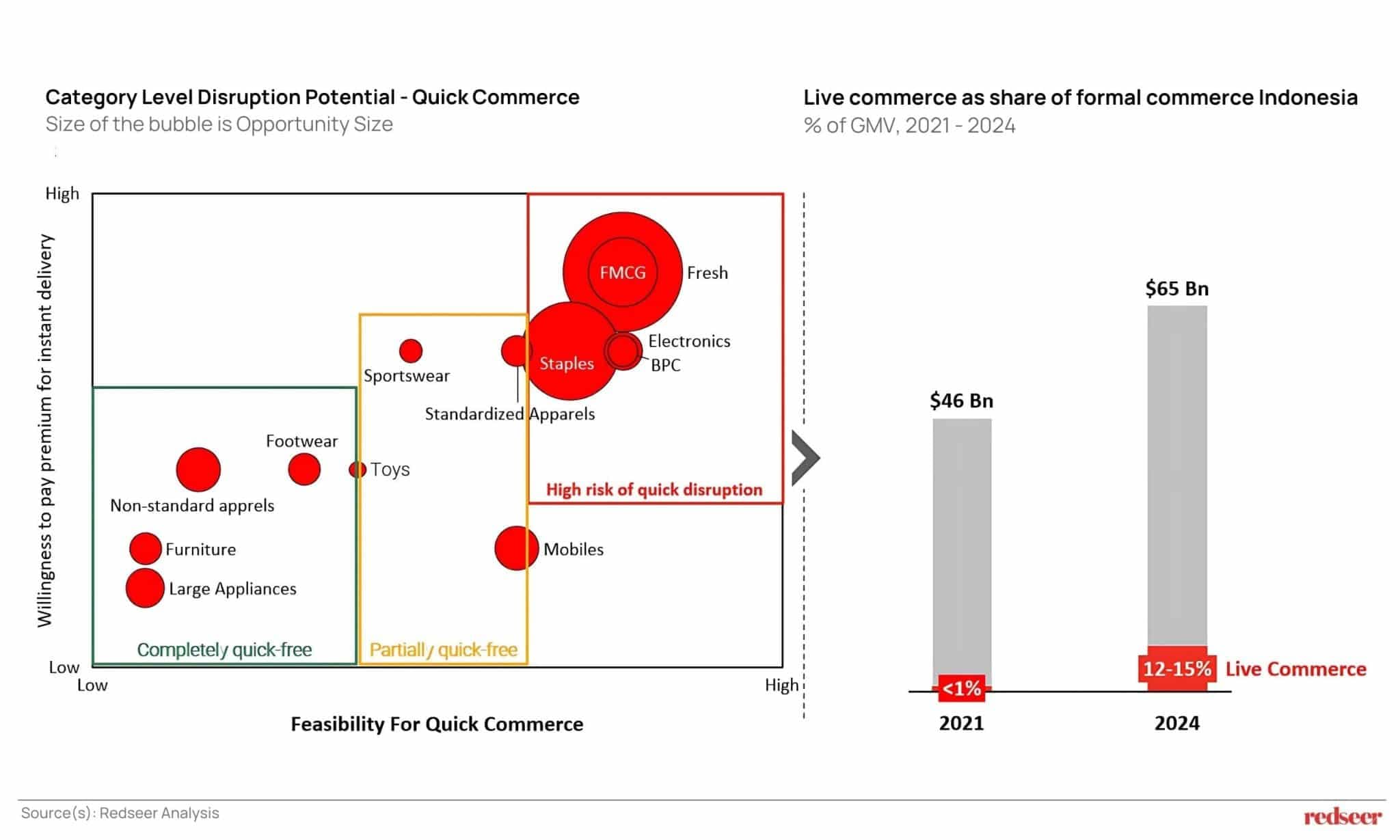

- Success of Live Commerce: Rapid success of live commerce has already proven the impulsive buying tendencies of SEA consumers.

These factors come together to create the perfect environment for the quick adoption of Q-Commerce, especially in metropolitan and Tier 1 cities where people are always on the lookout for convenience.

The Economics Behind Q-Commerce

The economics of Q-Commerce is just as intriguing as the demand itself. For Q-Commerce to operate profitably, a typical dark store must fulfill 1,300–1,400 orders per day, which is viable in areas with a population density exceeding 15,000 people per square km. Most major SEA cities already meet or exceed this mark. Delivery times and a customer’s familiarity with brands play a huge role initiating purchases, particularly in food and fast-moving consumer goods (FMCGs).

If executed properly, Quick Commerce in Southeast Asia could swiftly capture between USD 30 to 35 billion in gross merchandise value (GMV). The primary users will be those seeking convenience in metro and Tier 1 cities, who are often the most engaged and profitable for eCommerce businesses.

Categories Ripe for Disruption

Quick commerce rapidly disrupts key categories, especially in areas where shoppers are willing to pay a little extra for speedy delivery and where logistics is not an issue. Categories like groceries, fresh produce, electronics, beauty and personal care, and quick-service food are particularly susceptible to this swift shift.

Take the rise of live commerce in Southeast Asia, for instance. It’s a striking example of how swiftly consumer habits and market dynamics can shift with the introduction of new, convenient options.

This overlap between traditional and quick commerce trends necessitates swift action from existing players to adapt and capitalize on evolving consumer expectations, as the potential for rapid category disruption is significant.

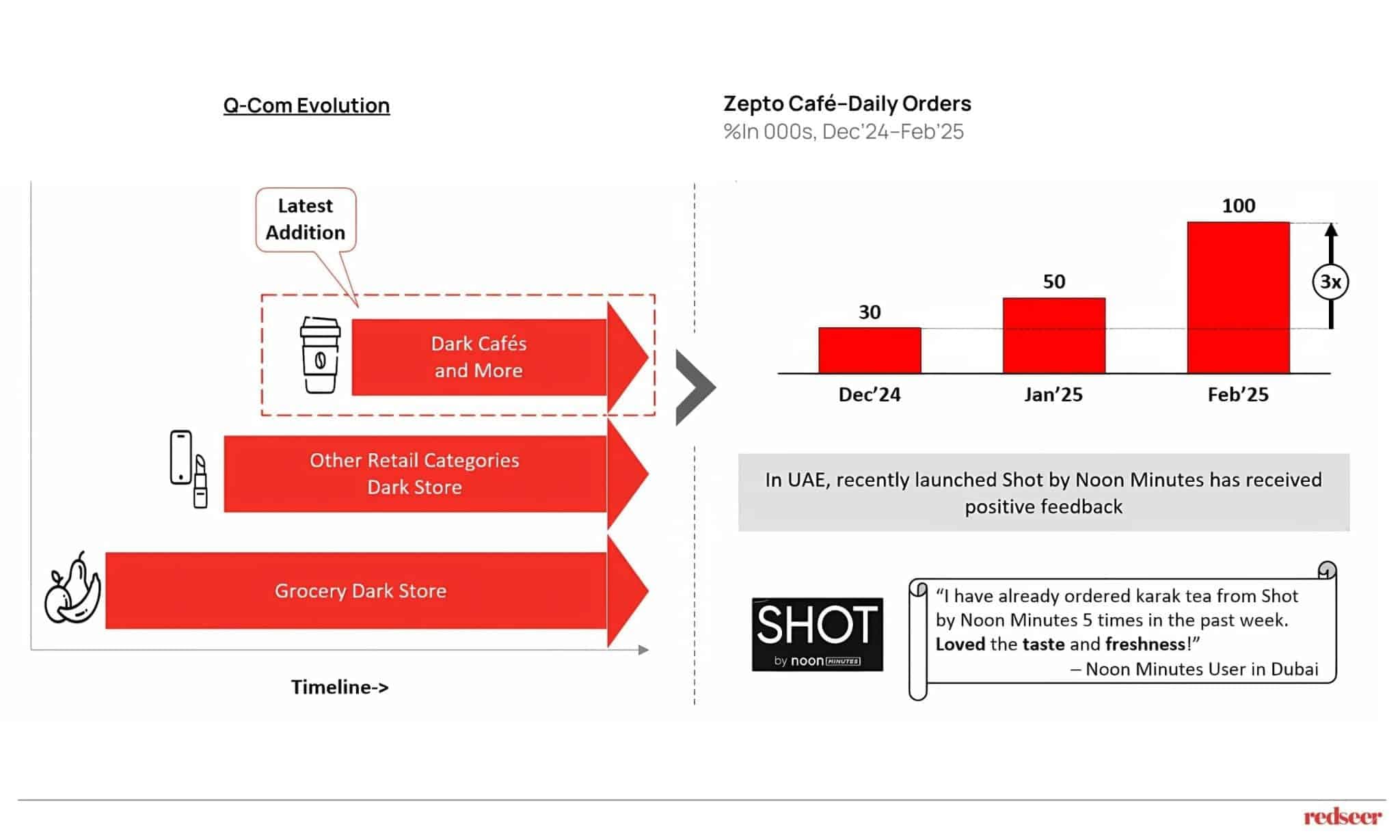

In India, platforms like Zepto Café and in the UAE, Noon Minutes are leading the charge with food deliveries in under 15 minutes. Users are already showing signs of loyalty and satisfaction. Talabat is another major player in the MENA region, dominating Q-commerce across several countries with a strong focus on variety.

Quick commerce is also causing another disruption in food delivery by offering delivery times under 15 minutes.

A good example here could be the daily orders for Zepto Cafe, which tripled from December 2024 to February 2025.

In Southeast Asia, around 42% of food orders are placed when people are already feeling hungry. Imagine how it would feel if there were a 30-minute window to your favourite dish when you are starving? That’s why speed becomes such an important factor, where consumers can choose familiar and trusted options. This also creates an opportunity for cloud kitchens that can tweak their operations to focus on being fast and responsive.

Partnerships between cloud kitchens and food aggregators have also started offering quick deliveries and have seen success.

Even in the UAE, platforms have tested out super-speedy delivery services, and customers seem to love it. This really shows there’s a strong demand for ultra-fast-food delivery, driven by the quick commerce model.

Redseer’s Strategic Advisor for Stakeholders

The Quick Commerce (Q-Comm) race in Southeast Asia is no longer about first-mover advantage, it’s about fastest-to-scale with the smartest economics.

SEA’s unique mix of high mobile penetration, urban congestion, and digitally native consumers creates the ideal breeding ground for the next $35B disruption. But this playbook won’t reward copy-paste models, it will reward those who master hyperlocal density, operational excellence, and brand-led experiences.

For investors:

This is a rare opportunity to back category-creators, not just category-participants. We expect asset-light dark store models, food-led Q-Comm, and platform-advertising monetization to emerge as the most bankable bets.

For founders & operators:

Seek inspiration from India and MENA lessons. Build differentiated demand triggers, close the last-mile trust gap, and lock in frequency through habit-forming use cases. The brands that will win here are those that don’t just promise speed, but deliver seamless, repeatable convenience at scale.

SEA isn’t just ready for Q-Commerce – it’s hungry for it! The winners will be those who move now, build right, and stay relentlessly customer-first.

At Redseer, we help businesses solve for what’s next. We have partnered with some of the top Quick Commerce companies in India, the Middle East, and Southeast Asia. We’ve helped them find promising micro-markets, grow their user base, optimize economics for dark stores, and build strong strategies. Whether you’re a retailer or an investor, our data-backed insights can help you navigate your Q-Commerce journey.

Written by

Roshan Behera

Partner

Roshan is a Partner based in Singapore and focuses on Southeast Asia. His sector coverage includes e-commerce, logistics, fintech, eB2B, on-demand services, and other emerging sectors.

Talk to me