Southeast Asia’s POS systems are on track to process nearly USD 680 Bn in transactions by 2028. This growth is driven by consumers demanding speed and convenience, and by SMEs rapidly shifting to QR payments and SoftPOS, which turn smartphones into payment terminals.

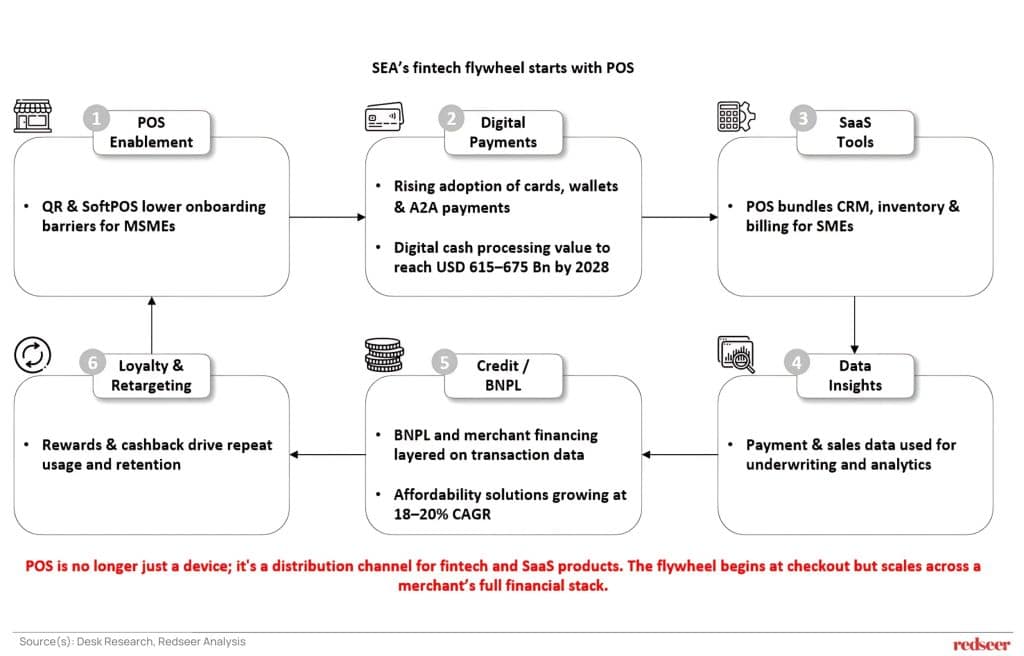

But POS is no longer just about payments. Today’s terminals are becoming the merchant’s all-in-one operating hub, combining payment acceptance with inventory control, customer engagement, and even financing. The real play is in integration: keeping merchants locked into a single ecosystem that powers every part of their business.

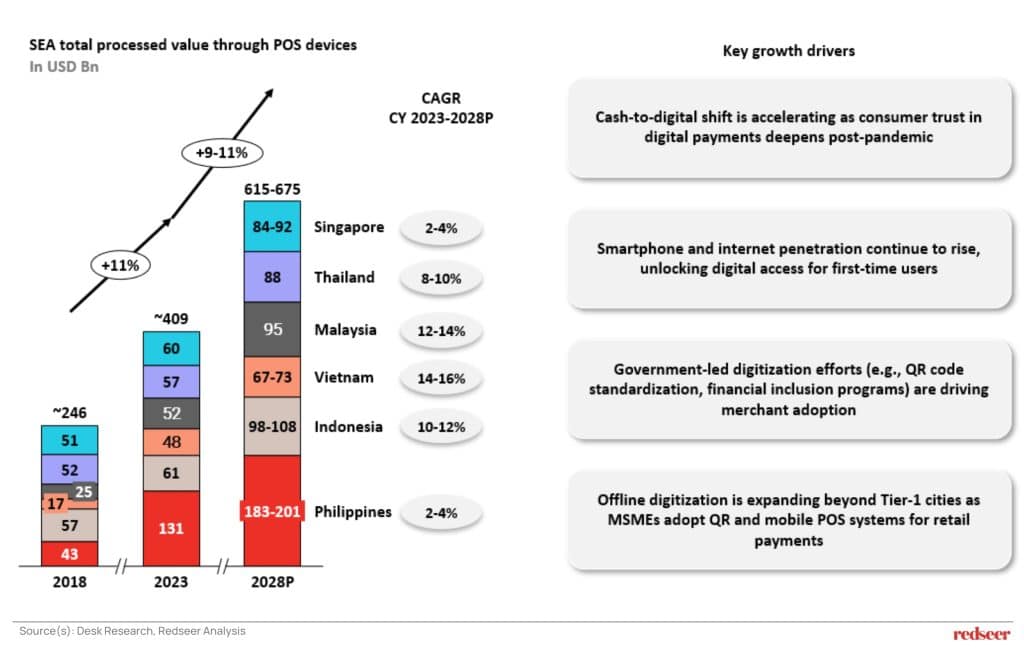

SEA’s digital checkout market is set to reach ~USD 680 Bn by 2028, driven by the cash-to-digital shift

Southeast Asia is on track to process ~USD 680 Bn through POS devices by 2028, with growth supported by the cash-to-digital shift, smartphone and internet reach, policy pushes around QR standards, and MSME digitization beyond tier one cities. For investors, this is a large base that can support software and credit layers. For POS players, this is a call to expand into provinces and long tail segments with light hardware and simple onboarding. For shoppers, this means faster and more reliable checkout in more places.

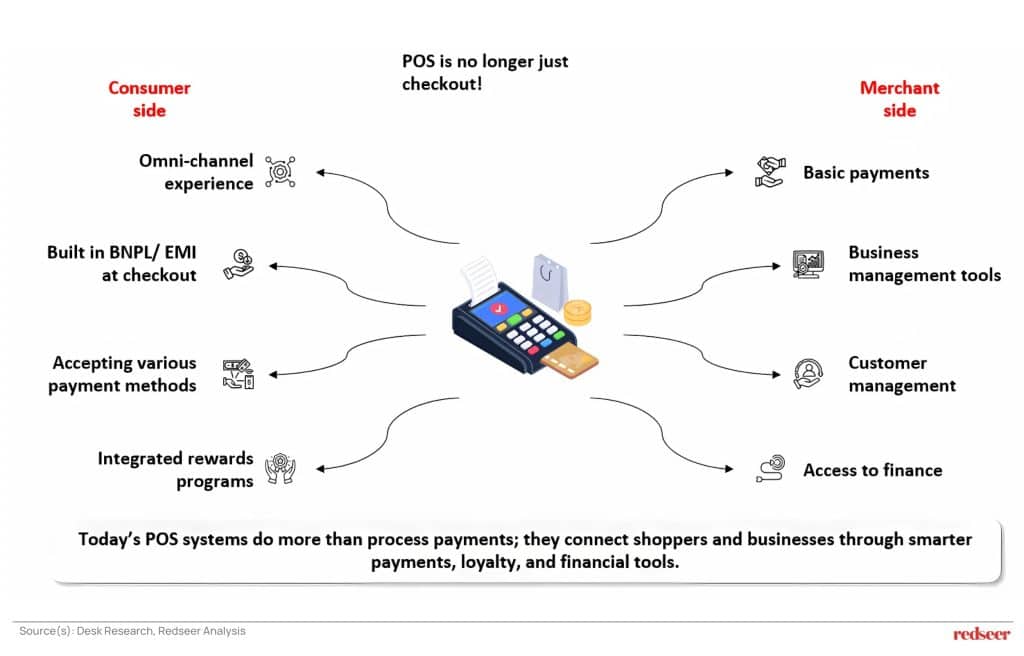

POS platforms are evolving into multi-functional interfaces for consumers and merchants

The terminal is turning into a software surface for both sides of the counter. Consumers see choice across card QR accounts to account and buy now pay later, while loyalty and rewards ride the same flow. Merchants bundle acceptance with inventory, billing, customer management, and simple reconciliation, and they unlock finance using sales data. The result is daily engagement and data capture at the point of sale, which supports use cases from healthy food retail to everyday wellness.

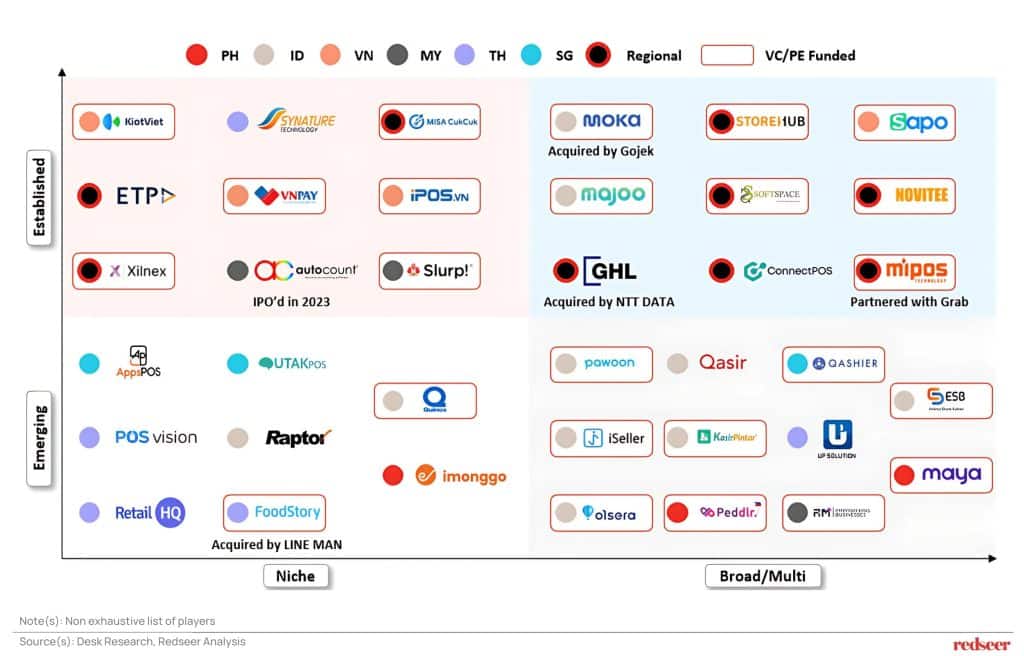

The Southeast Asian POS ecosystem is diverse and poised for platform-led scale

The landscape is crowded yet healthy with regional suites and local specialists, and it is moving toward platform-led scale. Winners will pair a common product spine with country-specific go-to-market and service quality, while consolidation and partnerships bring regulated rails and distribution. The broader SEA playbook shows how ecosystems mature as adjacent players integrate, which is now visible in payments and merchant services.

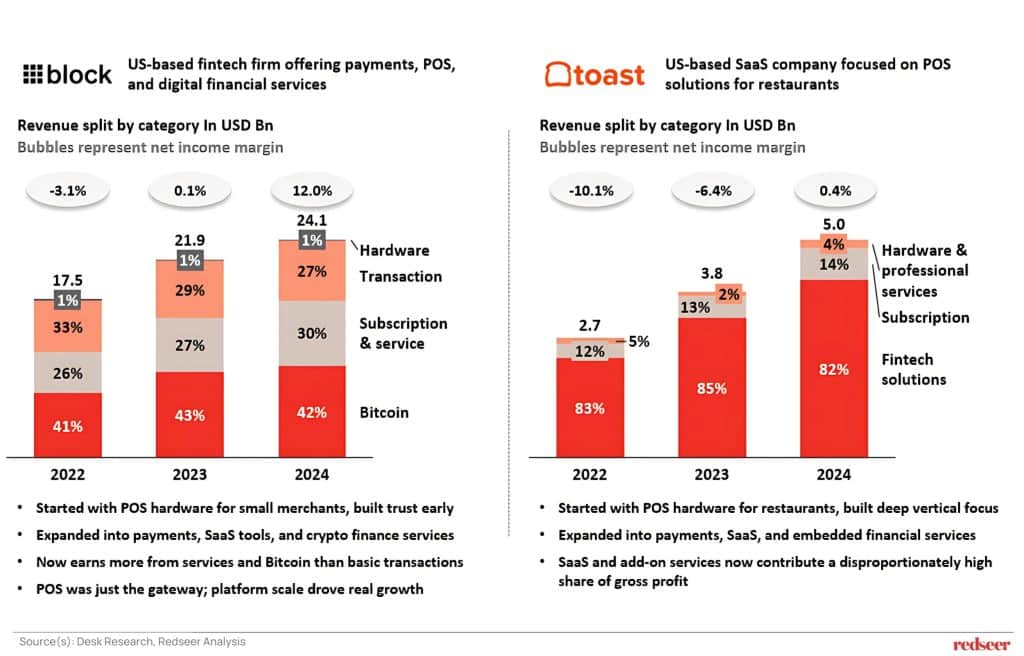

Block and toast have demonstrated that POS is a gateway to a much larger opportunity, and Southeast Asian players can follow similar monetization playbooks

Want to get strategic guidance?

Global benchmarks illustrate the monetization ladder from acceptance to profitable software and finance. Trust starts with reliable devices and simple onboarding, then volume scales through payments, then revenue quality improves through subscriptions, value-added services, and working capital. The prize is a mix that tilts toward software and financial services over time, and this aligns with a regional consumer who pays up for convenience and experience.

Winning POS platforms in Southeast Asia will expand beyond payments into full-stack merchant solutions

The flywheel begins at checkout and compounds value across the merchant stack. Start with digital acceptance and capture clean sales data, then layer software that saves time and reduces leakage, then extend credit and installments based on that data, then lock in loyalty through rewards and retargeting. QR and SoftPOS lower onboarding friction for very small merchants and similar engagement loops are visible in other consumer services, which reinforces the case for data driven retention.

In short, Southeast Asia POS is not only a payments story, but it is also a distribution story for software and finance built on a checkout moment that everyone already understands. Investors can underwrite growth from payments to platforms, operators can localize the ladder of services and scale with data, and consumers and merchants will get faster checkout with smarter value built in.