Increasing awareness and widespread enthusiasm for the reduction of carbon emissions worldwide has set up an exciting scene for Indonesia’s nascent carbon economy. Indonesia is unique when it comes to carbon, presenting several key attributes:

- Strong government support through a variety of policies and sectoral compliance measures;

- Has invited interest from the international community;

- Strong resources to support the creation of carbon offset, thanks to the abundance of peatland and mangrove forests; and

- The organic rise of enthusiastic and passionate players in the carbon trading and carbon capture scenes.

Want to evaluate new investment and M&A opportunities?

Picking up from our previous piece on climate tech, in this article, we will be diving into Indonesia’s exciting carbon offset ecosystem.

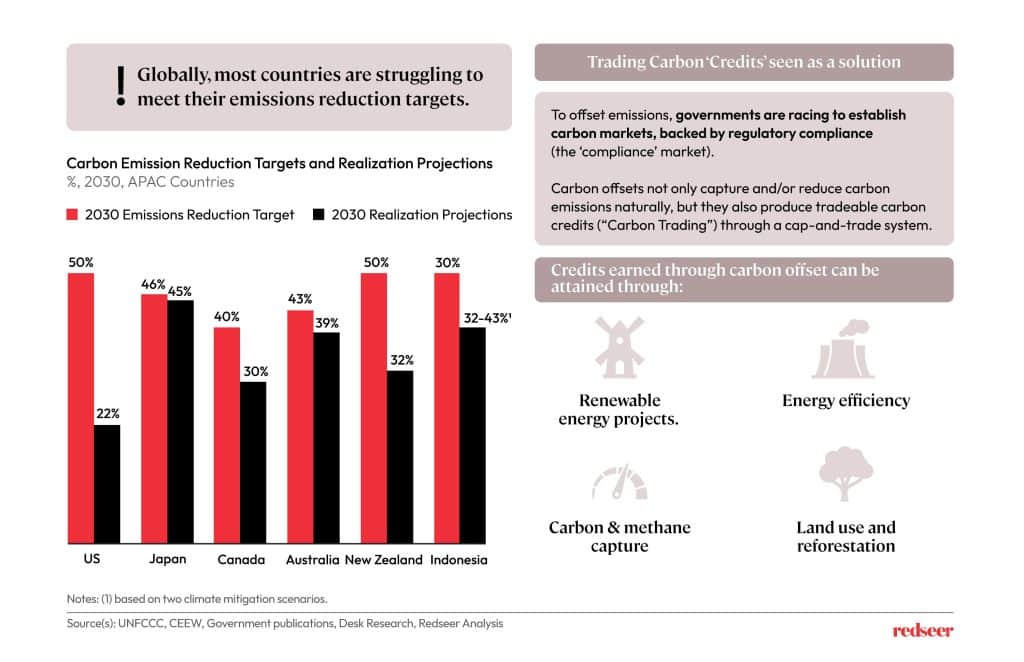

1. While most countries are missing their carbon emissions reduction goals, the carbon trading market has been steadily growing

Following the 2015 Paris Agreement, member states are obliged to meet carbon emissions reduction targets. This could be done through cutting down on fossil fuel usage, such as transitioning to electric cars and cutting down coal and petrol for both vehicles and power generation.

More ‘new age’ solutions to the carbon problem include forest projects and carbon capture technology, where a few innovative players have come in. With cap-and-trade systems universal among signatories and ratifiers of the Paris Agreement, players in this field can apply new tech used to measure forest carbon absorption and/or carbon capture.

Emissions offsets like forest and capture projects result in tradable ‘carbon credits’, something project owners could sell to high-emission manufacturers and energy companies.

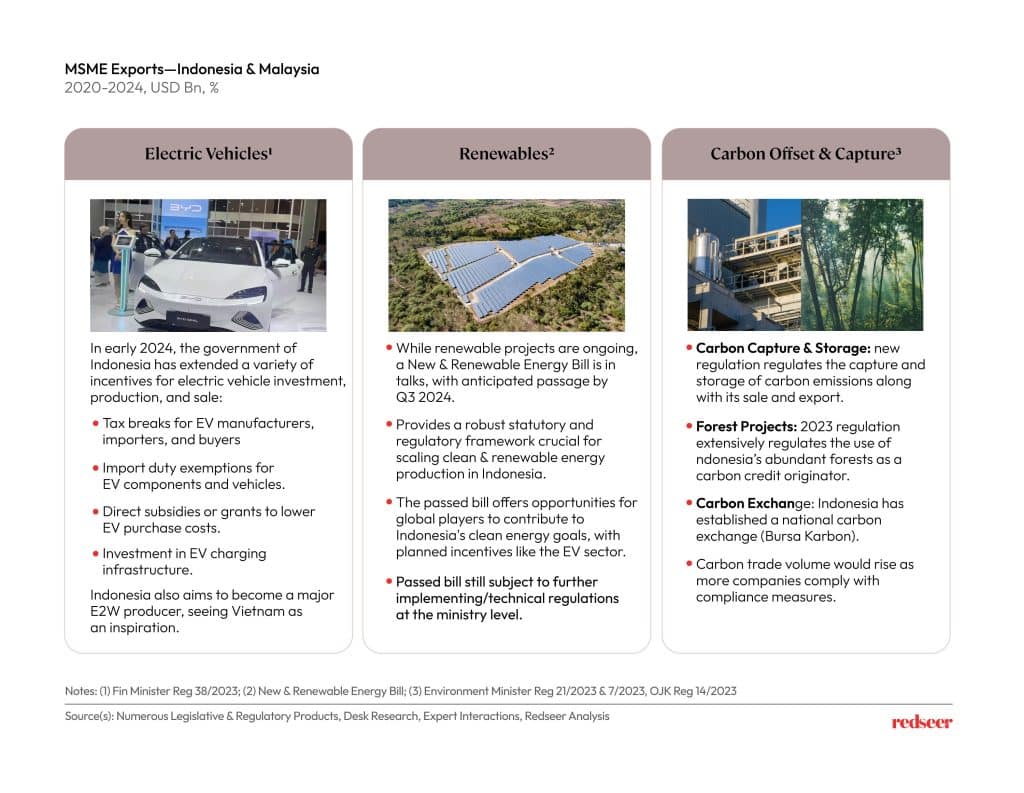

2. Indonesia’s aggressive carbon economic value initiatives show a multitude of options for businesses to capitalize on emissions reduction and offset plans; however regulatory framework remains big homework for the government

Under the Joko Widodo administration, Indonesia has introduced policies that resulted in the relatively widespread use of electric vehicles, the development of new renewable energy projects, and most notably carbon offset through forest projects (Environment Minister Regulation No. 7/2023) and carbon capture mechanisms (Presidential Regulation No. 14/2024). This policy direction is expected to continue, with carbon offset, capture, and storage being a key campaign policy point of the winning presidential and VP candidates, Prabowo Subianto and Gibran Rakabuming Raka.

A notable achievement is the kickoff of Indonesia’s carbon exchange in late 2023, allowing companies to publicly trade carbon credits. Nonetheless, most credit sales remain direct-selling offtake agreements due to the nascent nature of the mechanism.

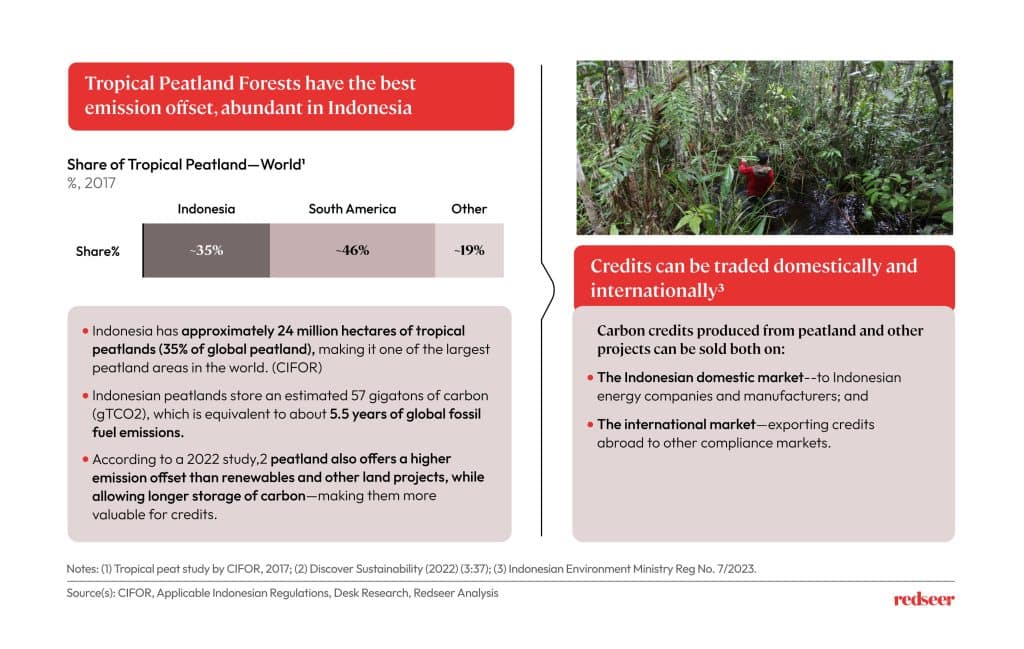

One area of strength Indonesia brings that could potentially create an ‘offset surplus’ is the abundance of forests in the country. One type of forest, tropical peat, has been eyed by conservationists and investors worldwide as a strong originator of carbon credits due to its offset origination capacity.

3. Indonesia’s peatlands become a highly attractive choice for carbon offset and carbon credit origination—with options to sell domestically and internationally.

Once seen as a mere hindrance to the development of palm oil plantations, today, Indonesia’s abundant and high-carbon absorption tropical peatlands have become extremely valuable in fighting climate change. A study that compared annual carbon absorption among different conservation projects indicated that peat forest projects could reduce more carbon than renewable energy projects.

According to CIFOR, tropical peat offers a significantly higher emission offset than other types of forests—making peatland projects in Indonesia extremely valuable in terms of tons of CO2 absorbed. In turn, tropical peat becomes an extremely valuable commodity that players in Indonesia have used to originate carbon credits.

New regulatory provisions entail following a certain threshold, carbon players could export credits — much thanks to the common frameworks established by international agreements in the past years. Players in the carbon space can officially sell offset beyond Indonesia, particularly to countries like the UK, the US, and New Zealand, who are significantly missing out on their 2030 emissions reduction targets.

While acquiring land rights and forest management permits (Perizinan Berusaha Pengelolaan Hutan–PBPH) could be a challenge, several local players have managed to kickstart efforts and establish a network of high-quality forest projects for carbon trading–as we can see in the next illustration.

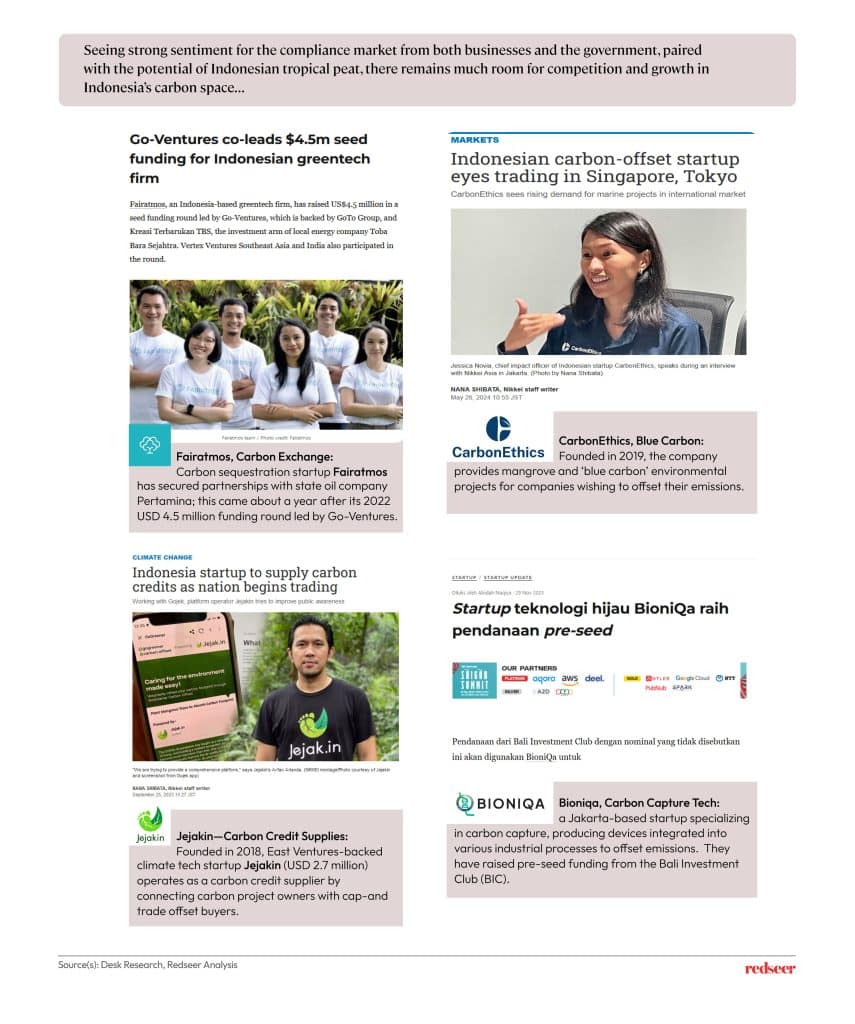

4. New investments in carbon space players mark confidence, bright prospects for players in this space

In Indonesia, enthusiasm for the carbon space doesn’t stop at the headlines. A few players have emerged in the carbon credit, exchange, and capture space. We expect more to come around as the carbon ecosystem matures, but early entry into this space would potentially ensure greater gains.

Conversely, the government is presently controlling the supply of carbon credits through selective licensing to avoid oversupply. However, as the number of government-measured and verified emissions are identified and carbon-heavy companies face regulatory compliance, so will the demand for carbon offset-oriented forest projects and carbon capture technology.

Stay tuned for more Southeast Asia policy updates—subscribe to our newsletter today.