Quick Commerce: India’s Retail Darling or Profit Mirage

Executive Summary What’s failed in other countries is scaling in India. India’s quick commerce (Q-commerce) has rapidly scaled into a $10B+ GMV market with 30M+ monthly users, becoming the fastest-growing retail format in the country. But beyond speed and convenience, Q-commerce is now shaping product discovery, brand building, and digital experimentation for both legacy and […]

Why Global Apparel Players Are Betting Big on India!

India’s $70B+ apparel market is scaling fast and would hit USD 130–150B by 2030 – Global brands are taking notice. With fashion demand exploding across classes and consumers hungry for newness, India is becoming the growth engine the global apparel industry needs. As growth stagnates in mature markets like the US, Europe, and China (hovering […]

India’s Home Decor Industry: Retail’s Secret Weapon in $2 Billion Size

As we continue our analysis of alternative growth categories in India’s retail markets, we now turn to a category that speaks of aspiration and taste—the $2 billion home decor market. Just like the toys category and saree market, the home decor segment too remains structurally fragmented, with manual distribution, inconsistent merchandising, and SKU chaos. Yet, […]

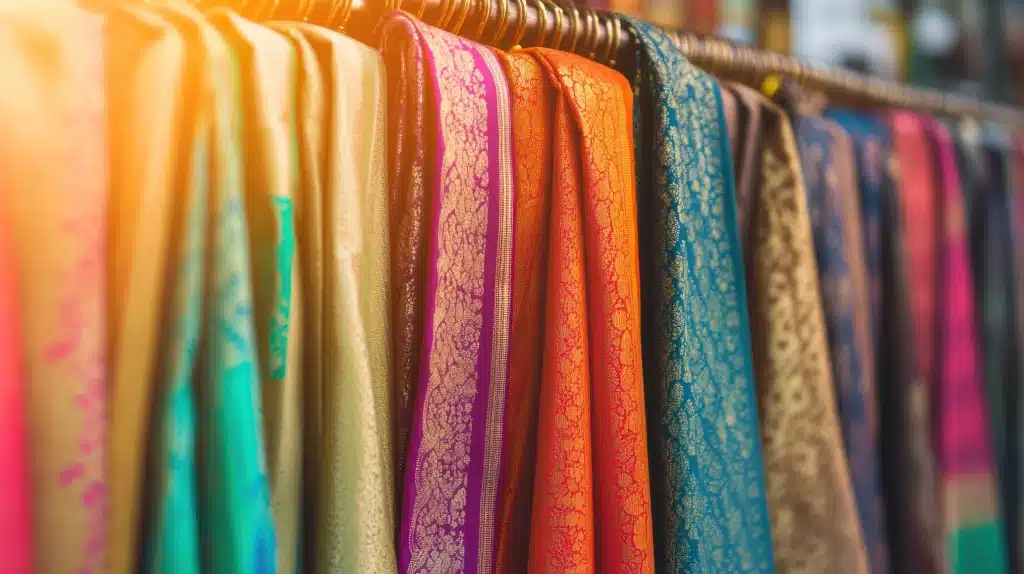

India’s $12B Saree Market: Hidden in Plain Sight, Ready to Scale

Retail’s next alpha may not lie in what’s new but in what’s been around for centuries. India’s $12 billion saree market is a vibrant, culturally rooted category that remains vastly fragmented and underserved, despite its high purchase frequency and deep emotional relevance. With 100+ million SKUs spanning fabrics, motifs, and regional identities, sarees represent a […]

Scaling Quick Commerce Beyond Metros: A Strategic Reassessment

Quick-commerce’s sustained, explosive rise in India is well established. The sector continues to grow at ~150% year-on-year during the first 5 months of this calendar year, driven by dark store footprint expansion, selection growth, category diversification, and fierce competition – all contributing to the provision of an affordable & wide product assortment to consumers at […]

Sary Merges to become SILQ – Mohammed’s Decacorn vision beyond B2B e-commerce

A conversation between Sandeep Ganediwalla, Partner at Redseer, and Mohammed Aldossary, CEO/Founder of Sary Editor’s Note The MENA startup ecosystem witnessed a landmark moment with the merger of Saudi Arabia’s Sary and Bangladesh’s ShopUp to create SILQ, backed by $110 million in funding. This rare cross-border consolidation represents one of the region’s most ambitious plays […]

Fashion Forward: Winning in India’s fast-growth Apparel Market

As global apparel markets plateau, with projected CAGRs of under or around 5% in Japan, Europe, the US, and China, India stands apart. The country’s apparel sector is forecast to grow at a rapid 10–12% CAGR from 2024 to 2030, making it one of the fastest-growing large-scale markets globally. India is ready – structurally and […]

KSA’s Coffee Revolution: How Cafés Are Brewing Up a SAR 17 Billion Market

Saudi Arabia’s food services landscape is experiencing a remarkable transformation, with the sector growing from SAR 63 billion to SAR 111 billion between 2019-2024. One segment has emerged as the clear standout performer: cafés. What started as a modest SAR 7.5 billion market representing 12% of food services has turned into a SAR 17 billion […]

How Redseer enabled BigBasket Convert High-Intent Non-Users into Online Grocery Buyers

Executive Summary BigBasket, one of India’s leading online grocery platforms, partnered with Redseer to understand why a large chunk of digitally savvy consumers were still not shopping on its platform in 2020, despite the COVID-19 ramp-up. While these users were active online, they weren’t converting into grocery buyers. Using a mix of data-driven research and […]

Redseer’s Commercial Diligence Supports Innovist’s Science-Led BPC Playbook

Executive Summary Redseer partnered with ICICI Venture to conduct a commercial due diligence (CDD) of Innovist, a fast-growing house of science-led beauty and personal care brands, including Chemist at Play, Bare Anatomy, and SunScoop. Our assessment unveiled key shifts in India’s BPC landscape, from rising interest in ingredient-led products, the emergence of science-backed brands, to […]

Scaling the Next-Gen Food Brand: Redseer Unlocking Curefoods’ Path to US$ 200 Million ARR

Executive Summary A fast-growing cloud kitchen brand engaged Redseer Strategy Consultants to validate its growth roadmap of reaching US$ 200 million in annual recurring revenue (ARR) within two years. Redseer identified critical success levers across brand acquisition, city expansion, kitchen rollout, and consumer funnel refinement. This has enabled the brand to rework its business plan for […]

E-commerce Redefined: Call for Brands to Adapt their Strategies

What started-off as an online service to order books and get them delivered at the doorstep in a few days, India’s e-commerce landscape has seen significant evolution in terms of product categories, assortment spread, discovery approach, delivery speed, and logistics – all focused towards catering more effectively to the diverse needs & preferences of a […]

The Diamond Disruption: What’s Fueling India’s Next $1B Consumer Category

The biggest tectonic shift in fine jewellery is happening above ground—are you ready to invest? Lab-Grown Diamonds (LGDs) are emerging as the fastest-growing segment in the global gems and jewellery market, with their share expected to rise from 3–4% in 2024 to 6% by 2029. LGD growth is expected to outpace natural diamond and gold […]

TikTok-isation of retail? Quick Commerce in Southeast Asia – the USD 35 Bn future of retail waiting to be unlocked!

Southeast Asia’s retail sector, backed by strong digital adoption and rapid urbanization, is on the cusp of a new wave of transformation. The region’s growing young middle class, coupled with rising eCommerce penetration and dense urban centers, makes it fertile ground for the rise of Quick Commerce (Q-Commerce) — a new-age fulfillment model promising ultra-fast […]

Beyond the Obvious: Unboxing India’s Next $Billion Opportunity in Retail – Toys

A closer look at India’s overlooked $2B toy segment and its surprising retail potential. As India marches towards a projected $1.6 trillion retail economy, much of the spotlight remains fixed on the usual suspects—fashion, electronics, and grocery. These are mainstream, no doubt. But true disruption often brews in the margins. The real inflection points? They’re […]

Beyond the Brew: Scaling Fore Coffee Through insights, Strategy, IPO

Executive Summary Fore Coffee, a rapidly expanding semi-premium coffee chain in Southeast Asia, has collaborated with Redseer Strategy Consultants over a five-year journey to achieve sustainable growth in a competitive market. Through comprehensive consumer behavior analysis, strategic market expansion planning, and support in crafting a compelling IPO narrative, Redseer has been instrumental in positioning Fore […]

How Lab-Grown Diamonds Are Reshaping Jewellery—And India Is Leading the Charge

For centuries, gold has been the undisputed choice for jewellery, especially in India. However, India’s jewellery market is undergoing a transformation. Diamonds are rapidly gaining prominence, from ~7% of the jewellery market in 2019 to ~17% in 2024, expected to grow to 22-27% by 2029, at ~20% CAGR – a trend mirrored across the globe. […]

India’s Got Retail: A Tale of Fragmented Supply & Consolidating Distribution

India’s retail ecosystem, expected to surpass USD 1.6 Tn consumption by 2030, is undergoing a transformative shift. Both supply & distribution are changing rapidly to better serve the diverse & evolving consumer needs. With the growing adoption of technology across the value chain and the advancements in infrastructure & logistics, the interplay of supply and […]

India’s Got Retail: A Tale of Fragmented Supply & Consolidating Distribution

India’s retail ecosystem, expected to surpass USD 1.6 Tn consumption by 2030, is undergoing a transformative shift. Both supply & distribution are changing rapidly to better serve the diverse & evolving consumer needs. With the growing adoption of technology across the value chain and the advancements in infrastructure & logistics, the interplay of supply and […]

The Rise of Dark Cafés: The Next Frontier in Q-Commerce

Q-Commerce has rapidly evolved from restaurant and grocery aggregation to dark stores, fulfilling a growing demand for ultra-fast delivery. Now, the latest addition to this ecosystem—dark cafés—is redefining how consumers access ready-to-consume beverages and snacks. Pioneers like Zepto Café have demonstrated rapid adoption, scaling to 100K daily orders within just six months. In the UAE, Shot by […]

Healthy ice cream scoop: SEA’s next cool investment

Inside Indonesia’s $8Bn BPC Market | Redseer Glow Economy

Heightened Ramadan excitement this year is set to drive $10 billion in retail spending

Ramadan Kareem! We extend our warmest wishes to you and your loved ones. This sacred time brings together people worldwide in a shared journey of reflection, fasting, and prayer. In anticipation of Ramadan, we conducted a comprehensive study to understand consumer needs, motivations, and preferences during this period. This year, we see a dynamic intersection […]

Ramadan Rush: Increased Excitement Set to Fuel Spend in UAE

As the holy month of Ramadan approaches, consumers across the UAE are gearing up for a season of reflection, generosity, and celebration. This period not only holds deep cultural significance but also presents a unique opportunity for businesses to align with evolving shopping behaviors. Consumer excitement for Ramadan is at an all-time high, with a […]

Make it “Premium” in Indonesia

Inside Indonesia’s $8Bn BPC Market | Redseer Glow Economy

Ramadan 2025: The year of Gifting, Wellness & Live Commerce

Inside Indonesia’s $8Bn BPC Market | Redseer Glow Economy

MENA Q-Com a $6 Bn Opportunity in 2025, >10% of Online Retail

Quick Commerce (Q-Com) is transforming the retail landscape by providing ultra-fast delivery and convenience, often in as little as 10 minutes. By 2025, it’s projected to represent a $6 billion market in MENA, surpassing 10% of the region’s online retail share. With rapid growth across categories, evolving consumer preferences, and innovations in delivery modes, Q-Com […]

India’s Retail Transformation: Why 3PLs Are Crucial to the Brand Boom

India’s retail landscape is shifting from a brand-deficient market to a thriving branded economy. In our last article, Transforming Retail & Logistics Needs in India | Redseer, we discussed how branded retail is projected to surpass $1 trillion in scale within the next decade. In this article, we shall focus on the second part and […]

India’s Retail Transformation and Evolving Logistics Needs of Brands

India is rewriting the retail and consumption playbook as the fastest-growing major economy in the world. It is on track to become the third-largest consumer economy globally. Redseer’s upcoming report on the evolving logistics needs of new-age brands highlights the retail market’s promising trajectory, projecting it to reach approximately $1.5 trillion by FY29 and $2.4 […]

Rising Aspirations: How Value-First Retail is Reshaping Consumption in India

Value-first offline retailers have emerged as a powerful force in India’s retail landscape, uniquely positioned to capture the aspirational retail opportunity. By offering competitive opening price points (OPPs) & average order values (AOVs), selection mix, and store experience, these retailers target a broad demographic, creating a larger addressable market and driving widespread geographic coverage, particularly […]

KSA-Hyperlocals: Moving Towards Multi-Verticality

The KSA hyperlocal market is positioned for significant growth, presenting substantial regional opportunities. While the total addressable market is estimated at SAR 600 billion, the current market size remains underpenetrated at SAR 23 billion, indicating considerable room for expansion. This report provides an analysis of the hyperlocal landscape, examining its current structure, growth potential, and […]

The Evolution of Saudi Arabia’s Fashion Landscape

From the evolving retail landscape to the booming e-commerce sector, Saudi Arabia’s fashion industry is undergoing significant transformation. In this newsletter, we’ll explore how these dynamic changes are reshaping the Kingdom’s fashion ecosystem, with a special focus on the sector’s growth from 24% of retail share in 2019 to a projected 27% by 2028. What […]

Pet Parenting in India: Redefining the Future of Petcare

India’s petcare industry is undergoing a transformation, helped by the growing recognition of pets as family members. The growing bond between people and their pets is no longer a simple relationship of ownership—it’s a transformation into full-fledged parenthood, leading to a shift in spending habits, preferences, and expectations.This evolution, as covered in our previous article […]

From Kibble to Care: Understanding India’s Evolving Petcare Market

India’s petcare industry, although still in its early stages, is steadily gaining momentum, driven by changing customer behavior and an increased focus on pet wellness. With more households adopting pets, particularly in the wake of the pandemic, spending on pet-related products and services is gradually picking up. Currently valued at $3.5 billion, the market is […]

India’s Petcare Market: Opportunities in an Evolving Market

India’s petcare market is still in its early stages but holds immense potential for growth. The pandemic triggered a seismic shift in the way Indians perceive pets. No longer just animals kept for companionship, pets have now become integral family members—“pawrents” take pride in caring for them. But how is this shift impacting the industry? […]

What’s Brewing in Southeast Asia’s Coffee Chains?

As we celebrated International Coffee Day, we revisited the vibrant world of Southeast Asia’s coffee scene. With a surge of investments and cross-country expansion, the region’s coffee market is evolving rapidly. Over the last year, industry players have focused on consolidation and improving profitability. Now, these leaner and more efficient companies are poised to capitalize […]

The Rise of eB2B Platforms: Powering the Next Wave of Retail Transformation

The retail landscape in Bengaluru and Hyderabad is experiencing a profound shift as digital transformation reshapes the operational fabric of kirana stores. With India’s retail market anticipated to reach USD 1450-1550 billion by 2028, the integration of digital technologies is becoming a game-changer. Redseer’s latest study commissioned with udaan underscores how eB2B platforms, are pivotal […]

India’s Beauty Industry : Transforming boundaries across Audiences and Categories

India’s beauty industry is rapidly expanding, with projections showing it will reach $34 billion by 2028. This growth is fueled by rising disposable incomes, increased consumer aspirations, and the influence of social media and e-commerce. As Indian consumers become more sophisticated, there’s a growing demand for premium beauty products and personalized experiences driven by global […]

Spotting the Next Big Thing: How Fast Fashion Brands Can Stay Ahead

Trends evolve at breakneck speed, but are fashion brands truly keeping up with the demands of consumers? In India’s current fashion landscape, there is a clear gap between the brands’ offerings and consumer preferences. This disconnect has created a prime opportunity for fast fashion brands to disrupt the industry by swiftly capitalizing on the latest […]

Trend Tempo: The Rapid Growth of Fast Fashion in India

Have you ever wondered how fashion enthusiasts and avid shoppers keep up with the rapid-fire trends from runway shows, influencers, and social media? The answer often lies in the world of “fast fashion.” Imagine scrolling through endless feeds of affordable, trendy garments from online retailers or snagging that stylish trench coat at a big-box store’s […]

Southeast Asia and India: Connecting Consumers Beyond Borders

Imagine my surprise on a Mumbai summer break. While browsing the shelves at a retail outlet, I saw Indonesia’s legendary Indomie noodles and those addictive Kopiko candies. After speaking with my friends, I realized Indian personal care companies like Wipro and Marico have been spreading their wings in Southeast Asia for years now – think […]

Decoding Omnichannel: Strategies for D2C Brands

In today’s bustling marketplace, where customers roam across multiple platforms before making a purchase, D2C (Direct-to-Consumer) brands are uniquely poised to redefine retail landscapes. However, capturing and retaining customer attention in this saturated environment demands a strategic embrace of omnichannel marketing, for D2C brands, which control every aspect of their production, marketing, and sales process, […]

Demystifying India’s e-Commerce Growth

Are you a frequent online shopper? When was the last time you purchased online? Which are your favorite ecommerce apps? Well if you can answer all these questions, then you too are a part of the growing e-commerce populace that’s driving India’s e-commerce revolution! From the towering skyscrapers of financial districts to the bustling markets […]

Unveiling India’s Q-Commerce Revolution: Can India be quick commerce’s first success story?

In the dynamic landscape of retail and ecommerce, one trend has emerged as a game changer: the meteoric rise of quick commerce (q-commerce) in India. Q-commerce, with a $2.8 Bn current market size, is set to become a disruptive force, poised to reshape the retail industry as we know it. With India’s burgeoning urban population […]

Ramadan 2024: How will Indonesian consumers spend USD 70Bn

Ramadan is a month of fasting and spiritual reflection for Muslims around the world, a time for family gatherings, community events, and religious observance. It is also a time of increased retail spending, as families stock up on food, gifts, and clothing in preparation for the Eid al-Fitr holiday that marks the end of the […]

What does eCommerce Consumer Confidence look like post festive season 2023?

Both online and offline retail in India started gaining momentum from Q1FY24 with offline retail growing faster than ecommerce in Q2FY24. As per seasonal trends and captured in our ECCI of 131 for Jul’23 this led to a strong festive season of Oct-Nov ‘23. Not surprisingly in the post-festive period, the sentiment for future 4-months […]

Is Singles Day the New-Black Friday?

Its that time of the year! Black Friday has had a significant impact on the buying behaviour of consumers and now has become integrated in the retail calendar in UAE. This year Black Friday’s market growth is anticipated to stabilize as compared to last year, however it has now evolved into a festive last quarter […]

Shopping Goes Social – $10Bn Opportunity for MENA Retailers

The fusion of shopping and social media is reshaping consumer behavior and advertising strategies, offering a potential windfall of over $10 billion for those who seize the moment. Social media’s ascendancy from a communication tool to an overpowering advertising force cannot be ignored. With users now spending more than double the time on these platforms, […]

Ramadan Across Borders

As we reach the mid of the holy month of Ramadan, we would like to extend our warmest greetings to you and your loved ones. This is a significant time when Muslims from all over the world come together to engage in spiritual reflection, fasting, and devotion through prayer. Here, we will take a closer […]

Ramadan 2023~ Changing habits, evolving patterns!

Ramadan is a significant time of the year for Muslims, with many observing the month-long period of fasting, prayer, and spiritual reflection. For retailers in the Middle East and Southeast Asia regions with significant Muslim populations, this period can be a lucrative time, with an expected $150 billion in retail sales. While Ramadan remains the […]

Decoding the Exceptional Trend of eGrocery in Developing Markets

The COVID-19 pandemic was a strong catalyst for the exponential growth of online groceries across the developing world. Initially driven by a response to the lockdowns and supply chain disruptions, the market has since evolved to cater to consumer habits, convenience and local drivers. As a result, various business models have emerged successfully to occupy […]

Ramadan Retail Renewal

As the sacred month of Ramadan draws near, we would like to send our heartfelt greetings to you and your dear ones. Ramadan is an extraordinary time when Muslims across the globe unite to observe a month of spiritual reflection, fasting, and prayer. Here we will provide a deeper insight into the shifting trends for […]

GCC Conglomerates

GCC online retail sector has witnessed a rampant expansion, leapfrogging from 10 Bn USD in 2019 to 30 Bn USD in 2022. A strong digital enabler ecosystem, proactive policymaking coupled with a digital-ready population of 54 Mn, GCC ecommerce boom is unravelling. 1. GCC Online retail is sizable: ~$30bn in GMV and has been growing […]

Quick Commerce: The Way Forward

Globally, it has not been an easy ride for the industry in the post-COVID period due to several key challenges such as logistics and profitability. We connected with Vincent Tjendra, CEO at Astro to discuss what players could do differently in the upcoming period. In this article, we take a deeper look at the Quick […]

E-Commerce Double Days – Doubling Down on Retention

Indonesia’s double-day sales are one the largest sale periods in the region. With evolving consumer preferences, sales campaigns also need to evolve. In this article, we take a look at changing e-commerce landscape in Indonesia. As the number of consumers grows in the country, preferences have shifted towards convenience-based shopping. 1. Indonesia’s double-day sales campaigns […]

E-Commerce Enablers – An Encouraging Future

While a large portion of merchants have become digitized in the region, conducting efficient operations both online and offline continues to be a major challenge. E-commerce enablers helped merchants go online during the pandemic, and now, new challenges arise in the evolving market, which create further opportunities. Here’s a discussion on how enabler platforms in […]

B2B Trucking – An Interview with Eric Dharma, Group president at Waresix

Globally there have been cautionary headwinds for the ad market as a whole, but Southeast Asia has significant headroom to grow due to its low maturity compared to other countries in the region. The market is noticing a shift of advertising spend from offline to online channels, and e-commerce ads in particular, due to higher reach […]

Black Friday Sales To Cross ~ $350 Bn This Year

Black Friday, the biggest shopping extravaganza, presents a ~$350 Bn global opportunity through online sales. This year Black Friday will coincide with FIFA World Cup, impacting customers’ purchase behaviour and shopping patterns. Driven by deals and discounts, the Black Friday season is filled with excitement for shoppers, and financial sharing applications are providing an additional […]

A Cup Full Of Food

Food delivery market is poised to benefit from the celebratory atmosphere that has been a feature of Mega sports events. High consumption enthusiasm will drive consumer spending and acts as a springboard to boost sales. “The Qatar cloud kitchen culture is rapidly evolving and will naturally get a major boost from the celebratory atmosphere” Ramez […]

The Most Inclusive Football Tournament

It is our pleasure to release our report “The Most Inclusive Football Tournament” covering key themes that will play out during the upcoming World Cup in Qatar. The championship in Qatar is one of the largest sporting events in a post-pandemic world. This report covers the impact, market outlook, and evolving consumer and supplier trends […]

The Most Inclusive Football Tournament

Football world championship in Qatar is one of the largest sporting events in a post-pandemic world. Enabled by the proliferation of digital media channels and internet/smartphone penetration, an unprecedented 5 billion consumers are expected to engage with the event. Consumption is expected to spike during the tournament which overlaps with the retail festive season. The […]

How can restaurants sustain in the evolving food service industry?

MENA Food Delivery Ecosystem is rapidly evolving. While food aggregators helped restaurants weather the pandemic, their impact on the profit margins has been reduced. Restaurants are creating own unique propositions to attract consumers and consecutively restaurant own apps are now the fastest growing segment. Evolving stakeholder economics is poised to reshape the food delivery market in […]

Is direct the way to go for Beauty?

The BPC market in the MENA region is going through a transformational period driven by evolving consumer needs and shopper persona. While legacy brands have undertaken various initiatives to fulfill emerging trends, consumers aren’t fully satisfied. This has led to the emergence of D2C brands who have been able to develop meaningful relationships with customers […]

Black Friday Alert!

Black Friday has emerged as one of the most important events in retail in the Middle East and North Africa (MENA), owing to the wide array of deals and discounts, spread out over the 5–6 week festive period. As retail traffic is set to be high; retailers in the region need to be cognizant of […]

Inside Story of 40,000 Crore Festive Season 2022

Diwali is an occasion when growth, prosperity and togetherness are celebrated across the world. This celebration comes with people exchanging gifts and sweets and the elderly blessing the younger ones with the joy of success. And when it comes to business, consumers’ happiness and appreciation are a true blessing. Well, thanks to the dynamic continuous […]

Black Friday Shopping Season Is Here

Black Friday is the most anticipated online shopping event of the year, owing to the wide array of deals and discounts spread out over the 5–6-week festive period. This year promises to be no different, with consumer purchase intent peaking in anticipation of this sales extravaganza. With interesting price drops and high consumer purchase intent, […]

SEA eB2B Landscape

The eB2B landscape in SEA countries of Indonesia, Vietnam and Philippines offers strong growth prospects with ~40% or higher CAGR during 2021-26. The inherent inefficiencies in the traditional supply chains make eB2B an attractive business proposition. It addresses stockouts, product variety, financing options and other pain points for retailers. Similarly, they help brands with increasing […]

The biggest ever World Cup

1. Online viewership expected to reach 5 Bn during FIFA World Cup 2022 5 Bn eyes are expected to be glued to FIFA World Cup in Qatar, expecting a growth of over 43% than the viewership witnessed during FIFA World Cup in Russia. Covid fueled digital penetration which has given fans multiple ways for football […]

What’s Brewing In Indonesia Coffee Chains? – Part 3

Compared to other business models, coffee-chain players have been less affected by COVID due to their greater online presence, access and affordable offerings. They are expected to gain more traction by targeting different markets and introducing new products. We believe the sector holds long-term potential on the back of its standardized product offerings to a wider […]

The biggest ever World Cup

1. Qatar, the first Middle East nation to hold the World Cup is spending a massive $200 Bn in the lead up to the Mega event Qatar is the first Middle East country which will be hosting the FIFA World Cup. This World Cup will be the most compact World Cup where all the stadiums […]

Online Fundamentally Altered Grocery Buying Behavior

1. Grocery was the most underpenetrated online sector pre pandemic… The Grocery sector has been a predominantly offline shopped sector before the covid 19 pandemic, due to its essential nature. Consumers have always preferred to personally check the products before shopping for grocery as it directly impacts their health and wellbeing. Grocery shopping was a […]

The Biggest GMV Churner of E-Tailing industry

Festive sales are a concept that has run across geographies, where China and US have gone mainstream with massive sales events like the Single’s Day Sale and Black Friday Sale respectively. Back home, festive season is in full swing, and so are the sales. Here are some interesting trends and projections for the upcoming festive […]

Redseer’s MENA Consumer Electronics perspective is now available

1. The Consumer Electronics retail market will represent a ~$100 Bn opportunity by 2027… The electronics market in MENA is currently ~$60 Bn and is forecasted to grow at a CAGR of 9% to be a ~100 market by 2027. UAE & KSA account for close to half of the market currently and their share […]

Influencing On The Way Up!

1. Merchants are increasingly shifting their ad spend wallet to digital channels; influencer marketing is a fast-growing segment Traditional media is losing share to digital media on a global scale. Over the past year, internet advertising has grown at a robust rate of 26% beating offline ad spending, which only grew by 9%. Predictably, digital […]

Luxury Retail: Online opening new horizons

Creators are now playing an equally important role compared to celebrities as the content is more relatable and the format is more engaging

UAE Luxury Retail – Strong Tailwinds at play

Online channel has increased in prominence and now makes up ~20% of luxury sales in UAE currently influencing more than 90%

ASEAN eCommerce and Logistics: Rising to Deliver – Part 5

Parcel volumes have witnessed growth in 2021, while the revenue per parcel has maintained a downtrend

Vietnam Consumer Internet – Firing On All Cylinders

The fund-raising activity in 2021 in Vietnam has broken all previous year deal making records. 2022 continues to show a similar trajectory

The $10Bn Used Smartphone Market To Watch Out For

India’s used smartphone market is poised to reach a staggering market size of USD 10Bn by FY26

SEA Travel and Hospitality – Time For Takeoff

SEA travel market was ~USD80 Bn in size in FY20 and is expected to grow to 1.3 times by FY27

Philippines Consumer Internet – Imminent Surge Ahead

Strong fund flows in the consumer internet economy will propel the industry ahead and lay a groundwork for increased market opportunities, penetration and revenue growth in the future

Indonesia Online Beauty and Personal Care – Local Charms

Online search and social media have the highest influence in creating product awareness

Unwrapping Ramadan 2022

Ramadan is a $6.2 Bn online sales event in MENA. Festive periods account for ~40% of annual e-tail in MENA.

15X Growth In Just 3 Years! We’re Talking About India’s Quick Commerce Market

Quick commerce is fundamentally changing consumer purchase behavior in metros and creating delight

MENA Dark Kitchen estimates revised upwards – a $2 Bn+ opportunity by 2025!

Dark Kitchens would account for 13%+ of the FoodTech market in 2025 the penetration would be significantly higher in UAE & KSA

The UAE Pre-owned market is the new market

Buying is seen as a better value-added proposition especially for home and electronics sectors where the estimated duration of use can be higher.

~$250 Bn Opportunity Awaits New Digital-First Brands In India By 2030

Digital brand are finding it increasingly rewarding and have a ~$250 Bn opportunity by 2030

India’s Journey To $1 Trillion Of Consumer Internet Economy Has Begun

India Internet is surging ahead with >50% y-o-y growth in 2021, and is poised to be a $1 Tn economy by 2030

What’s driving consumer internet in Indonesia?

Indonesia’s e-commerce market is one of the fastest growing globally and accounts for more than half of the SEA e-commerce market

India Online Furniture Market – Ready for ‘digital takeoff’

India’s furniture + home market saw a steep COVID-driven drop to $11.5 Bn in FY21, but is poised for strong recovery post COVID with strong recovery already underway in FY 22

Black Friday – $6Bn Online Shopping Event

Black Friday is a critical event in the retail calendar in MENA. This event which was first launched by Souq (now Amazon) as a 3-day online only event has now expanded to over six weeks of Q4. The event has been so popular that ~20% of annual online retail sales happen during the Black Friday sale period.

Key Black Friday Trends:

a. The Market is Stabilizing:

Last year BF season achieved +90% YoY growth; this year YoY growth is expected to stabilize at ~30%; Sales to reach ~$6 bn during BF period.

b. Differentiated Strategies are going to be at play

In terms of strategy, higher focus on private labels, Inventory led fulfilment and fast delivery speed are expected.

c. Consumer is moving beyond discounts

Discounts will become a right-to-play during BF. For right-to-win, other factors such as offer variety and exclusivity and experience will be key.

Changing paradigm of India’s grocery market

The eGrocery market is set to be sized $21-25 billion by 2025

Indian Female Innerwear’s $12 Billion Opportunity

The female apparel market, which stood at USD $25 billion in 2019, is expected to grow up to USD $38-40 billion by 2025.

Indonesia ECommerce Metamorphosis in a post Covid world

Indonesia’s e-commerce market is one of the fastest growing globally and accounts for more than half of the SEA e-commerce market

Indian E-Grocery: A Promising Opportunity Led By Value-First Users

Dark Kitchens – The Bright Future of Food Services

Pre-COVID estimates of $16bn, the food services market is now estimated at $9bn in UAE as lockdown restrictions suppressed the sector.

Smart clicks to win India’s online groceries & general merchandise basket

E-tailing market in India is expected to reach ~USD 100 Bn by 2023 from USD 24 Bn in 2018

India’s Online Packaged Food, Beverages, Personal Care and Home Utilities Consumer Goods Report

Though the demand for preventive healthcare has soared since the pandemic and startups in the space are striving to ride this tailwind, it is still largely an untapped market. The opportunities are huge for businesses. The report delves into the entire landscape and shares pointers on how to cash in on the opportunities by tapping into emerging technologies.

Online grocery: What brands need to know?

Indian grocery traditionally has been a primarily unorganized market, wherein more than 90% of the market is driven by traditional ‘kirana stores.

ASEAN eCommerce and Logistics: Rising to Deliver – Part 3

ASEAN eLogistics has seen massive growth, accounting for a multi-billion dollar industry in 2019 – we forecast 30-35% CAGR for the next 3-5 year horizon

Accelerated Digitization in India Internet Post COVID- Part 2

Contribution of E-Tailing to India Internet spiked massively as the category reached a USD 36 Bn Annualized GMV in June, +30% vs Jan.